Decentralized finance (DeFi) is changing fast, and Aave, a top platform in this space, has made a big update that could change how money flows back to its users. Aave’s new fee switch has led to large-scale buybacks of its tokens, reducing the supply and raising hopes that the AAVE token might go over $600 by the end of 2025.

This update is part of Aavenomics, the system that controls how Aave works. Earlier in 2025, the Aave community agreed to use some of the platform’s earnings to buy back AAVE tokens. The idea is straightforward but effective: instead of keeping the money unused in the treasury, it’s used to buy AAVE tokens from the market. This reduces the number of tokens available, which can help increase their value and give more benefits to long-term holders.

How the Fee Switch Works

The fee switch officially launched in March 2025, starting with a plan to spend $1 million per week on buybacks for six months. At the time, Aave’s treasury had already swelled to over $100 million, thanks to a huge spike in revenue, up 115% compared to the previous year.

By August 2025, the program had already completed about $24 million in buybacks, directly lowering the available supply of AAVE tokens in the market. This mechanism benefits stakers too, since AAVE holders who lock their tokens for governance and security gain additional rewards as revenues are redistributed.

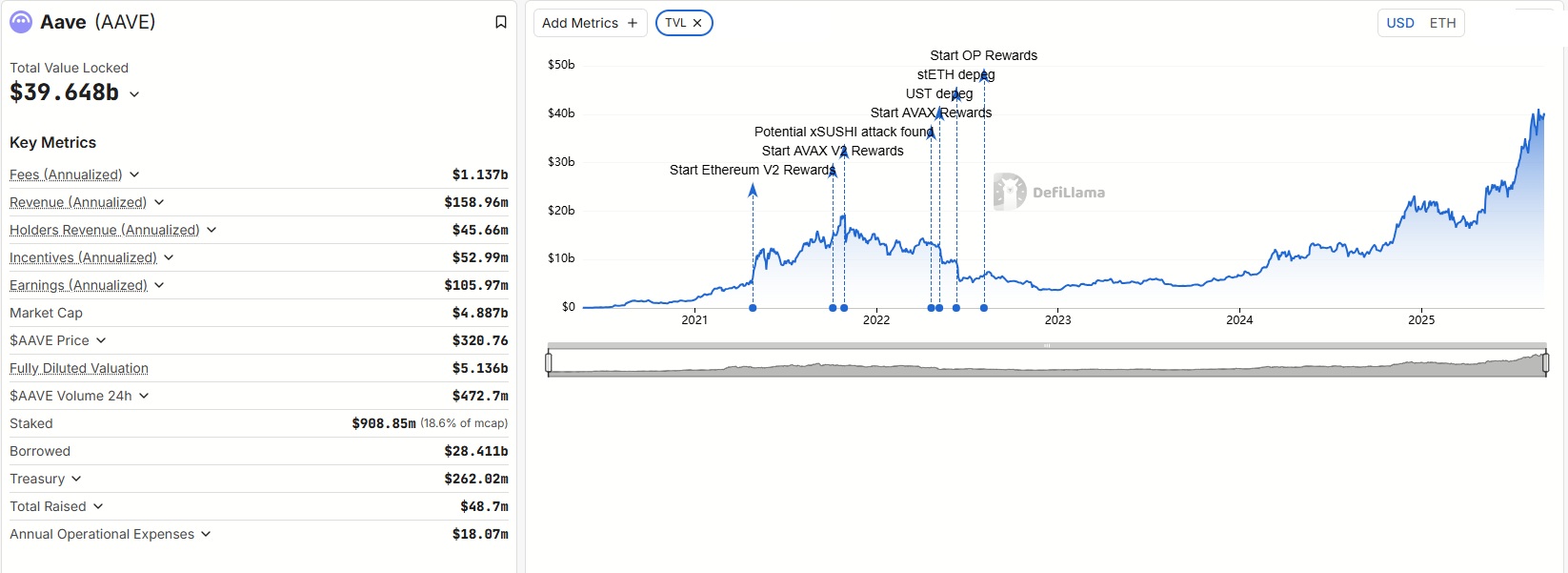

On-chain data backs this growth story. According to DeFiLlama, Aave’s total value locked (TVL), the measure of assets deposited into the platform—reached an impressive $39 billion.

