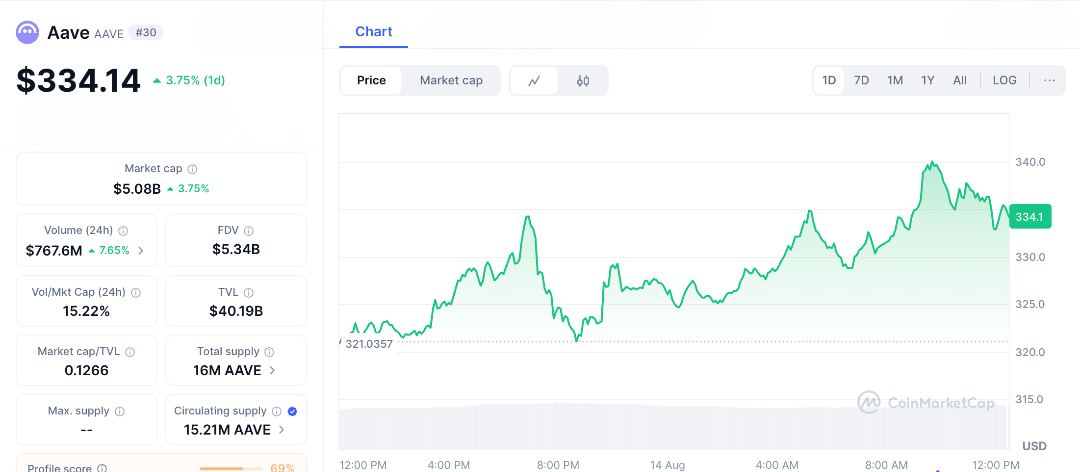

AAVE is standing strong while other altcoins start to gain momentum, making it a reliable option in a fluctuating market. As liquidity slowly returns, this DeFi leader is showing its strength and stability. Trading around $334 after a 10% weekly rise and a 29% monthly increase, AAVE proves that solid fundamentals and innovation are important even in uncertain times.

Recent gas-free upgrades, increasing deposits, and a dedicated user base are attracting capital, suggesting that Aave might be gearing up for a bigger rally. With Bitcoin at $121,000 and the total crypto market cap over $4 trillion, Aave could potentially push past $350 if liquidity keeps coming in. Will this mark the beginning of a broader altcoin surge with AAVE at the forefront, or is it just a temporary rise? Only time will tell, but for now, AAVE remains strong.

The DeFi Powerhouse

AAVE is becoming a key player in decentralized finance (DeFi). Initially designed to transform lending, it has now grown significantly and holds over $70 billion in deposits. This milestone underscores its popularity in a market seeking efficiency.

Recent innovations are catching attention. MetaMask’s gas-free rewards on AAVE’s Linea market offer a 2.4% APR boost using Zero-Knowledge (ZK) proofs, making borrowing and lending as easy as using social media. This real utility is bringing liquidity back to AAVE, even as other altcoins proceed cautiously. Stablecoin yields around 5-7% are attracting investors looking for steady returns.

Institutional confidence in AAVE is also growing. Coinbase’s relaunched Bootstrap Fund is contributing USDC liquidity to AAVE, with a goal of reaching $100 billion in net deposits by the end of the year. This ambitious target from founder Stani Kulechov could drive prices higher if achieved.

With Ethereum at $4,600 and Solana aiming for $300, AAVE’s strength lies in its reliable flash loans, strong risk management, and resilience to meme-driven volatility. This makes it a preferred platform for both cautious institutions and smart investors.

Could $400 Be Next?

AAVE is getting a lot of attention. Its price has jumped 32% in recent weeks, outpacing many other altcoins. Data shows a strong performance, Total Value Locked (TVL) has increased by 15% to $20 billion, and borrowings have reached $10 billion. This return of liquidity is supported by ETF investments and clearer stablecoin rules, benefiting established DeFi platforms like AAVE over more risky options.

Institutional interest is also growing. Plasma’s blockchain fund aims to manage $100 billion in assets using AAVE, combining traditional finance with DeFi innovation. Optimistic analysts believe the price could exceed $400, especially with events like “Stablecoin Summer” highlighting AAVE’s role in yield farming without the usual gas fees that users dislike.

Social media activity is high. On X, traders are talking about AAVE’s 10% weekly Return on Capital (ROC), signaling a potential altcoin season and reinforcing its reputation as a reliable option in a recovering market. For investors looking for both stability and growth, AAVE is becoming increasingly attractive and could shine in the next wave of DeFi momentum.

Even crypto heroes have their villains, and for AAVE, volatility is the main threat. While its price is holding strong, caution is needed, an RSI of 65 hints at possible pullbacks if Bitcoin corrects, and competitors like Morpho or Kamino are nibbling at market share. Regulatory hurdles on lending protocols could slow inflows, echoing lessons from 2022’s DeFi winter.

AAVE isn’t slowing down. New features like gas-free collateral voting (ezETH) are attracting more investment and helping the ecosystem grow. With a target of $100 billion in deposits, some analysts think AAVE could reach $416 by the end of summer if liquidity increases. In a market where altcoins are slowly gaining traction, AAVE stands out for its combination of reliability and innovation. This makes it an appealing choice for investors who are both cautious and looking for strong growth opportunities.

AAVE A Key Player in DeFi’s Growth

AAVE has been a standout in the world of decentralized finance (DeFi). Its ability to attract selective investments shows that a patient and strategic approach can be very effective. If the altcoin market fully heats up, AAVE could lead the way and turn a slow rise into a major rally.

For traders, the strategy is simple: stake wisely, diversify with stablecoins, monitor Total Value Locked (TVL) growth, and be prepared for market ups and downs. This might be the beginning of a significant period for DeFi, with AAVE at the forefront.

FAQs

1. Why is Aave crypto price holding strong?

Aave crypto price at $330 benefits from $70B in deposits, gas-free integrations like MetaMask on Linea, and selective DeFi liquidity.

2. Could Aave crypto price break $350 soon?

Yes, analysts eye $400 by summer if deposits hit $100B and altcoin momentum grows, with $330 as key support.

3. What drives Aave crypto price in 2025?

AAVE’s record TVL, institutional inflows via Coinbase’s fund, and 5-7% stablecoin yields fuel Aave crypto price resilience.

4. What risks could stall Aave crypto price?

Overbought RSI, competition from Morpho, and macroeconomic dips could push Aave crypto price back to $300 or lower.

5. Is AAVE a good bet during the altcoin warm-up?

AAVE’s fundamentals make it promising, but diversify, monitor TVL, and use regulated platforms to manage volatility risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.