Bitcoin seems to be entering a new chapter in late 2025 as institutional investors large financial firms, hedge funds, and major corporate buyers, begin returning to the market. Their renewed interest has revived excitement across the crypto space. But the big question remains, Is this the beginning of a long-term bullish phase, or just a temporary wave of enthusiasm? For years, Bitcoin has cycled between dramatic highs and sobering corrections. Each cycle has had a defining theme, retail hype in 2017, institutional adoption in 2020, and now, perhaps, institutional re-entry in 2025. This time, the signals suggest real momentum rather than speculative noise.

Recent market data points to a clear resurgence in institutional activity. One of the key indicators is the Coinbase Premium Index, which measures the price difference between Bitcoin on Coinbase Pro (commonly used by institutions) and other global exchanges like Binance. When this index is positive, it shows that big investors in the U.S. are buying Bitcoin aggressively, often paying slightly higher prices to secure large amounts.

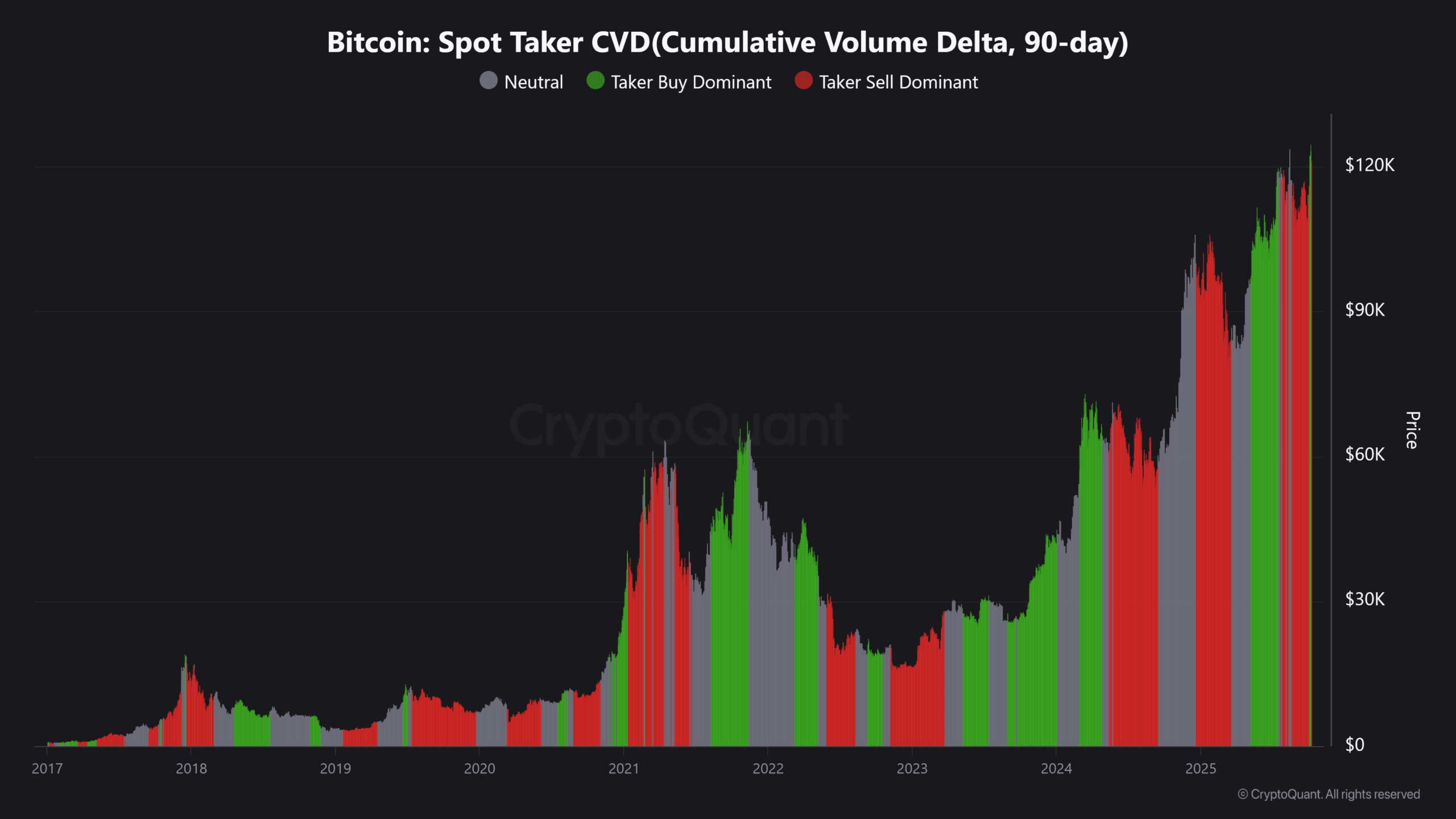

In the last few weeks of September 2025, this premium has remained consistently positive an encouraging sign that institutional buyers are quietly accumulating Bitcoin. Another crucial metric, the Spot Taker Cumulative Volume Delta (CVD), supports this view. It tracks the difference between aggressive buying and selling in the spot market. A rising CVD means buyers are dominating, pushing up prices and absorbing sell pressure.