The Role of Governance

Community governance has been central to this transformation. The Aave Finance Committee (AFC), which manages buyback execution, was empowered by near-unanimous community votes, showing just how strongly users supported this approach. More than 99% of voters approved the proposal, reflecting widespread agreement that fee redistribution makes the ecosystem stronger.

Governance also plays a role in expanding Aave’s use cases. For example, the latest upgrade (V4) integrates real-world assets (RWAs) like tokenized U.S. treasuries into the platform. This allows users to earn yields not only from crypto-native loans but also from traditional financial products represented on-chain. Fees collected from services such as flash loans and interest on deposits are now partially routed toward these buybacks, further reinforcing the model.

Competitors like Compound are struggling to keep pace. While Compound’s market share has stagnated, Aave continues to dominate with more than two-thirds of the DeFi lending sector, and it has done so while maintaining zero bad debt through turbulent market swings.

Market Reaction and Price Action

The market has taken notice. The price of AAVE rose from around $131 in April to $320 by early September, a gain of more than 140% in just a few months. Analysts attribute much of this growth to the buyback program, which acts as a steady demand force on the token.

Technical indicators also suggest strong momentum. Chart patterns like the inverse head-and-shoulders formation point toward potential breakouts above the $340 resistance level. Trading data confirms this, with more than $374 million in daily trading volume and steady accumulation among holders, according to Etherscan. Institutional investors are also showing renewed interest, drawn by improved staking incentives and the stability of Aave’s treasury-backed system.

Aave and DeFi’s Shift

Aave’s fee switch is part of a broader DeFi trend where protocols are moving toward value accrual for token holders. Uniswap’s activation of its own fee switch earlier this year boosted UNI’s price by more than 30%, showing that investors favor projects where revenues flow back into the ecosystem.

But Aave is in a league of its own. Even during market downturns, it generated over $1.7 million in revenue within just 48 hours, demonstrating resilience and scalability. Combined with its leadership in lending, integrations with real-world assets, and strong governance, Aave has positioned itself as a cornerstone of DeFi’s next growth phase.

Timeline of Key Events

- March 4, 2025 – Aavenomics proposal introduced, planning $1 million weekly buybacks.

- April 9, 2025 – First buybacks executed; treasury surpasses $100 million.

- May 2025 – Upgrades to staking module enable integration of tokenized real-world assets.

- August 2025 – Treasury grows to $115 million; TVL reaches $65 billion.

- September 2025 – Governance discussions focus on expanding to six additional blockchains under V4.

Price Predictions and Outlook

Analysts are divided but mostly optimistic. Some forecasts expect AAVE to reach $370–$400 in the short term, while more bullish projections place it as high as $445 by the end of 2025. If market momentum continues and the broader crypto sector remains strong, breaking the $600 level is not out of reach.

Supporting this outlook are several macro factors:

- DeFi adoption has grown significantly, with total value locked across all ecosystems rising 150% year-over-year.

- Aave’s net deposits exceed $36 billion, reflecting trust in the platform’s stability.

- Expansion to emerging chains like Mantle and Aptos could widen Aave’s reach.

- The GHO stablecoin, Aave’s native stable asset, has already reached a $150 million market cap, strengthening its ecosystem further.

Aave’s fee-switch governance and buyback program represent more than just a technical upgrade, they are a shift in how DeFi projects align incentives between platforms and token holders. By combining revenue redistribution, strong governance, real-world asset integration, and rapid growth in deposits, Aave has created the conditions for sustained momentum.

While market volatility remains a risk, the fundamentals suggest that Aave is well-positioned for long-term success. If adoption continues and investor confidence holds, the AAVE token could realistically aim for the $600 mark by 2025, placing it among the most valuable assets in decentralized finance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.