- Bitcoin trades below $112K MA but shows limited selling from long-term holders.

- Unrealized loss ratio at 0.06 signals market stability and low downside pressure.

- $100K remains key support; rebound above MA could restore bullish momentum.

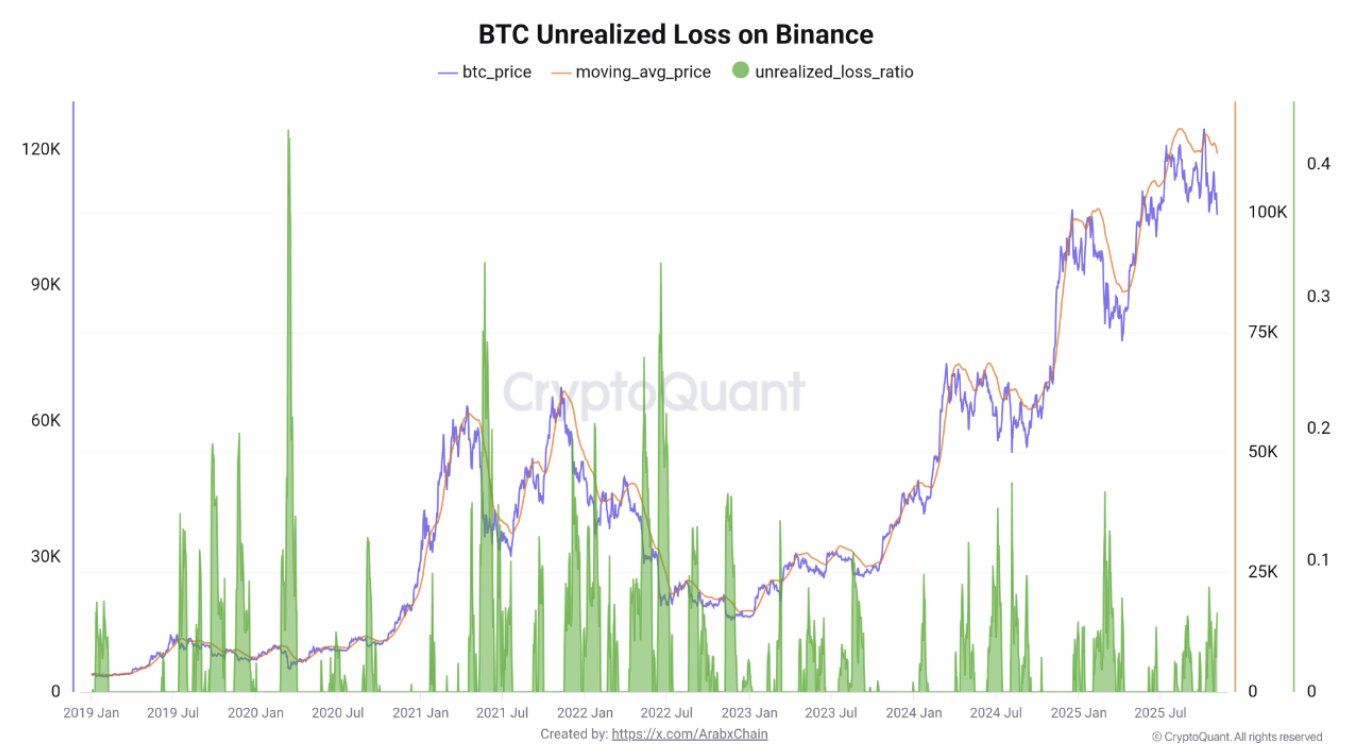

Bitcoin is currently trading below its moving average on Binance, with new data pointing to limited selling activity among long-term holders. According to CryptoQuant’s “BTC Unrealized Loss on Binance” chart, the cryptocurrency’s spot price stands near $105,000, while its moving average is positioned higher at approximately $112,245. This shift shows the market is in a consolidation phase after recent gains, with price momentum slowing as traders await new directional cues.

Binance Data Indicates Bitcoin is Trading Below the Moving Average With Low Unrealized Losses

“Low level of the losses indicator suggests there is no significant selling pressure from long-term investors. If the price rises back above the moving average, we may see a return of… pic.twitter.com/Qi3oklLp6Q

— CryptoQuant.com (@cryptoquant_com) November 4, 2025

The chart, which spans from 2019 to 2025, displays the relationship between Bitcoin’s price trends and unrealized losses recorded on Binance. Historically, higher unrealized loss ratios have coincided with market corrections, such as those observed during 2020, 2021, and mid-2022. These periods usually followed strong rallies and reflected increased liquidation pressure as traders exited overextended positions.

Low Unrealized Loss Ratio Signals Market Stability

Current data show an unrealized loss ratio of 0.06, indicating that only a small fraction of traders are holding Bitcoin at a loss. This is far lower than during previous market downturns, implying that most positions were accumulated near or below current levels. As a result, the market has yet to enter a loss phase that would typically trigger large-scale selling.

Source: CryptoQuant

Analysts note that when unrealized losses remain subdued while prices trade below the moving average, the market tends to stabilize rather than sell off aggressively. In previous cycles, significant spikes in unrealized losses have aligned with price bottoms, marking potential accumulation zones for investors.

Bitcoin Key Levels and Investor Behavior

The data also highlight $100,000 as a key psychological and technical support level. A major move below this mark could lead to renewed selling pressure and an increase in unrealized losses. Conversely, a recovery above the moving average may restore upward momentum and signal renewed confidence in Bitcoin’s trajectory.

Despite short-term caution, the low level of unrealized losses suggests that there is no major selling pressure from long-term holders. This suggests that investor behavior remains consistent, with market participants largely holding their positions through volatility.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.