On August 15, 2025, the crypto market is reacting to Coinbase’s decision to cut its XRP holdings by 57%, reducing the number of its wallets from 52 to 35, each containing 16.8 million tokens. This has led traders to wonder if confidence in XRP is waning or if this is a strategic adjustment in a changing market.

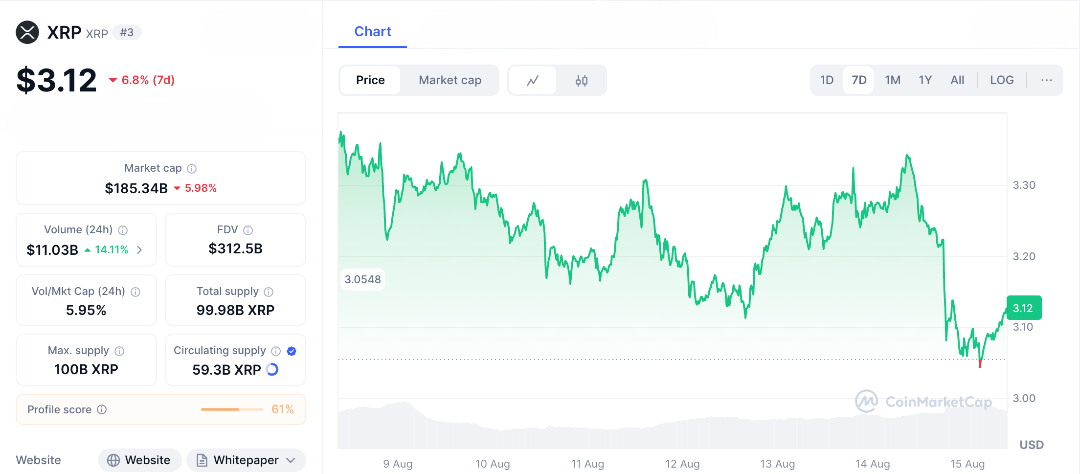

Coinbase, a major player known for dealing with regulatory challenges and market changes, has raised questions with this move. XRP is trading around $3.12 after a slight decline, leaving investors to speculate about Ripple’s future. This situation could be a warning to be cautious or an opportunity for smart buyers, as price drops in crypto often set the stage for significant recoveries.

XRP news never fails to mix triumph with turmoil, and Coinbase’s latest update is no exception. Their Q2 report revealed a 57% reduction in XRP holdings since June, trimming wallets down to 35 with uniform balances a move that seems aimed at portfolio rebalancing, liquidity, and compliance. This isn’t the first reduction. Earlier data showed a 40% drop in reserves, but the latest cut raises questions about internal strategy possibly tied to risk management amid inflation worries and tariff talks shaking markets.

Crypto followers remember Coinbase’s 2021 XRP delisting during the SEC lawsuit, followed by a 2023 re-listing after the court ruled it isn’t a security in secondary sales. With holdings sharply down, skeptics suggest institutional faith may be weakening, especially as Bitcoin ETFs absorb liquidity, leaving altcoins like XRP in the shadows. Optimists, however, see this differently, Coinbase may simply be optimising for efficiency, while it’s on-chain activity surges, with remittances in Africa and Latin America processing trillions annually.

Traders are wondering if institutional confidence in XRP is decreasing. Coinbase’s recent decision to cut its XRP holdings raises questions, even as Ripple’s bank partnerships grow, daily trading volume exceeds $10 billion, and some analysts predict XRP could reach $5 by the end of the year. Skeptics note that major institutions like BlackRock hold very little XRP, suggesting that if Coinbase’s reduction signals caution, prices could fall to $2.50.

However, there’s another perspective. XRP has gained 40% over the past year, outperforming many other cryptocurrencies. This is driven by its practical use in cross-border payments, where fees are reduced by 60% using On-Demand Liquidity. If this current dip is temporary, it could be a buying opportunity, as large investors have often accumulated during similar downturns. With Bitcoin at $119,000 attracting investments, a shift to altcoins could push XRP back toward the $4 mark.

This situation highlights the ongoing tension in crypto between innovation and institutional behavior. Coinbase, which handles $2 trillion in annual volume, has a significant influence on market flows. Its 57% reduction in XRP holdings may indicate a cautious approach in light of U.S. regulations that favor fiat-backed stablecoins over XRP’s algorithmic model.

Despite this, there is hope. Ripple’s RLUSD stablecoin trials show efforts to diversify, potentially enhancing XRP’s utility. With possible ETF approvals for Solana, this news could inspire filings for XRP-focused products, turning what seems to be a setback into a potential opportunity for growth.

XRP at a Crossroads

Reflecting on years of covering crypto, Coinbase’s decision to reduce its XRP holdings feels significant. But this doesn’t necessarily mean trouble; it could spark a rally if smart investors see an opportunity. XRP’s usefulness in real-world payments might outlast any short-term issues. If institutional support returns, XRP could reach $5. If not, it might test the $2.50 level.

This news is important. Share it if Coinbase’s move has made you reconsider your investments or if you’re planning to buy during the dip. Is it a loss of confidence or a smart move? The story continues.

FAQs

1. Why did Coinbase cut XRP holdings by 57%?

Recent XRP news reveals Coinbase reduced XRP from 52 to 35 wallets, likely for liquidity management amid tariff talks and inflation fears.

2. Does this mean institutional confidence in XRP is crumbling?

The XRP news suggests caution, but Ripple’s $10B daily volume and bank partnerships show resilience, hinting at strategic rebalancing.

3. How has the XRP news impacted its price?

XRP dipped slightly to $3.50 post-news, but analysts see $5 by year-end if adoption grows, with $2.50 as key support.

4. What could drive XRP’s recovery despite this XRP news?

Ripple’s ODL, RLUSD stablecoin, and potential ETF filings could counter Coinbase’s move, boosting XRP news and adoption.

5. Should I invest in XRP after this XRP news?

XRP’s utility is strong, but diversify, monitor whale accumulations, and use regulated platforms to manage volatility risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.