- Broad altcoin sell-off signals market-wide profit-taking pressure.

- DeFi and infrastructure tokens face steep double-digit losses.

- High-liquidity assets see synchronized correction across sectors.

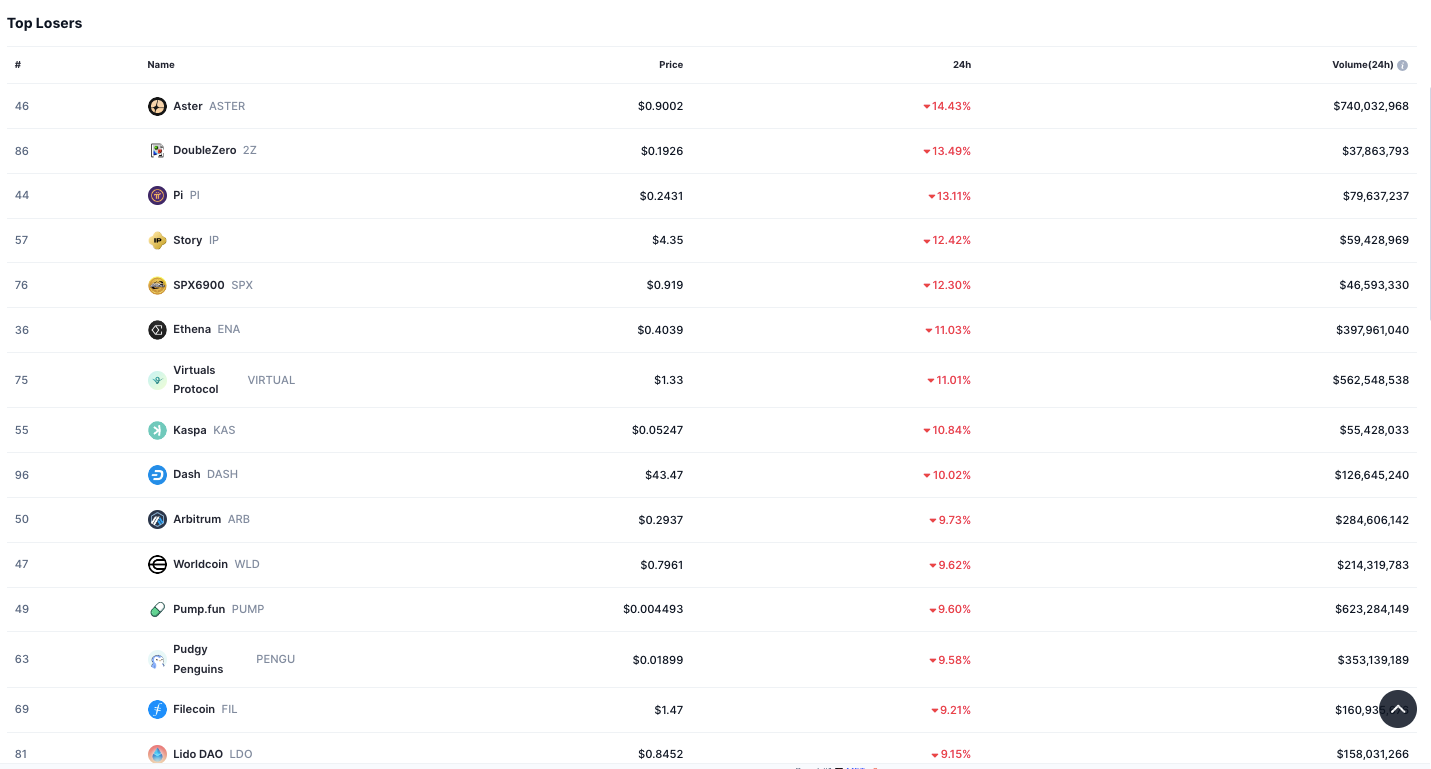

The crypto market has recorded a decline across major altcoins over the past 24 hours, with several mid- and large-cap tokens recording double-digit losses. Market data indicates that the downturn affected nearly every sector of the digital asset space, from decentralized finance (DeFi) projects to infrastructure and meme tokens, highlighting an intensified wave of short-term profit-taking.

Aster (ASTER) was the worst-performing asset of the session, falling by 14.43% to $0.9002 amid a high trading volume of $740 million. The drop follows large inflows into the token earlier in the week, showing that recent investors have started offloading positions, the move positions ASTER as one of the most volatile mid-tier assets currently in circulation.

DoubleZero (ZZ) and Pi (PI) followed, losing 13.49% and 13.11% respectively. Story (IP) also fell, dropping by 12.42% to $4.35, marking one of its largest single-day pullbacks since early October.

DeFi and Infrastructure Tokens See Heavy Pressure

The decline extended beyond individual assets to broader sections of the DeFi and infrastructure markets. SPX6900 (SPX) and Ethena (ENA) each posted double-digit losses, ranging from 11–12%, despite maintaining daily liquidity levels above $350 million. The combined pullback among these high-volume assets reflected a wider retreat from speculative and yield-linked positions.

Source: CoinMarketCap

Other notable declines came from Virtuals Protocol (VIRTUAL), Kaspa (KAS), and Dash (DASH), each losing between 10% and 11%. The sell-off across both proof-of-work and layer-2 ecosystems indicated weakened sentiment in projects tied to network scalability and computational efficiency.

Altcoins Broader Market Sees Synchronized Correction

Arbitrum (ARB) fell by 9.73%, extending its weekly downtrend despite a slowdown in layer-2 transaction activity and reduced on-chain volume. Meme and social tokens were similarly impacted, with Pump.fun (PUMP) and Pudgy Penguins (PENGU) each dropping around 10%.

Worldcoin (WLD) lost 9.62%, continuing its correction after recent attention from AI-sector investors. Filecoin (FIL) and Lido DAO (LDO) also declined more than 9%, underlining that the downturn reached beyond speculative assets and into established liquidity networks.

Overall, the trading session reflected a sequential market retracement affecting multiple sectors simultaneously. The scale of declines across high-liquidity assets signaled a broad unwinding of positions, as traders adjusted their exposure following strong rallies earlier in the week.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.