- Major tokens in accumulation zone faced weekly declines despite higher trading activity.

- Pyth, Conflux, and Kaia defied the trend with notable gains amid market-wide corrections.

- Accumulation phase signals selective investor interest, not a uniform path to recovery.

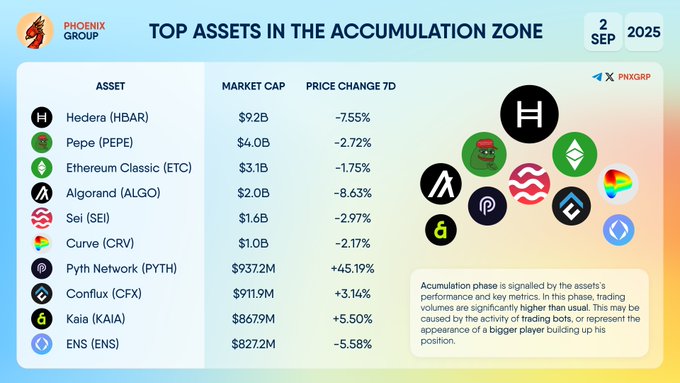

On September 2, 2025, Phoenix Group released an update highlighting digital assets currently in the accumulation zone, a stage marked by increased trading volumes even as prices remain flat or fall. Market participants often monitor this position closely because it can indicate long-term positioning from larger traders. The update revealed a diverse group of tokens experiencing uneven performance, reflecting a broader pattern of correction across the crypto market.

TOP ASSETS IN THE ACCUMULATION ZONE

$HBAR $PEPE $ETC $ALGO $SEI $CRV $PYTH $CFX $KAIA $ENS pic.twitter.com/kdGwbvhMuj— PHOENIX – Crypto News & Analytics (@pnxgrp) September 2, 2025

Several major assets identified in the accumulation zone recorded losses over the past week. Hedera (HBAR) held the highest market capitalization at $9.2 billion, but it dropped 7.55%. Meme token Pepe (PEPE) carried a $4.0 billion valuation and declined 2.72%. Ethereum Classic (ETC) was valued at $3.1 billion after falling 1.75%, while Algorand (ALGO) ended the week at $2.0 billion following an 8.63% slide.

Other assets also trended downward. Sei (SEI) dropped 2.97%, Curve (CRV) slid 2.17%, and Ethereum Name Service (ENS) fell 5.58% to a market cap of $827.2 million. The data showed that tokens in the accumulation phase are not immune to price pressure, even when trading activity increases.

Positive Movers in the Accumulation Zone

While the majority of listed assets posted declines, three projects moved in the opposite direction during the week. Pyth Network (PYTH) recorded the strongest performance, surging 45.19% to a $937.2 million market cap. Conflux (CFX) added 3.14%, reaching $911.9 million, while Kaia (KAIA) rose 15.50% to $867.9 million.

Source: Phoenix Group

These gains contrasted with the broader losses and highlighted that activity in the accumulation zone does not produce uniform outcomes. In this case, PYTH, CFX, and KAIA experienced measurable increases despite the downward trend impacting larger tokens.

Tracking Accumulation Zone Behavior

The concept of the accumulation zone refers to periods when heightened trading activity occurs without major upward price action. Analysts often link these phases to institutional investors or large-scale traders gradually building positions. Whether such activity leads to recovery depends on external factors, including liquidity conditions and market-wide sentiment.

Phoenix Group’s update underscored this variability. While tokens such as HBAR, PEPE, ETC, ALGO, SEI, CRV, and ENS lost ground, PYTH, CFX, and KAIA gained value. The divergence illustrates how the accumulation phase can highlight selective investor interest rather than signaling a uniform recovery.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.