- BTC futures basis turns negative as traders cut leverage and reduce risk.

- Moving averages signal ongoing bearish pressure across derivatives markets.

- Spot price steadies near $95.6K after volatility and a sharp volume surge.

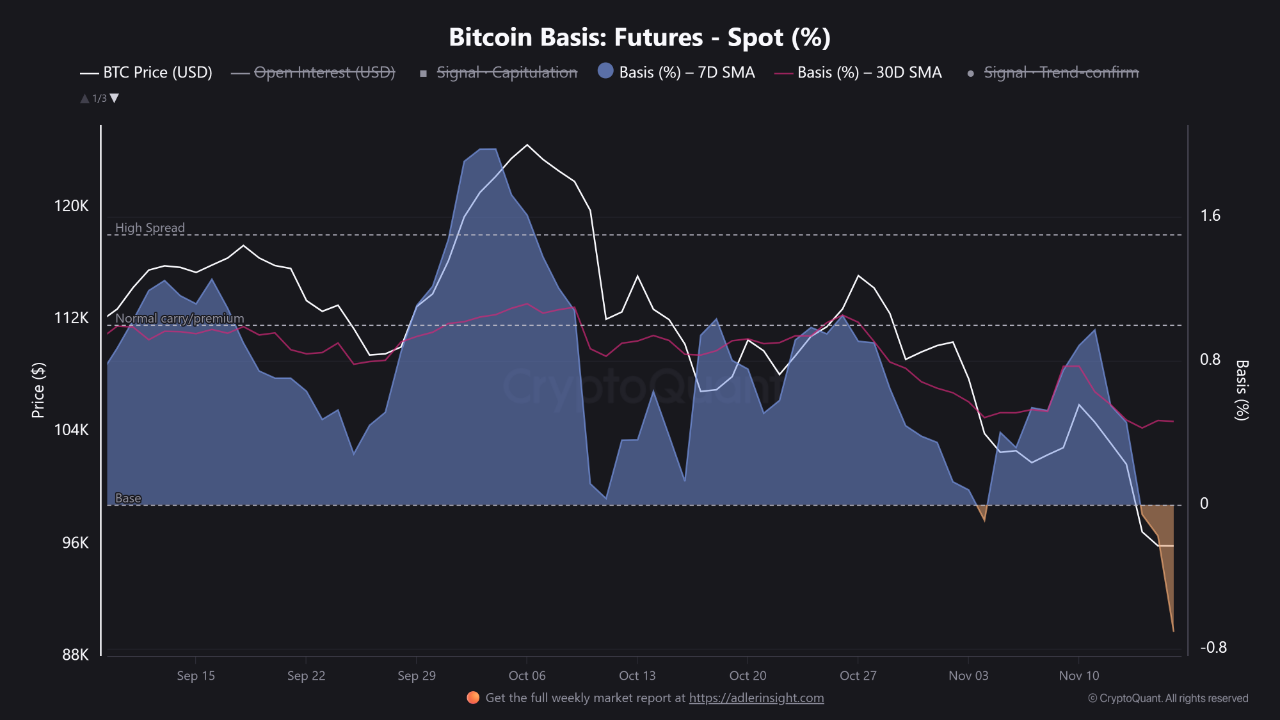

Bitcoin’s futures market showed a major shift in sentiment this week after the futures–spot basis moved below zero, indicating that contracts are now trading at a discount to the spot price. The development comes at a moment when Bitcoin’s price has experienced intraday swings and a broader cooling of momentum.

Negative BTC Basis Signals Caution

“The market is no longer showing a futures premium; instead, traders are pricing risk lower. A return above 0% – 0.5% Basis would be the first sign of recovering confidence.” – By @abramchart

Full analysis ⤵️https://t.co/TKg09oP01E pic.twitter.com/ROrHlBwvM8

— CryptoQuant.com (@cryptoquant_com) November 17, 2025

Market data tracked by CryptoQuant indicate that the basis has flipped negative, as both short-term moving averages continue to slope downward, reflecting reduced demand for leverage and growing caution among traders.

Futures Basis Slips Below Zero as Leverage Demand Weakens

According to CryptoQuant’s analysis, the futures–spot basis transitioned into negative territory after spending September and early October in a high-spread zone that previously reflected elevated bullish positioning. The shift became more pronounced as the 7-day and 30-day averages declined through October, eventually entering the “Base Zone,” a range associated with selling pressure or position reduction.

The chart data shows that Bitcoin’s basis moved from above 1.6% in late September to below 0% in November, a reversal that indicates weak futures premiums and muted appetite for leveraged long positions.

Source: CryptoQuant

Analysts noted that a negative basis typically appears during periods of de-risking or unwinding long positions. CryptoQuant reported that a return above 0% to 0.5% would be the first indication of recovering confidence in the derivatives market.

Spot Market Finds Stability Near $95,600 After Volatile Sessions

While futures markets point to unease, Bitcoin’s spot price showed signs of stabilization. The cryptocurrency traded near $95,591, recording a 0.08% increase over the past day following a period of accelerated volatility. The price fell toward $93,000 before rebounding through early morning trading, an action that helped narrow losses and return BTC toward the mid-$95,000 range.

Source: CoinMarketCap

CoinMarketCap data shows Bitcoin’s market capitalization at roughly $1.9 trillion, with trading volume climbing more than 52% to $76 billion. The surge in activity showed increased participation from both buyers and sellers following the latest pullback. The network’s circulating supply held at 19.94 million BTC.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.