As decentralized finance (DeFi) matures, the need for efficient, unified liquidity grows more pressing, especially on ecosystems like Avalanche, where trading activity and innovation are rapidly scaling. Blackhole emerges as a next-generation decentralized exchange (DEX) and liquidity hub built specifically for Avalanche, backed by experienced Web3 contributors, extensive audits, and funding support from the Avalanche Foundation.

Blackhole aims to solve one of DeFi’s long-standing problem of fragmented liquidity across disparate platforms and incentive models. By combining advanced vote-escrow tokenomics, customizable trading pools, fair token launches, and deep community ownership, Blackhole seeks to become Avalanche’s primary trading backbone. Let’s understand.

What Is Blackhole?

Launched in 2025, Blackhole is positioned more than a traditional DEX. It positions itself as Avalanche’s central liquidity hub, integrating multiple innovations into a single platform. Its architecture draws from success models such as Curve, Velodrome, and Uniswap v3, but custom-fits them for Avalanche’s developer and trader ecosystem.

The Blackhole has opened 🕳️ pic.twitter.com/D7vcm1win1

— Blackhole (@BlackholeDex) July 11, 2025

Key Features & Innovations

Blackhole’s uniqueness lies in its feature-rich, composable design:

-

Advanced ve(3,3) Tokenomics

The protocol introduces two types of vote-escrowed NFTs (veNFTs):-

Singularity veNFTs: Users lock $BLACK (up to 4 years) to receive voting power and emissions.

-

Supermassive veNFTs: Users permanently burn $BLACK to mint non-decaying governance tokens with superior rewards aligning long-term commitment with protocol control.

-

-

Permissionless Liquidity Pools

-

Supports both volatile and stable assets with customizable swap curves—including concentrated liquidity functions similar to Uniswap v3.

-

Any project or user can launch a pool with configurable fee structures and incentives.

-

-

Genesis Pools

-

A novel feature allowing new projects to fairly launch liquidity with community backing.

-

Unsuccessful pools are refunded, protecting participants while seeding promising protocols—a DeFi-native version of “fair launches.”

-

-

No Team or VC Allocation

-

Zero tokens were allocated to insiders, team members, or venture capitalists.

-

All ecosystem-controlled tokens are locked into protocol-owned veNFTs, meaning revenue redistribution and control stays with platform users.

-

-

Extensive Security Audits

-

Audited multiple times by PeckShield and Code4rena.

-

Ongoing threat detection and response ensure a high bar for smart contract safety.

-

Avalanche is a high-performance, scalable L1 competing with Ethereum and Solana, increasingly popular for gaming, RWAs (real-world assets), and modular DeFi apps using its Subnet system. However, its trading activity has historically been fragmented across several DEXes, many of which operate with traditional models and limited incentive alignment.

Blackhole enters this market not simply as another DEX, but as the coordination layer for liquidity, incentives, and governance on Avalanche – all deeply local to its infrastructure.

Ecosystem Integrations & Listings

To support visibility, trading depth, and real-time analytics, Blackhole has successfully integrated with the largest DeFi infrastructure providers in an extremely short time building trust among people:

Tracked by DefiLlama

-

Blackhole is fully listed on DefiLlama, the leading blockchain analytics dashboard. Users can now monitor:

-

Live Total Value Locked ($145.57 million as of 21st July)

-

Protocol fees, trading volumes, and revenue

-

Weekly/monthly growth trends

-

Integrated with Kyber Network

-

Blackhole integrates with KyberNetwork, leveraging its aggregation engine to offer users better swap rates and deeper liquidity across trading pairs.

-

This boosts performance for retail traders while improving capital efficiency for liquidity providers.

Listed on DeBank

-

Blackhole is live on DeBank, making it easier for users to:

-

Track their wallet balances and positions

-

View veNFT holdings

-

Monitor liquidity participation and governance

-

$BLACK Token – How It Powers the Protocol

Launched in July 2025, $BLACK is the native token of the Blackhole Protocol. The token underpins all governance, incentives, and trading activities.

Token Utility:

