The crypto market is known for its rapid ups and downs, but the recent $100 billion drop in just one day was still a shock for many traders. The total market value fell from about $3.6 trillion to $3.5 trillion, reminding everyone that even in strong years, unexpected events can cause sharp declines. These pullbacks can feel worrying, but they are also a normal part of the crypto cycle. Understanding what caused this particular drop helps investors stay calm and make thoughtful decisions instead of reacting out of fear.

At our publication, we’ve watched market swings for years through the deep downturns of 2022 and the strong rallies of 2024 and 2025. The pattern is always the same, when prices fall suddenly, it’s rarely because of a single reason. Instead, several pressures usually build up at once. This time, the drop was fueled by a major hack, uncertainty about interest rates, and large investors moving their funds. By looking closely at each of these factors, we can see how they came together and what may happen next.

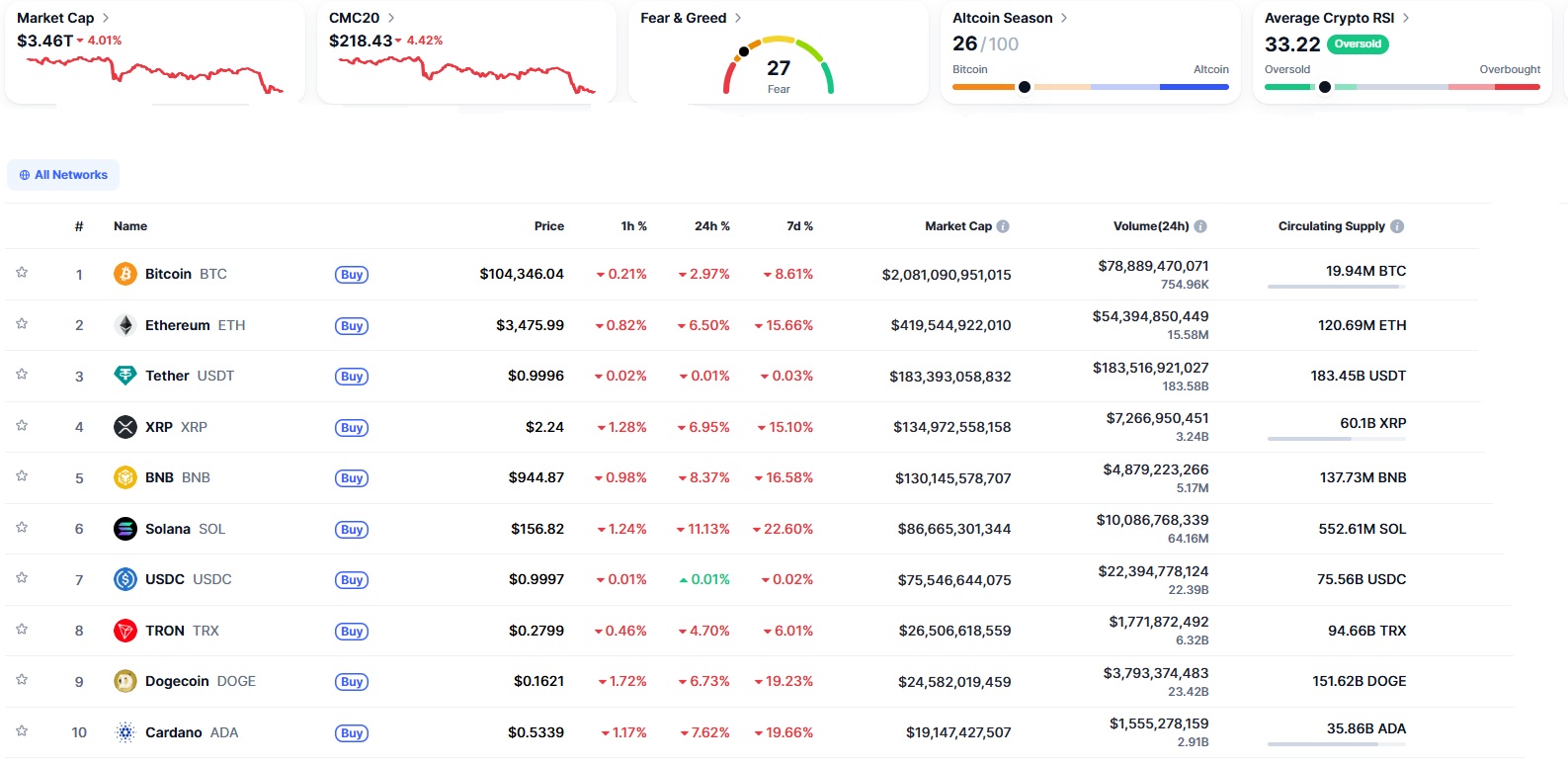

The sell-off began early on November 3 and spread across the entire market within hours. Bitcoin fell to around $104,346, about a 3 percent drop. Ethereum dropped more around 6 percent falling to roughly $3,400. Popular altcoins, including Solana, Chainlink, and Dogecoin, also saw heavy losses. Many leveraged traders were forced out of their positions as prices tumbled, which added even more downward pressure.

Trading activity spiked sharply as people rushed to move their money. At the same time, long positions worth over a billion dollars were liquidated. Liquidations happen when traders borrow too much and can no longer maintain their positions when prices fall. When these liquidations hit the market all at once, they push prices down even further. Even though this looked severe, the market drop represented only a small percentage of the total crypto value. What made the day unusual was how quickly multiple negative triggers appeared at the same time.

The first major trigger was a $128 million exploit involving Balancer, a decentralized finance protocol. The attack affected different blockchains, including Ethereum, Arbitrum, and Polygon. While the exploit did not shut down any networks, it damaged confidence in DeFi platforms and caused a quick dip in Ethereum’s price. With so much value locked inside these platforms, even one large exploit can spark widespread fear.

Balancer and its forked protocols were exploited, resulting in ~$128M in funds drained across Ethereum, Arbitrum, Base, Polygon, and other chains. Berachain even halted its entire network to contain the damage.

This Balancer exploit is structurally impossible to replicate on… https://t.co/rQ1pKT6lT4 pic.twitter.com/ghNUXpTcSP

— dori (@dori_coin) November 3, 2025

