- Internet Computer leads altcoin rally with 26% surge and nearly $800M in trading volume.

- Privacy and PoW tokens like Zcash and Dash dominate gains amid rising liquidity.

- Market rebound shows renewed investor confidence in mid-cap and infrastructure assets.

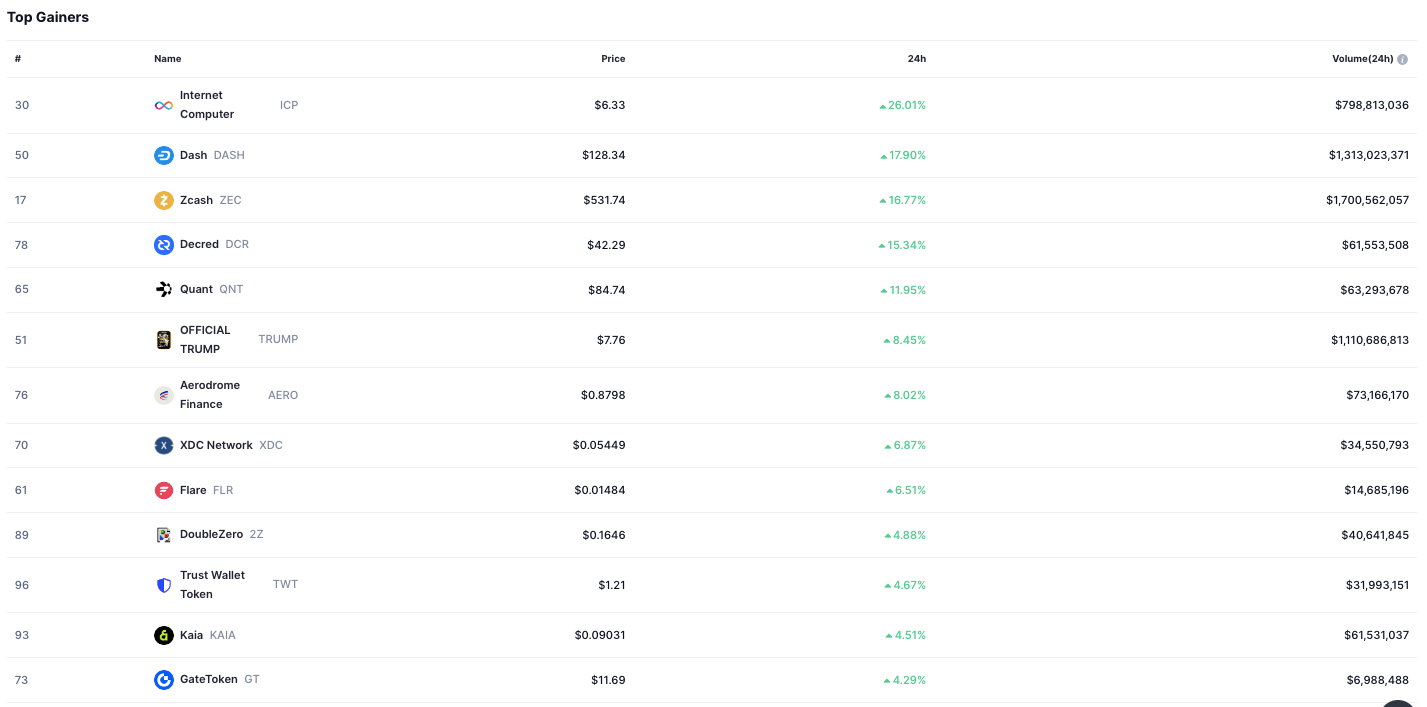

Several altcoins recorded strong price increases over the past 24 hours, led by Internet Computer (ICP), which posted the highest daily advance among major digital assets. Market data showed ICP climbing 26.01% to $6.33, with trading volumes reaching approximately $798.8 million. The move reflected renewed market activity after recent consolidation across the broader cryptocurrency sector.

Following ICP, Dash (DASH) and Zcash (ZEC) registered double-digit gains of 17.90% and 16.77%, respectively. Zcash’s price rose to $531.74, supported by $1.7 billion in trading volume, the highest among top performers. Dash also attracted significant interest, with volumes exceeding $1.3 billion, suggesting increased participation in privacy-oriented and legacy proof-of-work assets.

Broader Market Sees Increased Trading Activity

Beyond the leading gainers, Decred (DCR) advanced 15.34% to $42.29, while Quant (QNT) rose 11.95% to $84.74. Both recorded higher-than-usual trading volumes, indicating expanded market engagement beyond major altcoins.

Source: CoinMarketCap

The politically linked Official Trump (TRUMP) token also posted gains, climbing 8.45% to $7.76 on $1.1 billion in trading volume. The token’s continued activity reflected rising speculative participation during the latest market rebound.

Mid-Cap Tokens Extend the Uptrend

Mid-cap and smaller-cap assets followed the same upward trend. Aerodrome Finance (AERO) gained 8.02%, while XDC Network (XDC) and Flare (FLR) increased 6.87% and 6.51%, respectively. Additional upward moves were observed in DoubleZero (2Z), Trust Wallet Token (TWT), Kaia (KAIA), and GateToken (GT), each rising between 4.29% and 4.88%.

Liquidity Returns to Alternative Assets

The performance of these tokens pointed to a broader recovery phase led by infrastructure and privacy-focused projects. High daily volumes across multiple assets indicated a reemergence of liquidity in the altcoin segment.

Analysts observed that the rebound came after prior market corrections earlier in the week, suggesting that capital rotation toward alternative digital assets remained active. The gains, concentrated among utility and network-layer projects, reflected short-term optimism as the market tested resistance levels across key capitalization tiers.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.