Solana continues to stand out in the crypto market, and the latest surge in ETF inflows shows how much confidence investors have in the project. In just 24 hours, Solana-focused exchange-traded funds (ETFs) attracted $9.7 million, a strong signal that interest in Solana is growing again. This momentum comes at a time when the price has been recovering from the $150 support level, a zone that many traders view as a healthy base for future gains. As conversations grow about Solana possibly climbing toward the $200 mark, it is useful to understand what is driving the excitement and why investors are paying attention.

To start, it helps to understand what an ETF is. An exchange-traded fund is a financial product that allows people to invest in assets like stocks or cryptocurrencies without buying the assets directly. A Solana ETF lets investors get exposure to SOL price movements through regular brokerage accounts. For large institutions, this is more convenient than buying and storing cryptocurrency on their own. So, when ETF inflows increase, it often means big players are entering the market with confidence.

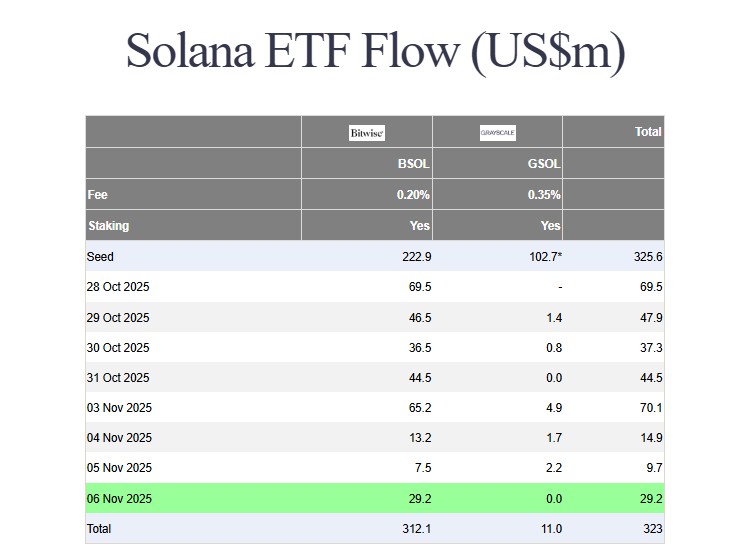

In the past day, $9.7 million has flowed into Solana ETFs, with Bitwise bringing in $7.5 million and Grayscale adding $2.2 million. This brings total inflows since launch to nearly $300 million. That is significant for any crypto project and shows that Solana is gaining attention not only from traders but also from financial institutions that want long-term exposure.

Several reasons explain why Solana is attracting these inflows. One major factor is its ability to handle transactions quickly and at very low cost. Solana is known for high speed and low fees, which makes it more appealing for activities like decentralized finance (DeFi), trading platforms, and token swaps. As more people use these applications, the network becomes more valuable, and institutions notice that growth.

Another factor is Solana’s recent price performance. After dropping to around $150, it quickly bounced back, showing strength during a period when many other cryptocurrencies were struggling. When a price rebound happens at a strong support level, many investors see it as a sign of stability. This is often when ETF inflows rise, because institutions tend to buy during confirmed recovery phases rather than at market tops.

Technical indicators also support this upward momentum. Traders who follow charts have noticed that Solana’s price has been recovering from an oversold condition, which often means sellers are losing control and buyers are stepping in. Funding rates in futures markets have also dipped into negative territory, which suggests many traders were betting against Solana. When the price rises during this period, it can trigger what is known as a short squeeze, pushing prices up even faster. In the past 24 hours, millions of dollars in short positions have been liquidated, giving Solana an additional boost.

On-chain data supports this positive picture. Activity on the Solana network has been rising steadily. More wallets are becoming active, more developers are contributing to new applications, and more value is being locked into DeFi platforms. These real-world signs of growth matter because they show people are using the network, not just trading its token. When network usage grows alongside ETF inflows, it becomes a strong foundation for price appreciation.

Solana has also worked on its reliability. After facing network issues in past years, it has made major upgrades, improving uptime and speed. Changes like the Firedancer upgrade are designed to make the network more stable under heavy activity, something institutions look for when considering long-term investments.

Looking ahead, the possibility of Solana reaching $200 depends on a few conditions. Continued inflows into ETFs will play an important role, because institutional demand often sets the tone for market direction. Global economic conditions also matter. If interest rates soften, risk assets like cryptocurrency usually benefit. Solana’s upcoming ecosystem announcements and events, such as developer conferences, may also bring new partnerships or upgrades that support positive momentum.

For everyday investors, the recent inflows show growing confidence in Solana’s long-term potential. While no price target is guaranteed, the combination of strong network activity, improving reliability, and institutional interest creates a supportive environment for growth. Understanding these factors can help both beginners and experienced traders navigate the market more confidently.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.