Aave, one of the leading decentralized finance (DeFi) lending platforms, recently announced a partnership with Maple Finance to expand institutional lending in the crypto space. The collaboration was expected to bring major excitement and new liquidity to the market. However, instead of boosting Aave’s token price, the announcement barely made an impact. The price continued to slide, leaving many wondering if this partnership is a sign of progress or just another overhyped promise during a bearish phase.

Aave’s partnership with Maple Finance aims to connect DeFi lending with traditional finance. Maple specializes in institutional credit markets, allowing companies and funds to borrow crypto assets through blockchain-based pools. Together, Aave and Maple planned to open new lending channels worth around $500 million, giving investors access to yields of up to 8% on stablecoin pools.

This collaboration was introduced as a potential “bridge to traditional finance,” offering institutions a secure and transparent way to enter the DeFi ecosystem. In theory, it could have boosted trust, liquidity, and transaction volumes within Aave’s ecosystem. However, market reaction was muted.

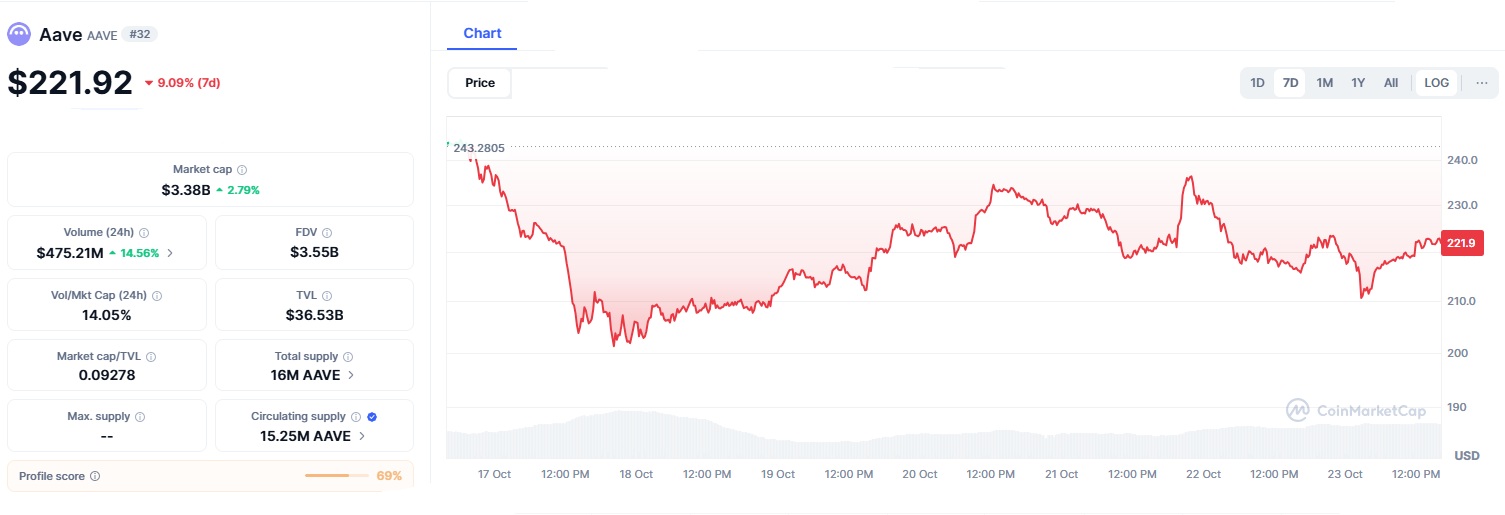

On October 21, 2025, Aave’s (AAVE) price fell 4.5%, rejection at the $235-resistance, despite the partnership news. The trading volume over 24 hours dropped by 12% to $150 million, showing that investors were not rushing to buy.

Technical indicators also pointed to weakness. The Relative Strength Index (RSI) stood at 39, signaling that AAVE was in an oversold zone, a sign of bearish momentum. The price hovered around the key $220 support level, which had previously acted as a strong base during July’s market rally. If AAVE breaks below this level, analysts expect it could fall another 17%, further reaching $100, which aligns with the long-term support at the 200-week EMA.

On the other hand, if the price manages to recover and break through $225, it could aim for $240, especially if the total value locked (TVL) in DeFi platforms climbs. Here’s a summary of AAVE’s key market data:

| Metric | Value | Market Implication |

|---|---|---|

| Price | $221.92 | Down 9 % despite partnership |

| 24-hour Volume | $150M | Up 2% |

| RSI | 39 | Oversold zone |

| Key Support | $220 | Break may lead to $100 |

| Resistance | $225–$235 | Possible rebound zone |

| Whale Outflows | 1.2M AAVE since September | Selling pressure continues |

This price drop reflects not only Aave’s individual challenges but also the overall slowdown in the DeFi market. Total lending volumes across DeFi platforms remain 60% lower than their 2021 highs. Even though Aave still holds about $10 billion in total value locked, investor confidence has weakened as the market faces lower yields and higher risks.

The Maple partnership was meant to inject new energy into DeFi lending, but the timing may have worked against it. With global markets showing cautious sentiment and crypto liquidity drying up, even strong announcements are not enough to turn prices upward.

Aave’s Future

Aave’s governance community recently voted on several updates for Aave V4, including improvements to flash loans, risk management, and cross-chain lending. These upgrades could make the protocol more efficient and user-friendly in the coming months. However, the immediate outlook remains uncertain. If whale outflows, large investors selling their tokens continue, AAVE could slip further toward the $100 level. But if DeFi liquidity improves and buyers return, a rebound toward $250 by November is possible.

Aave’s partnership with Maple Finance highlights a key stage in DeFi’s development the effort to attract institutional capital. However, the lack of an immediate price reaction shows that market sentiment remains cautious. Whether Aave rebounds or drops further will depend on broader DeFi recovery, investor confidence, and upcoming V4 upgrades.

For now, the $220 level acts as a critical line in the sand, a bounce could signal renewed strength, while a breakdown could confirm a slide toward $100.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.