Strategy’s Executive Chairman Michael Saylor believes that Bitcoin has finally stabilized and that the market has already hit its bottom. In a recent interview with host Grant Cardone, Saylor explained that most of the forced selling in the market has already “washed out,” which means the heavy liquidation pressure that pushed prices down is largely gone. Bitcoin’s price often moves in sharp waves, and these swings can feel overwhelming for both new and experienced investors. During these moments, people often look for reliable voices like Saylor who understand the long-term patterns behind the market.

We are ₿uying.pic.twitter.com/6g11E9G6pO

— Michael Saylor (@saylor) November 14, 2025

During their discussion, Cardone asked Saylor where he thinks Bitcoin is headed next and how much further it could fall. Saylor said he sees Bitcoin holding steady at its current levels and expects it to start moving upward again. In his view, the most difficult part of the downturn is already behind investors. He added that months of deleveraging have cleared out many weak positions, helping the market reset. Saylor also emphasized the importance of long-term thinking.

He said that anyone making decisions on a 12-month timeline is essentially trading, and trading comes with very different risks. “If you’re a trader, you know you’re a trader. I have zero advice for you,” he said.

However, for entrepreneurs and long-term investors, Saylor believes the right approach is to think in time frames of four to ten years. According to him, Bitcoin makes the most sense as a long-term investment, not a short-term gamble.

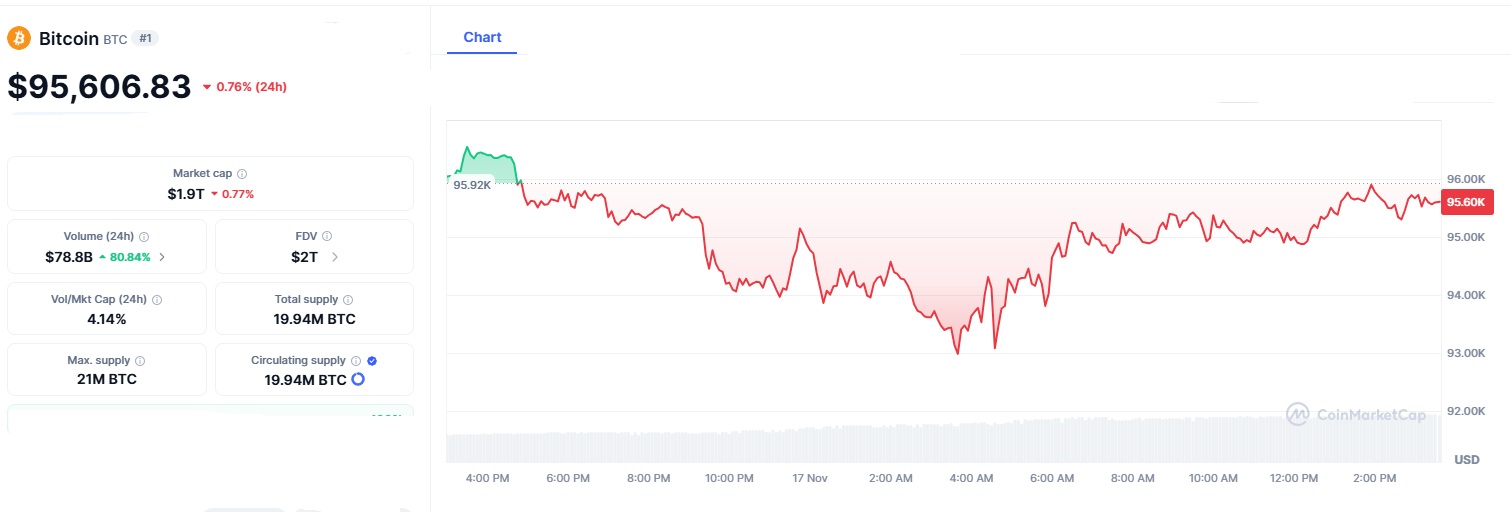

Saylor argues that the recent drop in Bitcoin’s price was driven mainly by leveraged traders getting liquidated. When the market falls quickly, traders who borrowed too much are forced to sell their Bitcoin automatically. This often speeds up the decline until the excess leverage is wiped out. Saylor believes this cycle has run its course.

He sees Bitcoin’s decline from its $110,000 peak as a natural correction rather than the start of a deeper crash. This view is shaped by his long-term investment strategy. Strategy now holds more than 250,000 Bitcoin, worth tens of billions of dollars, making the company one of the biggest corporate holders in history. His decisions have often been tied to major market inflection points, and many of his past predictions about Bitcoin reaching long-term support levels have proven to be accurate.

Bitcoin’s history is filled with moments where liquidation-driven corrections led to stronger long-term rallies. After each halving cycle, the market often experiences a period of volatility before building momentum. The recent price drop resembles earlier post-halving pullbacks, including those in 2016, 2020, and 2024.

With Saylor confident that Bitcoin has already found its floor and is preparing for its next major rally, do you believe the current reset is a long-term buying opportunity or do you expect more volatility ahead?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.