Bitcoin falling below $100,000 has caught everyone’s attention not just because of the number, but because of what it represents. For many months, the six-figure price acted like a psychological support level. Seeing Bitcoin drop under it can feel worrying, especially for newer investors. But in Bitcoin’s long history, short-term price drops happen often. They are normal, and sometimes even healthy for the market.

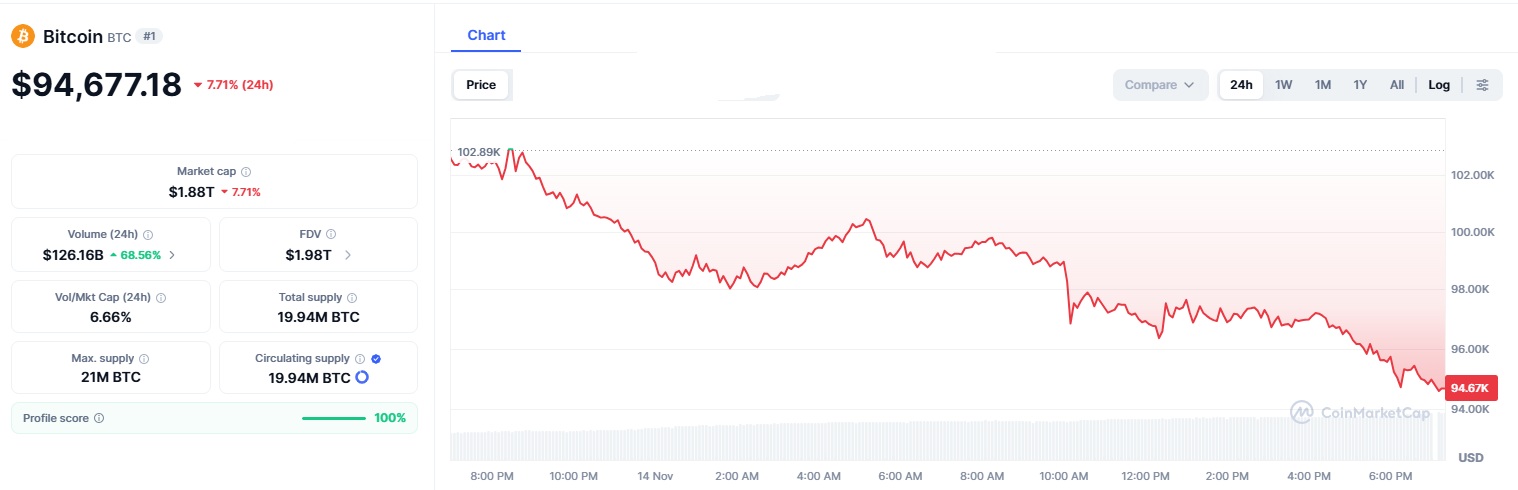

The recent fall from about $103K to around $94K is roughly a 7 percent decline. This move comes from a mix of real-world events and the usual ups and downs of the market. Rather than signaling something is “wrong,” this drop is more like the market taking a breather after a strong period of growth. Bitcoin has always moved in cycles, influenced by global news, investor reactions, and the growing financial ecosystem built around cryptocurrencies.

One of the biggest reasons for the latest weakness is the long U.S. government shutdown. At first, it may seem unrelated to Bitcoin, but shutdowns delay important economic reports that investors rely on. These reports include data on unemployment, economic performance, and overall financial health. Without this information, investors across all markets stocks, commodities, and crypto become more cautious.

Historically, government shutdowns bring uncertainty, and uncertainty often leads to reduced interest in riskier investments. Even though Bitcoin is sometimes seen as a protective or alternative asset, it still reacts to global economic signals. For example, during the 2019 government shutdown, Bitcoin also dipped before recovering strongly once economic reports became available again.

We may be seeing the same situation now. The shutdown has made it harder for markets to understand how the economy is performing, so some investors are choosing to wait on the sidelines until clearer data is released. And because Bitcoin typically moves with more intensity than traditional tech stocks, it feels the impact of this caution more than other assets. Overall, Bitcoin’s recent drop is less about long-term weakness and more about temporary uncertainty in the global financial system, something the cryptocurrency market has weathered many times before.

Another major contributor to the price drop is behavior from long-term Bitcoin holders. These are investors who typically hold their coins for extended periods often for months or years. In the past month, a large amount of Bitcoin was moved or sold by these holders as they took profits near recent highs.

This is common when Bitcoin reaches new peaks. Long-term holders tend to sell small portions of their holdings to secure profits, especially after strong rallies. This reduces upward momentum in the short term and can temporarily push prices down. But historically, such phases are often followed by periods of renewed strength because selling clears away excess pressure that built up during rapid climbs.

On-chain data, which tracks Bitcoin movements on the blockchain, shows that despite these sales, most long-term holders still maintain strong conviction. The majority continue to hold, even through dips, just as they did during past market resets. For beginners, this is an important insight: long-term holders usually act with patience, and their behavior often provides clues about the health of the market. The recent selling reflects profit-taking, not fear.

Spot Bitcoin ETFs have become a major force in the market, allowing large institutions and everyday investors to buy Bitcoin through familiar financial products. Earlier this year, these ETFs brought billions of dollars into the market, helping lift Bitcoin toward new highs. But recently, ETFs recorded more outflows than inflows, meaning some investors chose to rebalance their portfolios after months of upward movement.

This temporary pause in institutional demand removed an important source of buying pressure. However, fluctuations in ETF flows are normal. Institutions often rotate funds between different assets, especially during uncertain economic periods. This rebalancing does not signal a loss of interest in Bitcoin rather, it shows that Bitcoin is being treated more like a mainstream asset class, with investors adjusting positions the same way they would with stocks or commodities.

As clearer economic data becomes available and market confidence returns, ETF inflows often pick back up. In past cycles, renewed institutional buying has helped Bitcoin recover from similar dips, and many analysts expect a similar pattern this time.

📉 Bitcoin isn’t crashing — it’s cleaning.

What you’re seeing now is not a trend reversal, but a massive liquidity hunt.

Here’s what’s actually happening 👇🔥

💥 1. Price is only moving toward liquidity pockets

The drop is slow, controlled, and targeted.

No panic, no volume… pic.twitter.com/aVDjcFIrmT— abdullahX (@abohass82) November 14, 2025

Bitcoin Dip That Reflects Strength, Not Weakness

Bitcoin dropping below $100,000 may seem dramatic, but when you look at Bitcoin’s long history, this kind of dip is completely normal. It follows a familiar pattern where the market cools down after a period of strong growth. The recent U.S. government shutdown shook global confidence, long-term investors took some profit after the price hit new highs, and ETF investments slowed for a short time. All of these together caused a temporary pullback, not a sign of a long-term decline.

Bitcoin is continuing to mature as an important global asset. These ups and downs show that Bitcoin is becoming more tied to real-world events, but they also show how strong and adaptable it is. For new and experienced investors, this moment is a good opportunity to understand what influences Bitcoin’s price and to prepare for the next chapter in its long-term growth.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.