In the pulsating heart of the blockchain frontier where speed meets innovation and fortunes can flip with a single block Solana Crypto is roaring back as the high-octane contender in the crypto race. Picture a network forged in ambition, now outpacing competitors with blistering-fast transactions, an exploding dApp ecosystem, and memecoins that define the culture. As a battle-tested crypto narrator who’s chronicled Bitcoin’s epic ascents and Ethereum’s stormy seas, I’ve learned to trust the charts when they whisper moonshots. And today, July 28, 2025, Solana is flashing signals too loud to ignore: a clean breakout from resistance, followed by a textbook retest, has analysts eyeing $260 or higher. But this isn’t just technical chatter it’s the kind of setup that sparks group chat legends and fuels FOMO across trading desks. Whether you’re already strapped in or still on the sidelines, this chapter of Solana’s saga might just be the one you’ll wish you didn’t miss.

What’s Fuelling Solana’s Breakout?

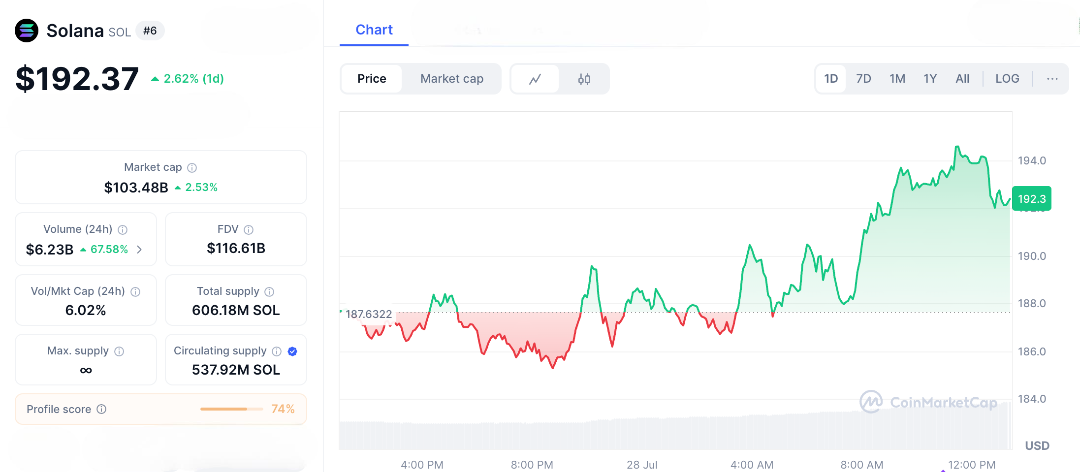

Let’s unpack the momentum that’s quietly turning heads. Solana’s native token, SOL, is charting a resilient course through market chop, currently trading around $192 after a 2.62% daily gain. More importantly, it broke through the $190 barrier a psychological and technical ceiling that had stalled its ascent for weeks. This wasn’t some flash-in-the-pan move. It followed a textbook consolidation, with SOL dipping to test support near $180, then bouncing back with authority.

The retest a classic bullish signal where old resistance becomes new support played out like clockwork, flushing out weak hands and reaffirming buyer strength. Underlying metrics echo this shift: transaction volumes are surging, daily fees are peaking, and users are piling into Solana’s low-fee playground, drawn by everything from DeFi yield farms to memecoin mania. Behind the scenes, whale accumulation is rising, hinting at growing institutional interest. And one of Solana’s former Achilles’ heels network stability has turned into a strength, thanks to major upgrades like Firedancer, which is already reinforcing uptime and resilience.

What Makes This Solana Breakout “Clean”?

In trader speak, a “clean breakout” means no fluff, no fake-outs just a crisp move through resistance with conviction. That’s exactly what Solana delivered: SOL sliced through the $190 ceiling on rising volume, free of messy wicks or hesitation. This kind of price action screams sustainability, not speculation.