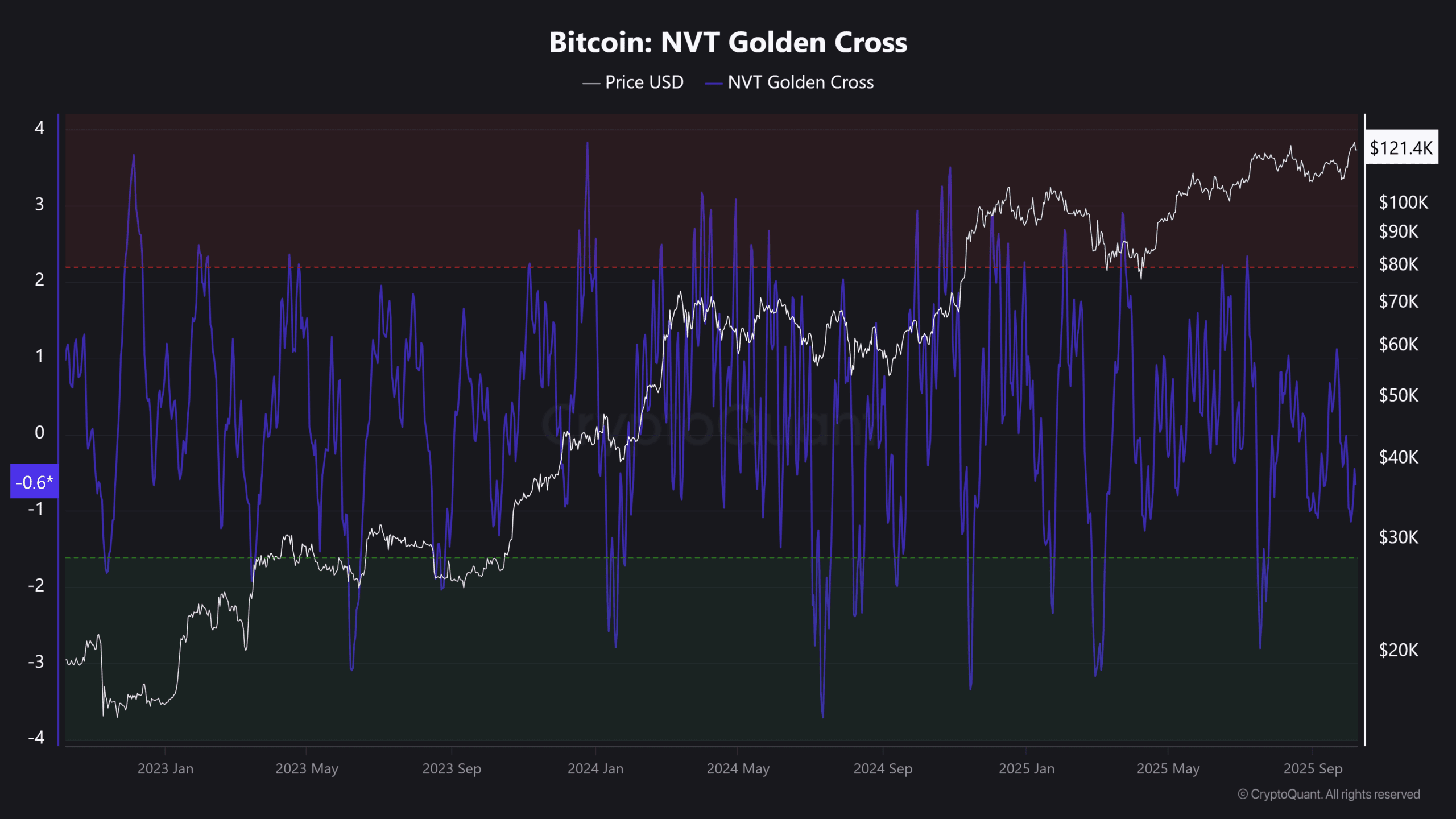

Meanwhile, on-chain data also paints a healthy picture. The NVT Golden Cross, a metric comparing network value (market cap) with transaction volume, has rebounded by more than 38%. This suggests that the network’s activity is catching up to its valuation, indicating stronger fundamentals.

The derivatives market adds further stability to this setup. Binance’s funding rates, which reflect how traders are positioned in futures markets, remain steady around 0.01%. This rate shows mild bullish sentiment enough to support upward movement, but not so high that it signals over-leverage or overheating. Together, these indicators suggest that Bitcoin’s rally is being driven by real buying interest rather than short-term speculation.

Bitcoin Key Indicators at a Glance

| Indicator | What It Measures | Current Trend (Oct 2025) | Interpretation |

|---|---|---|---|

| Coinbase Premium Index | Difference in BTC price between Coinbase and global exchanges | Positive | Institutional buying on U.S. exchanges |

| Spot Taker CVD | Net buying vs selling in spot markets | Rising | Demand is absorbing sell pressure |

| NVT Golden Cross | Market cap vs transaction activity | +38% recovery | Healthier network fundamentals |

| Funding Rate | Futures trader sentiment | 0.01% | Balanced, low-risk optimism |

Institutional investors often act as the backbone of long-term market strength. When large funds or corporations buy Bitcoin, it adds credibility, liquidity, and stability to the asset. Their involvement tends to attract more retail investors who see institutional confidence as a sign of trust. This renewed accumulation is also happening as crypto markets recover from the March 2025 correction. Many institutions view Bitcoin as a hedge against inflation and traditional market uncertainty. With global economic conditions still uncertain, digital assets like Bitcoin are regaining their role as an alternative store of value.

