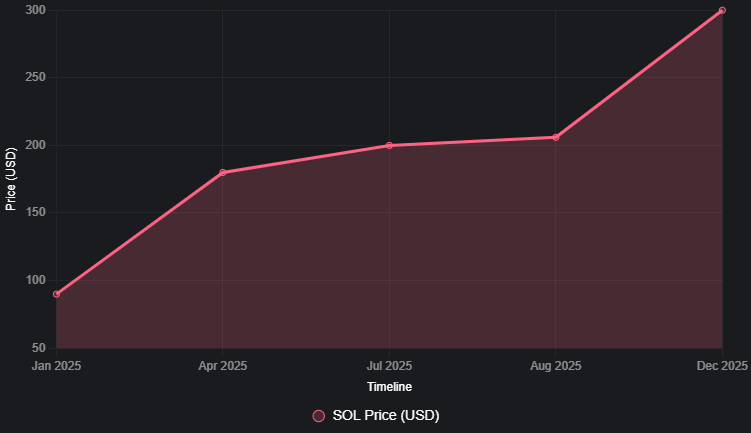

Solana, one of the fastest-growing blockchains in the world, is once again in the spotlight. Its native token, SOL, has climbed about 16% in the past week, reaching $213 as of August 29, 2025. Analysts believe that if current trends continue, Solana could break through the $300 mark in the coming months. The latest surge is being powered by large-scale investments from institutions, companies and funds managing billions of dollars, that now see Solana as a long-term opportunity.

Why Institutions Are Buying Solana

In the past, cryptocurrencies were often dominated by retail investors, meaning individuals buying smaller amounts. But in 2025, institutions are leading the charge. Recent data shows that publicly traded firms now hold $1.72 billion worth of SOL. At the same time, staking volumes have grown to 8.277 million SOL, with investors earning an average 6.86% annual return (APY) through platforms like Lido and Jito.

One striking example is Upexi, which purchased 1.9 million SOL since April at an average price of $168.63. This amounts to an investment of roughly $320.4 million. Other major players such as DeFi Dev Corp and Soul Strategies have also poured in over $1.5 billion collectively, signaling strong institutional appetite.

On-chain data further confirms this momentum. According to Solana Explorer, the number of daily active addresses crossed 2 million in August, showing growing adoption. In addition, 68% of Solana’s circulating supply is now staked, which indicates investor confidence in the network’s long-term stability. Meanwhile, decentralized exchange (DEX) volumes have increased by 200% year-over-year, reflecting Solana’s rising dominance in decentralized finance.

Price Predictions and Market Outlook

The big question now is whether this institutional momentum can push SOL to $300 or beyond. Technical analysis provides some clues. Solana recently confirmed a strong support level at $111, giving analysts confidence in its resilience. Short-term price targets range from $255 to $280, with long-term forecasts suggesting highs of $480 if bullish trends continue. In the most optimistic scenario, such as a major crypto “altseason”, analysts even see the potential for $1,000 per SOL.

Forecasts vary depending on the source. For example, CoinDCX predicts August highs of $220, while DigitalCoinPrice projects an average of $315.20 in 2025. Beyond 2025, expects SOL to average $384 in 2026 and climb to $559 in 2027, supported by developer activity and scalability improvements.