Technical indicators are lining up like a bullish constellation:

-

RSI is elevated but not overheated suggesting strength, not exhaustion.

-

MACD has flashed a bullish crossover, confirming momentum is building.

-

Moving averages? All stacked in favour of the bulls, with short-term lines leading the charge.

The macro backdrop adds tailwinds too. With Bitcoin holding firm above $100K, the whole market has a stronger floor. Meanwhile, Solana’s integration with real-world assets, like tokenised securities, is catching the eye of traditional finance. Add to that cross-chain bridge partnerships, and Solana is shaping up to be a true liquidity hub. And if this all feels familiar it should. Back in 2021, SOL soared from under $50 to over $250, fuelled by a similar technical setup. This latest breakout? It’s echoing that same bullish rhythm, and if history rhymes, we could be on the cusp of another parabolic run.

Could $300 Be in Sight for Solana?

Analysts are doubling down on optimism, rolling out price targets that could supercharge crypto portfolios. In the short term, many are eyeing a swift push to $205, riding the momentum from Solana’s flawless retest. But the more ambitious calls are where things get exciting: $260 is pegged as the next major milestone especially if a golden cross emerges on higher timeframes, a historically bullish signal that’s got chart watchers hyping.

And then there’s the whisper the boldest bet yet: $300. That level, analysts argue, isn’t just hopium. It hinges on real catalysts:

-

An explosion in DeFi total value locked (TVL),

-

A memecoin supercycle that reignites retail mania,

-

And the ongoing network effect from Solana’s thriving dApp ecosystem.

With a market cap north of $90 billion, Solana is already a heavyweight but many say it’s still undervalued when stacked against Ethereum. Why? Because Solana delivers over 3,000 transactions per second at a fraction of a cent, a technical edge that could attract institutional and global capital as adoption ramps up.

Every Crypto Epic Has Its Dragons

Of course, no crypto rally is without its fire-breathing risks. Volatility lurks around every corner a surprise macroeconomic jolt, sudden network congestion, or even regulatory turbulence could yank Solana back toward the $180 support zone. And then there’s the layer-1 rivalry, with contenders like Sui and Aptos nipping at its heels, pushing Solana to constantly innovate or risk falling behind. But here’s the kicker: the recent retest confirmation provides a technical safety net. It signals that pullbacks may be golden entries, not red flags. In my years navigating bear traps and surfing bull waves, one truth has held steady tokens with real utility and strong charts usually lead the charge. And right now, Solana checks both boxes.

Imagine the investor who grabbed SOL at $150 just last month. They’re now sitting on potential triple-digit gains, possibly retelling their victory story over coffee or in Discord threads a story that could soon be yours. As this chapter of the blockchain saga unfolds, Solana isn’t just another token. It’s a movement combining blazing speed, scalability, and a fervent community spirit. Whether it surges to $260, $300, or beyond, this journey is one worth watching and riding. In this world of digital assets rewriting financial norms, Solana might just be scripting the next bestseller.

So stay sharp, diversify wisely, and let the charts guide you because in crypto’s wild frontier, it’s often the bold who walk away with the treasure.

FAQs

- What is Solana Crypto?

Solana Crypto, or SOL, is the native token of the Solana blockchain, designed for high-speed, low-cost transactions supporting DeFi, NFTs, and dApps. - What does the clean breakout and retest mean for Solana Crypto?

It confirms SOL broke past resistance at $190 with strong volume, retested it as support, signaling potential for further price increases. - Why might Solana Crypto hit $260 or higher?

Bullish technical indicators, rising transaction volumes, whale activity, and ecosystem growth drive predictions, with some analysts eyeing $300. - What is the current price of Solana Crypto?

As of July 28, 2025, SOL is trading around $193, reflecting a 2.5% daily gain after the breakout. - What risks are associated with Solana Crypto?

Volatility, potential network issues, and competition from other layer-1 chains could lead to price dips, requiring careful research before investing.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.