-

Lock for veNFTs to vote on weekly emissions

-

Earn a share of protocol revenue

-

Used in LP incentives, bribe markets, and launchpad governance

Supply & Stats

| Metric | Value (as of July 21, 2025) |

|---|---|

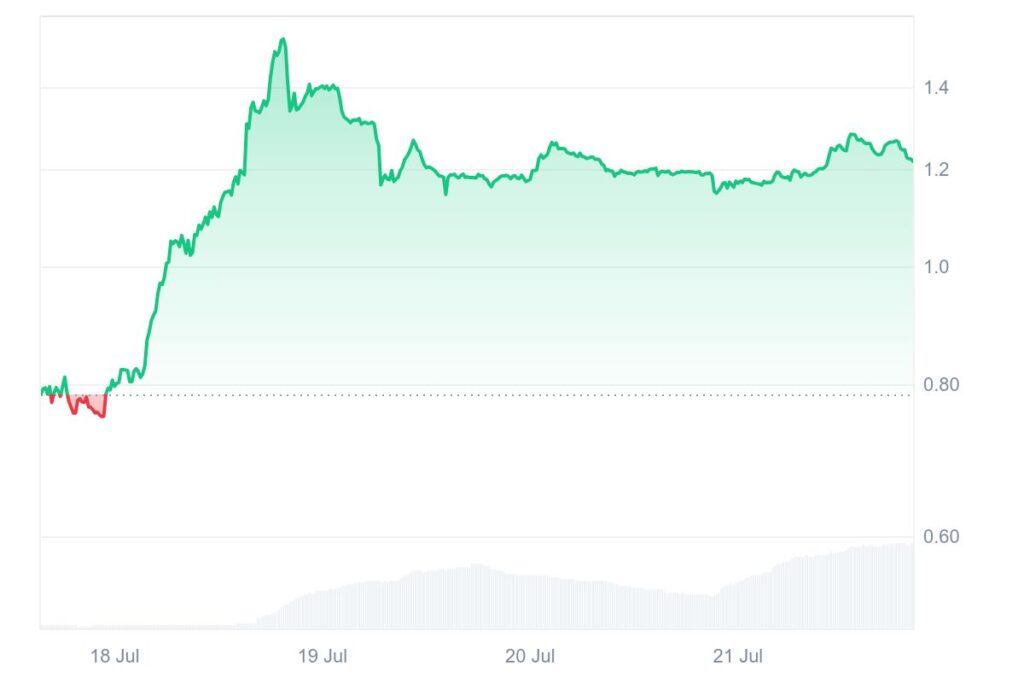

| Price | ~$1.22 (+58% since launch) |

| Circulating Supply | $114 million $BLACK |

| Market Cap | ~$140 million |

| 24h Trading Volume | $9.12 (+146%) |

Source: CoinMarketCap

-

No private sales, VC allocations, or team unlocks

-

Protocol-owned veNFTs control treasury emissions — reinforcing community-led governance

Key Competitors

To understand Blackhole’s path, we must examine the competition it faces both within Avalanche and across similar DEX ecosystems.

Within Avalanche

| Protocol | Strengths | Limitations |

|---|---|---|

| Trader Joe | Longest-running DEX on AVAX; strong brand | Limited governance; weaker incentives |

| Pangolin | AVAX-native, multi-chain effort | Fragmented growth; lacks veTokenomics |

| Curve (AVAX) | Stable swaps; governance system | Focused on stablecoins only |

Cross-Chain/Cosmopolitan Competitors

| Protocol | Notable Features |

|---|---|

| Velodrome (Optimism) | High TVL; ve(3,3) governance pioneer |

| Camelot (Arbitrum) | Flexible pools; ecosystem-first culture |

| Uniswap v3 Ports | Exact liquidity control; concentrated TVL |

| Thena (BNB Chain) | Emerging L1 leader in veTokenomics |

Where Blackhole Leads:

-

Combines the best from these systems—permissionless pools, dynamic fees, veNFTs, bribery voting—with local alignment to Avalanche.

-

Eliminates insider overhead by removing team/VC allocations.

What Blackhole Must Do to Become #1 on Avalanche

- Cultivate Long-Term Liquidity Providers: Blackhole must prove that its veNFT model motivates sustainable liquidity—through both emissions and bribes. If traders and projects see better ROI locking liquidity here versus Trader Joe or elsewhere, TVL will follow.

- Lead Developer Ecosystem Utility: By prioritizing open-source tools, SDK integrations, and LST (liquid staking token) partnerships, Blackhole can attract builders who need deep, programmable liquidity.

- Maintain Decentralization & Credibility: Its zero-insider model positions Blackhole as a truly user-owned protocol. That trust must be preserved through community-first governance, clear treasury management, and transparent emissions.

- Expand EVM & Cross-Domain Partnerships: Building bridges with other Avalanche subnets and L2 networks (e.g., partnering with gamefi leaders or LSTs) will extend Blackhole’s gravity further.

- Iterate on Product: To avoid ossifying like early DEXes, Blackhole will need to refine core modules—AMMs, ve systems, airdrops, fee structure—without overcomplicating UX.

Risks Ahead

-

Mercenary Capital: Voters may direct incentives to short-term profitable projects, which can dilute long-term alignment.

-

Bribery Wars: Protocols often suffer from vote-buying inflation spirals that hurt governance outcomes.

-

Market Sentiment: DeFi’s ongoing volatility means TVL and volume can crash swiftly without sustained usage incentives.

A Supermassive Opportunity

Blackhole isn’t just another DEX but it’s becoming the financial infrastructure layer of Avalanche. With no insider allocations, decentralized emissions, and full transparency, it appeals to both values-based users and serious DeFi builders.

Its growing TVL (>$145M), integrations with DefiLlama, Kyber Network, and DeBank, and successful $BLACK token launch all point to increasing momentum. But sustaining leadership in a competitive DeFi landscape requires more than innovation—it requires execution, trust, and continued community alignment.

Its next test will be whether it can scale sustainably while preserving community trust something no DEX, even Uniswap or Curve, has truly perfected. If it succeeds, Blackhole will do more than dominate Avalanche, it may redefine what a modern liquidity hub should be in Web3.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.