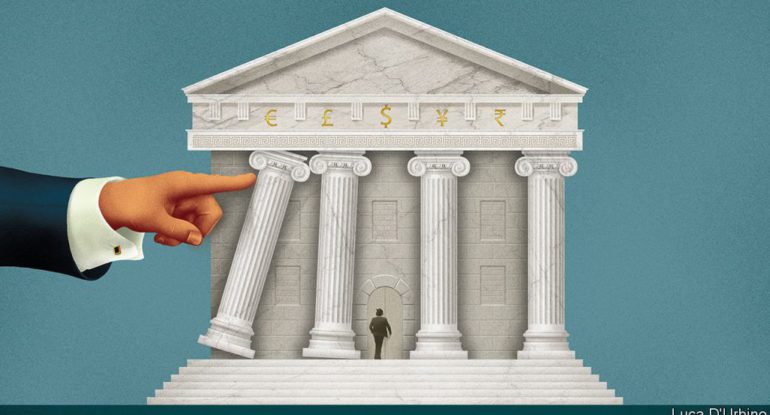

Central Banks Are Not Very Excited About Blockchain And Digital Currencies!

The central banks are not very excited about blockchain technology. Representatives from central banks across the globe assembled for a one-day conference last week in Kyiv, Ukraine, to address their central bank digital currency (CBDC) projects. The seminar was organized by the National Bank of Ukraine (NBU), which is a CBDC pioneer.

Roman Hartinger, head of its innovative development department, said that the central banks desired to examine and test their ideas and outcomes with the banking community. Among those who visited were the representatives from Japan, Canada, Lithuania, Belarus, Finland, Netherlands, Uruguay, and South Africa.

In 2016, NBU began investigating the concept of digital currency named e-hryvnia, which was titled after its national currency. It tested a civic token operating on a fork. The pilot runs with the aid of the tech startup AttickLab, fintech companies Uapay and OMP 2013, and “Big Four” professional-service company Deloitte as an auditor.

The testing run from September to December 2018, and the outcomes revealed that “there are no fundamental advantages in using specifically the DLT to develop a centralized e-hryvnia issuance system.”

The central bank doesn’t reject the alternative “decentralized” model, where various trusted payment processors would issue e-hryvnia. At the instant, the experiment is on hold and is waiting for more input from the banking community and legislation regulating digital assets in Ukraine.

The representatives from Canada and the Netherlands share the doubt about the distributed ledgers during the conference.

“The essence of the DLT infrastructure is that no single party should be trusted enough, but don’t we just trust a central bank to maintain the integrity of the global ledger?” stated Harro Boven, a policy adviser in the payments policy department of the Dutch central bank.

Scott Hendry, senior special director of fintech at Bank of Canada, which examined the Jasper project that was created on R3’s Corda DLT, stated that DLT is not required when producing a central bank digital currency. At the time, they have no intention of transforming their prevalent system.

“There doesn’t seem to be a lot of benefits if you look at a DLT system and the current efficient centralized system for the sole purpose of interbank payments,” Hendry stated before adding that in their office “they wouldn’t change anything in the technology stack currently in use.”

The speakers did not close their doors from employing DLT, but they were not enthusiastic about it either.

Facebook’s Libra reportedly warns the government; that’s why it’s now analyzing central bank digital currencies. The central banks discover Big Tech publishing stablecoins a menace as it would be down to a matter of “who will have a money issuance prerogative, governments, or the private tech companies?”

“Libra was a wake-up call for us. Central banks have been challenged to innovate,” Harro Boven spoke on stage. Meantime, a representative who requested not to be identified, reported that people would desire to utilize Libra if the monetary system turned up.

Facebook’s Libra triggers them to traverse what was long delayed. He stated he was not concerned about the competition against Facebook, asserting that their best defense is to do their job.

While, the Swedish central bank has already started testing its CBDC, known as e-krona. The country has been progressing towards becoming cashless since 2017.

Add a comment

You must be logged in to post a comment.