Pepe Coin is making waves as a meme token inspired by the frog character from the early 2000s comic “Boy’s Club.” Launched on Ethereum as an ERC-20 token, it quickly gained popularity and reached a market cap of nearly $5 billion. Unlike other coins focused on technology or utility, Pepe Coin relies on community support, a no-tax policy, and a deflationary burn system to manage its massive 420 trillion supply. Early investors saw huge returns, with some even becoming millionaires overnight. The big question now is, Can Pepe Coin actually reach $1, or is it just another passing craze?

Can Pepe Coin Really Reach $1?

Analysts are divided on whether Pepe Coin can ever hit $1. The math is staggering, with 420 trillion tokens, a $1 price would mean a $420 trillion market cap way bigger than the entire U.S. stock market and over 200 times all of crypto combined. Most experts say that’s just not realistic.

But Pepe is a meme coin, and meme coins often ignore logic. Their value comes from hype and community excitement, not fundamentals. On social media, traders chatter about possible “god candles” if momentum hits, with some technical charts showing breakouts above $0.0000146. Realistic forecasts are more modest: Analysts suggest a 2025 peak near $0.0000535 a big jump, but still far from $1. Long-term enthusiasts dream of $0.01 by 2040, if burns speed up and the community stays hyped but even that would take a massive shift.

Pepe Coin is popular mainly because of its cultural appeal. It features no-tax trades and a burned liquidity pool with 93% locked on Uniswap, which creates scarcity. Projects like Pepe Palace, a game that burns tokens for NFTs, add practical uses for the coin. If Bitcoin prices rise, Pepe Coin might benefit. It surged 7,000% in its first month alone. Social media also boosts its popularity, with over 1.2 million Twitter followers and lots of Google searches.

When you're pre-rich…

With Pepecoin (PEP) in your wallet, every moment is beautiful. pic.twitter.com/kr6CEKc7YD

— Neo (@PepecoinMaxxer) August 18, 2025

However, there are risks. A $15 million token theft by rogue developers previously shook investor confidence. Competition from other meme coins like Shiba Inu and new AI-powered coins like MIND could decrease its appeal. If the hype fades or the market goes down, Pepe Coin could see its value drop, with important support around $0.00000282 at risk.

Pepe Coin is like a rollercoaster in a meme-powered world. Can it reach $1? Probably not soon, but its strong community support and smart token burns keep people hopeful. Traders on X call it the “OG meme” and predict it could double in value if the current excitement continues. Right now, it’s a speculative coin, not one with practical use. Will it stay at its current level or surge again? That depends on the crowd’s enthusiasm.

Share this story with your friends—Pepe Coin might just surprise everyone.

FAQs

- What is Pepe Coin?

Pepe Coin (PEPE) is a meme-based cryptocurrency on Ethereum, inspired by the Pepe the Frog meme, with no intrinsic utility but strong community support. - Can Pepe Coin reach $1 in 2025?

Highly unlikely; its 420 trillion token supply would require an unrealistic $420 trillion market cap to hit $1, far exceeding current crypto markets. - Why is Pepe Coin rallying?

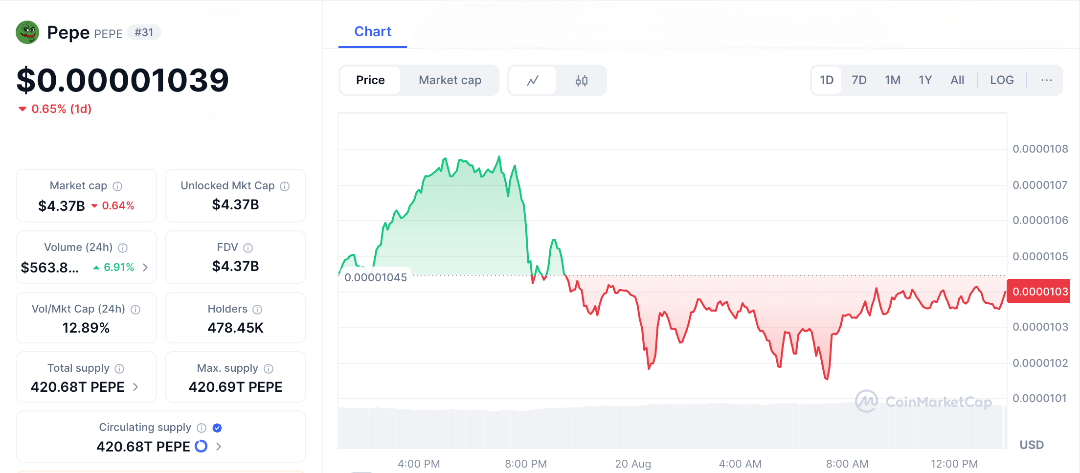

Pepe Coin’s price, around $0.000010, surges due to social media hype, whale activity, and exchange listings, despite a recent 7% weekly drop. - What are realistic price targets for Pepe Coin?

Analysts predict Pepe could reach $0.0000535 by 2025 or $0.0002733 by 2030, driven by community momentum and token burns. - Is Pepe Coin a safe investment?

Pepe Coin is highly speculative due to its volatility and lack of utility; investors should research thoroughly and brace for significant risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.