As of November 28, 2025, Bitcoin has rebounded, trading above $90,000 after a sharp drop that took the price to around $81,600 on November 21. The market sentiment, as measured by the Crypto Fear & Greed Index, has also improved from “Extreme Fear”. Analysts note this rebound was driven partly by short-squeezes and a possible shift in sentiment, although global economic pressures, liquidity shifts, and uncertain market structure still pose challenges.

While whale accumulation and oversold technicals suggest a possible rebound, institutional flows were still negative as of November 26, pointing to a fragile market structure.

Why the Market Sees a Potential Bitcoin Bounce

In past cycles, deep drawdowns have frequently been followed by rebounds. Sell-offs purge leveraged positions and over-extended bulls, creating a reset potentially allowing more stable capital to enter. If sentiment stabilizes and buying pressure returns, BTC can rebound with less overhead resistance. One of the strongest bullish signals comes from long-term holders and institutional wallets accumulating during dips. This behavior suggests confidence at lower price levels and reduces circulating supply pressure a structural tailwind for price.

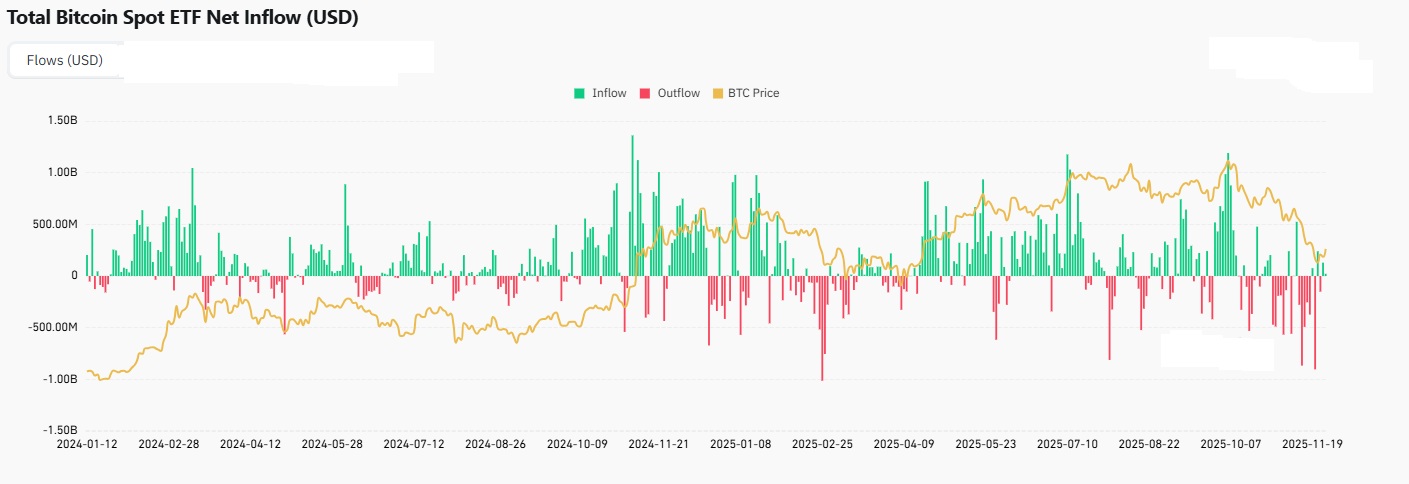

U.S. Spot Bitcoin exchange-traded funds (ETFs) are finally seeing money flow back in after going through a long stretch where more investors were selling than buying. From November 12 to November 20, these ETFs faced heavy selling. Investors pulled out about $3.16 billion, while only $75.4 million was added on November 19. Overall, this period ended with a net outflow of $3.09 billion, meaning far more money left than entered.

But things started to change from November 21 onward. According to data, Bitcoin ETFs received about $151 million in new inflows, showing that investor interest is beginning to return.

Source: Coinglass

With recent washout wiping out many leveraged positions, the market is currently at a lower-risk state. Fewer open long leverage and margin positions decreases the chance of cascading liquidations that can further drive down price which often helps stabilize and even reverse downtrends.

In a macroeconomic environment with rising inflation and geopolitical uncertainty, Bitcoin’s value proposition as a hedge or “digital gold” becomes stronger. That can attract both retail and institutional inflows particularly from investors seeking alternatives to traditional safe-havens.

Technical analysis indicates Bitcoin retesting key weekly demand zones around $89,500-$92,000. While a successful retest could signal a stronger move up, a failure to hold this zone could lead to deeper corrections. A daily close above $87,000 was cited as a bullish signal by some analysts. Bearish divergences were also noted in the market.

Key Signals That Could Confirm or Reject a Bounce

| Indicator

|

Why It Matters

|

|---|---|

| Long-term holder net inflows | Sustained accumulation suggests support from patient capital |

| Open interest and leverage levels | Low leverage reduces risks of forced liquidations |

| Macro policy changes (rates, inflation reports) | Will shape capital flow into risk assets like BTC |

| Exchange reserve levels | Drops may indicate decreased sell-side pressure; spikes may warn of dumps |

| On-chain activity vs. market sentiment divergence | Healthy on-chain metrics against weak sentiment can signal undervaluation |

A convergence of positive signals, inflows, low leverage, macro tailwinds could support a sustained rally. But a shock on any of the risk vectors could easily reverse gains.

Bitcoin’s Path Forward Is Opportunity — But Not Without Danger

Bitcoin’s rebound above $90,000 shows that the market is slowly regaining confidence, but the recovery is still delicate. Positive signs like long-term holder accumulation, lower leverage, and improving ETF inflows offer reasons for optimism. At the same time, global economic uncertainty and weak institutional demand remind investors that volatility is far from over. The next major move will depend on how these factors balance out in the weeks ahead.

Do you think Bitcoin’s latest rebound marks the start of a stronger uptrend, or is the market still too fragile for a sustained rally?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.