- Aster and MemeCore lead altcoin losses amid strong trading activity.

- Gold-backed tokens and emerging projects face reduced investor demand.

- High trading volumes suggest temporary correction, not broad market exit.

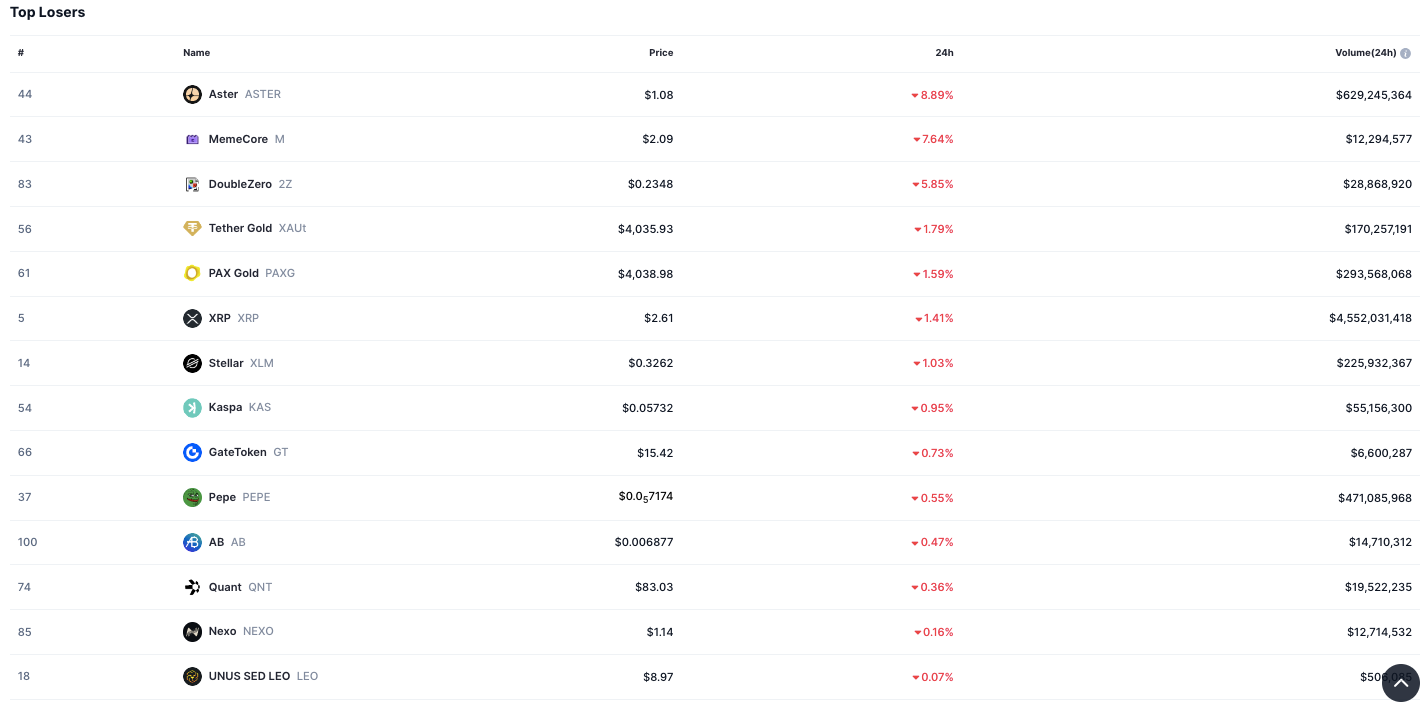

The crypto market experienced a broad decline over the past 24 hours, with several mid- and large-cap assets recording measurable losses. Trading data shows that Aster (ASTR) and MemeCore (M) were among the day’s weakest performers, reflecting a temporary pullback across both speculative and established tokens.

Aster (ASTR) registered the biggest fall of the day, dropping 8.89% to $1.08. The asset’s trading volume stood at $629 million, showing strong market activity despite declining prices. MemeCore (M) followed closely with a 7.64% decrease to $2.09. The decline came as meme-oriented tokens continued to face volatility, following a period of heightened speculative trading that had pushed several such assets to short-term highs earlier in the month.

Ecosystem and Gold-Backed Tokens Also Slip

Emerging project tokens mirrored the broader market trend. DoubleZero (2Z) slipped 5.85% to $0.2348, extending its recent downward movement amid declining risk sentiment in newer ecosystems. Meanwhile, digital commodities tied to gold saw reduced investor demand.

Source: CoinMarketCap

Tether Gold (XAUT) and PAX Gold (PAXG) both traded near $4,036, losing 1.79% and 1.59%, respectively. The decline in these assets shows subdued trading interest in gold-backed stablecoins despite ongoing market uncertainty.

Blue-Chip Altcoins Post Moderate Losses

Among major altcoins, XRP recorded a 1.41% decline to $2.61. The token maintained a daily trading volume of $4.55 billion, signaling continued liquidity despite the price dip. Stellar (XLM) also edged lower by 1.03% to $0.3262, while Kaspa (KAS) fell 0.95% after steady miner accumulation over recent weeks. GateToken (GT), the exchange token of Gate.io, retreated 0.73% over the same period.

Meme and Utility Tokens Show Minor Movements

Pepe (PEPE), one of the most actively traded meme tokens, declined by 0.55%, with a liquidity of over $471 million. Analysts noted that the move likely reflected profit-taking rather than broader market weakness. Smaller-cap tokens, including Quant (QNT), Nexo (NEXO), and UNUS SED LEO (LEO), posted minimal changes, down 0.36%, 0.16%, and 0.07%, respectively.

Market Overview

Despite the general decline, trading volumes across several assets remained high, showing ongoing participation from both institutional and retail traders. Market analysts stated that the pullback implies a temporary moderation in risk exposure rather than an extended sell-off, with volume levels hinting at possible stabilization in upcoming sessions.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.