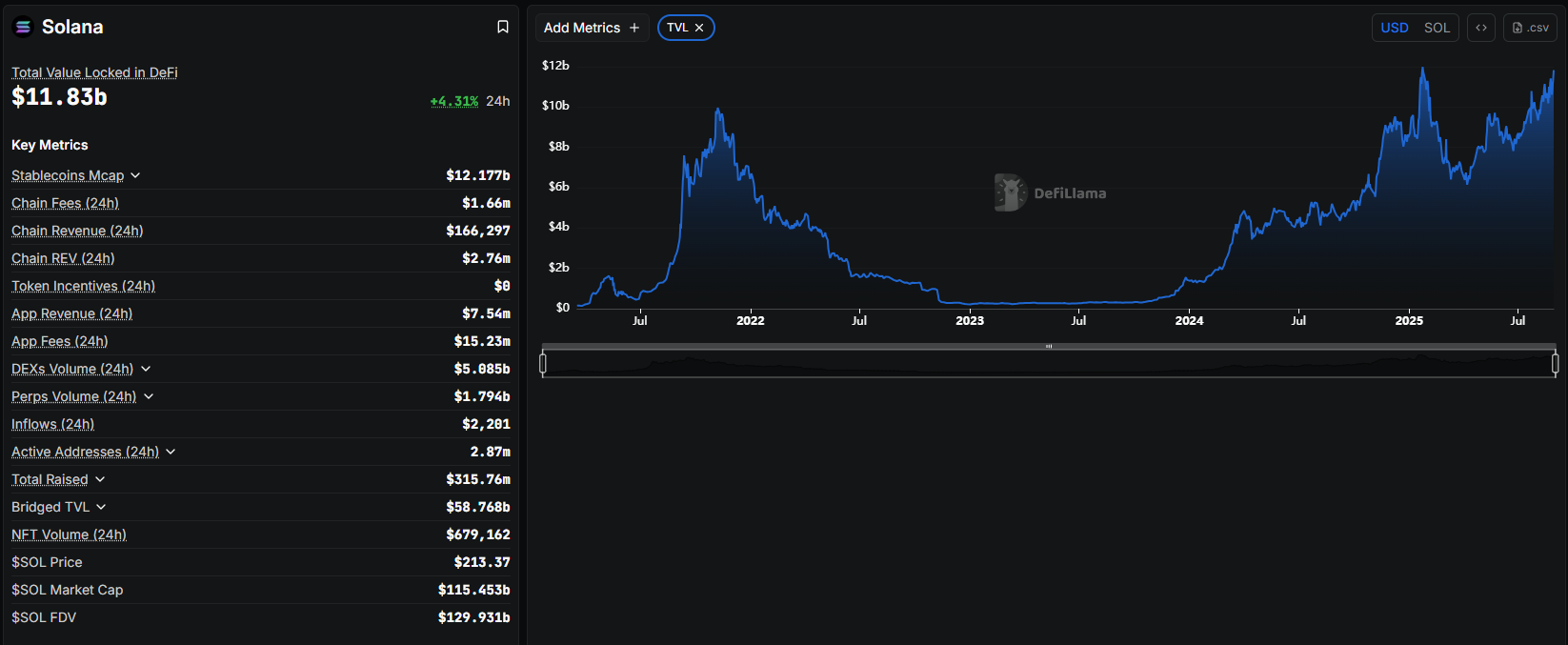

These predictions are tied to the rapid expansion of Solana’s ecosystem. Over 1,000 projects launched in the third quarter of 2025 alone, ranging from meme coins to artificial intelligence applications. This wave of innovation has pushed Solana’s total value locked (TVL) to a record $11.83 billion, placing it firmly among the top networks for decentralized finance.

Strengths and Challenges

Part of Solana’s appeal lies in its technical advantages. The blockchain can process about 3,000 transactions per second (TPS), far faster than Ethereum, which handles around 15–30 TPS on its base layer. This speed and low cost make it attractive for DeFi protocols, gaming platforms, and developers looking for scalable solutions.

However, Solana is not without challenges. The network has experienced outages in the past, which created doubts about reliability. While upgrades like Firedancer have helped reduce these risks in 2025, institutions remain cautious. Additionally, global macroeconomic factors, such as high interest rates, inflation, and geopolitical tensions, could limit the scale of future rallies.

Regulation is another key factor. Solana received a boost in July when the U.S. approved a Solana ETF, causing a 3–4% price jump and opening the door for wider mainstream adoption. But at the same time, stricter oversight could bring hurdles for both investors and developers.

Timeline of Solana’s 2025 Journey

-

January – SOL dipped to $90 during the post-winter correction.

-

April – A halving rally lifted the token to $180.

-

July – The approval of a U.S. Solana ETF pushed the price above $200.

-

August – Institutional buying stabilized SOL around $206, with analysts watching $300 as the next big resistance level.

Looking Ahead

Solana’s trajectory in 2025 shows a clear shift from being seen as a speculative asset to becoming a serious infrastructure layer for finance, technology, and digital assets. With institutions accumulating billions in holdings and staking activity near record levels, the foundation for long-term growth appears strong.

Still, investors should keep in mind that cryptocurrencies remain highly volatile. Solana dropped by 21% in August at one point, falling from $206 to $150 before recovering. Such sharp corrections highlight the risks that come with rapid inflows of capital.

If Solana maintains its current pace of adoption and investment, breaking through the $300 mark is realistic. Beyond that, its scalability, ecosystem growth, and institutional confidence could push it even higher in the years ahead. For now, Solana remains one of the most closely watched altcoins, representing both the opportunities and the challenges of a maturing crypto market.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.