OKB, the utility token of the OKX exchange, made headlines by cutting its circulating supply in half overnight. This move caused prices to soar, leaving many traders wondering: Can it stay above $100, or will it drop back to around $50?

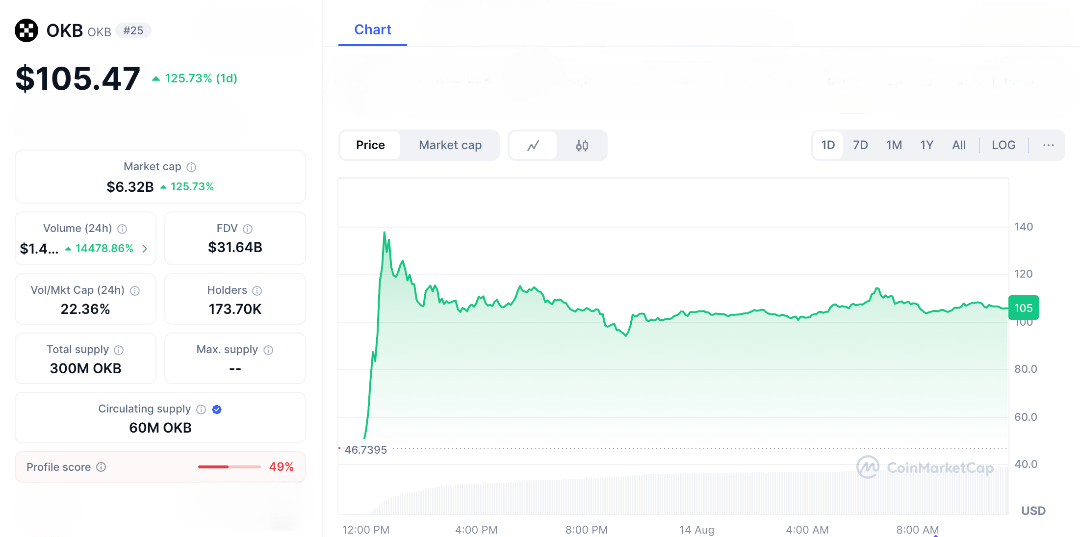

On August 13, 2025, OKX burned 65 million OKB tokens worth $7.6 billion, permanently capping the supply at 21 million, similar to Bitcoin’s scarcity approach. As a result, the price surged from $46 to $142 before settling around $105. Trading volumes also spiked by 13,000%, reaching $1.42 billion. This deflationary strategy aims to increase value, reward holders, and reduce supply. The big question now is whether these high prices will last or if a price drop is likely.

OKB holders were surprised to learn that over half of the circulating supply had been permanently burned, similar to Bitcoin’s halving but on a larger scale. This move isn’t just for show; it has practical benefits. OKB holders get discounts on trading fees, staking rewards of around 5-7%, and access to exclusive OKX perks like token launchpads. By capping the supply at 21 million, OKX aims to create scarcity, potentially making OKB a valuable asset in a market filled with inflationary altcoins.

There is a lot of excitement among investors. With Bitcoin at $121,000 and the total crypto market over $4 trillion, this burn could help OKB stay above $100 and possibly rise towards $150 if more people start using it. Some analysts predict potential 200% gains, comparing this situation to Binance Coin’s price rallies after supply cuts, where reduced supply increased demand from loyal exchange users.

But every thriller has its twists. Can OKB really stay above $100, or is a slide back to $50 coming? Skeptics aren’t convinced. Bears point to its volatile past remember when it dipped below $20 during the 2022 bear market? Critics also wonder if burning tokens truly solves the bigger question: real demand for utility and adoption.

Yes, OKX is a top exchange with $2 trillion in annual trading, but competition is fierce. Binance’s BNB and Coinbase’s ecosystem have broader reach. On-chain data shows whales stocked up pre-burn, but yesterday’s rally was fuelled by retail FOMO. That raises the risk of profit-taking cascades if sentiment sours, especially amid macro-economic jitters like delayed rate cuts.

Technical signals add another layer, the RSI spiked overbought at 61, hinting at potential pullbacks. Support at $80 could hold if daily volumes stay above $500 million. And if regulatory scrutiny on centralised exchanges slows adoption, OKB could quickly fall to $50, erasing gains almost overnight.

What’s really interesting about OKB’s token burn is what it means for crypto’s deflationary strategies. Remember how SHIB and LUNA had huge supply cuts that didn’t always meet expectations? OKB’s burn is different. OKX is transparent about what they’re doing, and the burn is backed by a successful exchange with billions in reserves.

If OKB can maintain a price above $100, it might inspire others to try similar strategies, showing that aggressive tokenomics can work in well-established markets. Online communities are buzzing with debates about whether the price will continue to rise or fall. This seems real: a good blend of utility and scarcity. With Bitcoin’s dominance decreasing, altcoins like OKB could finally get their time to shine.

OKB’s Half-Supply Burn—Gamble or Game-Changer?

With OKB’s supply cut in half, the token is facing a real test. Will it rise to $150, rewarding holders with staking perks and trading discounts? Or will it drop back to $50 due to excessive hype? Crypto often rewards bold moves, but it’s also known for its unpredictability. This burn might elevate OKB to a top-tier status, or it could show that not all token burns lead to lasting increases in value.

Whether you’ve perfectly timed a token burn or learned from mistakes, share your experience. OKB’s journey is just beginning, and everyone’s watching closely to see what happens next.

FAQs

1. Why did OKB’s supply halve overnight?

OKX burned 65.26 million OKB tokens, permanently reducing the total supply to 21 million to create scarcity and boost value.

2. Can OKB sustain $100 after the burn?

OKB hit $142 post-burn but trades at $102; sustaining $100 depends on sustained demand and exchange growth, with $80 as key support.

3. What risks could crash OKB back to $50?

Profit-taking, competition from other exchange tokens, and macroeconomic pressures like rate hikes could push it toward $50 if momentum fades.

4. How does OKB’s burn compare to Bitcoin’s halving?

Like Bitcoin’s halving, OKB’s burn reduces supply to drive price, but it’s centralised burn is riskier, relying on OKX’s performance.

5. Is OKB a good investment post-halving?

OKB’s utility and deflationary model suggest upside, but diversify, monitor whale activity, and stake cautiously due to volatility risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.