The second factor came from the U.S. Federal Reserve. Recent comments from one of the Fed’s leaders suggested that interest rates may not be cut as quickly as markets were expecting. Crypto tends to react strongly to interest rate expectations because cheap borrowing often pushes more money into riskier assets. When the Fed sounds cautious, investors often pull back.

I fully supported the FOMC's decision last week to cut interest rates by a quarter point.

As I said at the University of Utah on Wednesday, the risks to the economy had shifted. pic.twitter.com/T4Tyzolwqv

— Mary C. Daly (@MaryDalyEcon) September 24, 2025

The third trigger was activity from large holders known as crypto whales. A major Bitcoin wallet that had been holding coins since earlier cycles sold more than 13,000 BTC during October, with over 1,200 BTC sent to an exchange just before the drop. Whales selling usually signals to smaller investors that more declines could follow, causing further sell-offs. Similar activity in Ethereum created additional downward momentum.

This is one of the reasons behind $BTC dump.

Wallets holding 10-10K BTC has offloaded $2.5 billion in BTC since October 12th.

This is nearly $100M+ in daily sell pressure which has supressed BTC price.

Along with that, a few DATs are also selling Bitcoin which is causing both… pic.twitter.com/V9Z4rZW6YI

— Cas Abbé (@cas_abbe) November 1, 2025

All three events, an exploit, economic uncertainty, and whale selling combined to accelerate the fall.

After the drop, the overall mood in the market turned nervous. A popular sentiment index measuring crypto fear levels fell into the “extreme fear” range. While this sounds negative, these levels have historically appeared right before markets begin to recover. In previous cycles, extreme fear often signaled that most of the selling pressure had already happened.

There were also signs that some investors were preparing for a rebound. Stablecoin inflows into major exchanges increased, which usually means people are moving money onto trading platforms to buy at lower prices. Technical indicators such as oversold signals on Bitcoin charts hinted that the market might be nearing a temporary bottom. Still, upcoming economic reports could influence the next move. If job numbers or inflation data in the U.S. come in hotter than expected, investors might remain cautious.

Volatility Is Part of the Crypto Market Journey

The $100 billion plunge was dramatic, but not unusual in a market as fast-moving as crypto. It was the result of several events happening at once an exploit, economic uncertainty, and large investors shifting their funds. While fear spiked, there were also early signs of buying interest returning. Crypto’s history shows that volatility often creates both challenges and opportunities. By understanding the forces behind market swings, investors can navigate uncertain moments with more confidence and patience.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.