Aave is one of the most well-known lending platforms in decentralized finance. It lets people lend out their crypto to earn interest or borrow crypto by using their existing assets as collateral, all without going through a bank or financial institution. Like most crypto projects, Aave’s token price can change quickly. Recently, the price of AAVE dropped by more than 10%, which naturally worried many new investors. When markets are uncertain, price drops often get the most attention and can make a situation seem worse than it really is.

However, price alone does not show the full picture. When you look beyond the token’s short-term movement and focus on how the Aave platform itself is functioning, a more balanced view appears. Even as the token price fell, people continued to deposit funds into the protocol, use its lending services, and generate revenue for the platform.

This gap between a falling token price and a healthy underlying system is important. It shows that while market sentiment can change quickly, the core strength of Aave as a lending platform remains in place. Understanding this difference helps beginners see why short-term price drops do not always reflect the true condition of a project.

What Caused the Recent Price Decline

The recent drop in AAVE was largely triggered by a large sale from a single major holder. Reports indicate that around $37.6 million worth of AAVE was sold in a short period. This kind of move can have an outsized impact on price, especially in markets where many traders are using leverage. As prices started to fall, traders who had borrowed money to bet on higher prices were forced to close their positions. These forced sales, known as liquidations, added more downward pressure. Around $1.59 million in long positions were liquidated, accelerating the decline.

Trading volume spiked sharply during this period, rising by more than 200%. This suggests that the drop was driven more by market mechanics and leverage than by a widespread loss of confidence in Aave itself.

Total Value Locked Continues to Grow

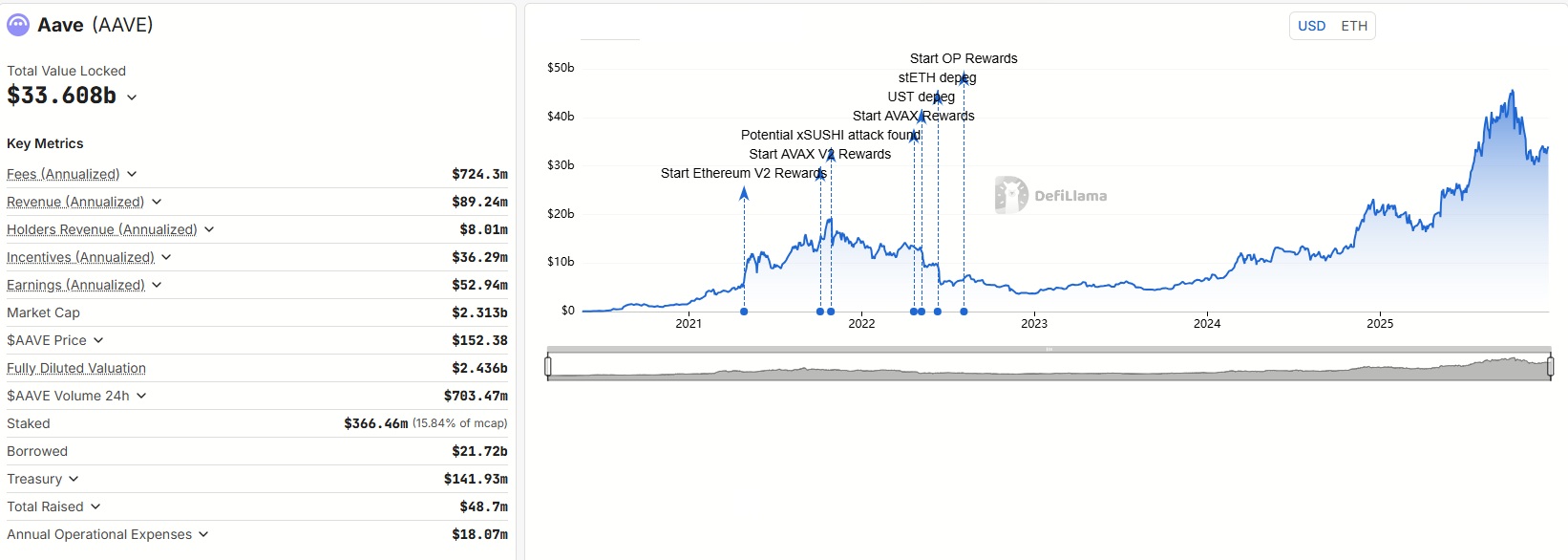

While the token price was falling, the amount of money locked into the Aave protocol was actually increasing. Total Value Locked, often called TVL, measures how much capital users have deposited into a DeFi platform. Data shows that Aave’s TVL increased by roughly $1.42 billion over a short period. This is a meaningful signal. In times of stress, users often withdraw funds from lending platforms. Instead, capital continued flowing into Aave.

This behavior suggests that many users, including larger participants, still trust Aave as a place to lend assets and earn yield. They appear focused on long-term utility rather than short-term price movements.

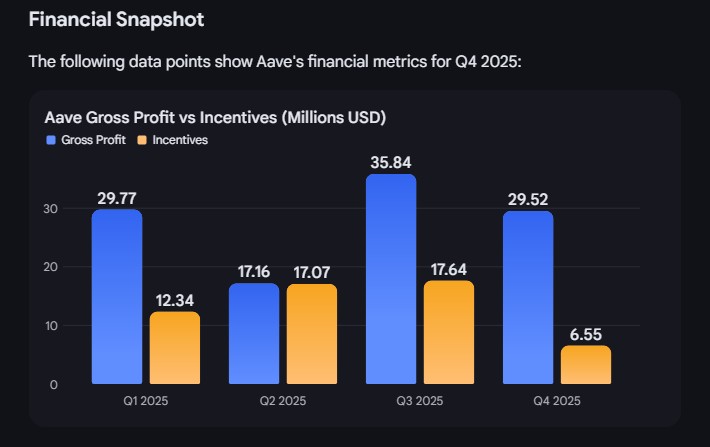

Another sign of strength is Aave’s ability to generate income. In the fourth quarter of 2025, the protocol earned around $22.97 million after accounting for incentives. This revenue comes from borrowing activity and interest payments. Unlike projects that rely mainly on token price increases, Aave operates as a functioning financial service. When people borrow and lend on the platform, it produces real fees. This makes Aave more resilient during market downturns. Consistent earnings help support long-term development and signal that the protocol provides real value to users.

One area that does show some softness is user activity. Transactions and borrowing have slowed, even as more capital is being deposited. This may seem confusing at first, but it reflects cautious behavior rather than weakness. Many users appear to be positioning funds and waiting. They are depositing assets but not aggressively borrowing or trading. This often happens during periods when markets are uncertain and participants want flexibility. Such phases are common in crypto and often precede larger moves once confidence returns.

Aave’s Position in the Bigger DeFi Picture

Aave’s recent price drop highlights how quickly market sentiment can change, but the protocol’s steady growth in deposits, ongoing revenue, and continued user trust show that its foundation remains strong. For beginners, this is a reminder that short-term price moves do not always reflect the true health of a project. Looking at how a platform is actually used often gives a clearer picture than price alone.

When prices fall, do you focus more on short-term market reactions, or do you look at how a platform like Aave is performing behind the scenes?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.