However, institutions typically enter markets cautiously and for strategic diversification, not speculation. Their return indicates confidence in Bitcoin’s long-term viability rather than short-term hype. While the signs are encouraging, sustaining a bullish trend depends on maintaining balance. If funding rates spike and traders become overly optimistic, the market could overheat leading to sharp corrections. The ideal scenario is gradual growth driven by steady inflows rather than sudden speculative surges.

Some analysts predict that if institutional buying continues and Bitcoin’s on-chain health remains strong, the price could reach $150,000 by mid-2026. This would represent a 50% jump from current levels. Others warn that if market leverage increases too quickly, Bitcoin could face a correction back to around $100,000 before climbing higher again. The future direction will depend on how well institutions manage their entries and whether retail investors follow with sustainable participation.

Looking Ahead

If institutional inflows continue, Bitcoin may be entering a more mature phase one less dependent on hype and more on fundamentals. The combination of strong spot demand, improving on-chain metrics, and controlled leverage forms a solid foundation for potential growth. However, the crypto market remains unpredictable. While the signs point to strength, overconfidence could still trigger setbacks. The coming months will reveal whether this institutional wave is a sustained transformation or just another short-lived surge.

Bitcoin’s bullish momentum in late 2025 is being powered by real institutional demand, healthy on-chain recovery, and steady market sentiment. If these trends hold, the next leg of the bull market could be both powerful and sustainable marking a turning point in Bitcoin’s evolution from speculative asset to global financial cornerstone.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.