- Broad token mix shows crypto assets entering accumulation across all market tiers.

- Trust Wallet, ImmutableX, and Astar lead larger caps; Streamr, Nosana hold small-cap momentum.

- Extended accumulation signals growing investor interest and potential market shifts.

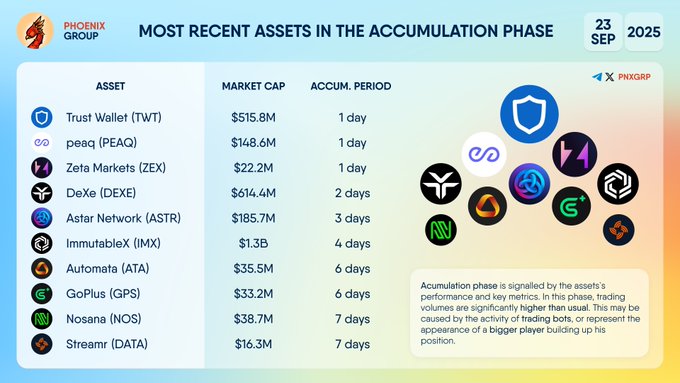

Crypto Assets have entered a new accumulation phase, according to Phoenix Group’s September 23, 2025 update. The development displays a mix of large and small market tokens showing heightened activity. The list includes Trust Wallet (TWT), ImmutableX (IMX), and Astar Network (ASTR), alongside smaller projects such as GoPlus (GPS), Nosana (NOS), and Streamr (DATA).

MOST RECENT ASSETS IN THE ACCUMULATION PHASE

$TWT $PEAQ $ZEX $DEXE $ASTR $IMX $ATA $GPS $NOS $DATA pic.twitter.com/Qg7byiydE2— PHOENIX – Crypto News & Analytics (@pnxgrp) September 23, 2025

Trust Wallet, with a market capitalization of $515.8 million, was reported to have entered accumulation after a single day. ImmutableX, valued at $1.3 billion, has been in the phase for four days, making it the largest token among those tracked. The inclusion of multiple projects across different market caps indicates a broad-based trend of sustained interest.

Crypto Assets Market Capitalization Overview

The report detailed a wide range of projects across varying capitalization levels. DeXe (DEXE), valued at $614.4 million, and Astar Network (ASTR), at $185.7 million, were identified as key contributors to the accumulation list. peaq (PEAQ) was also included, holding a $148.6 million valuation after one day of activity.

At the lower end of the spectrum, Zeta Markets (ZEX) was listed with a $22.2 million capitalization. Streamr (DATA), valued at $16.3 million, and Nosana (NOS) both remained in accumulation for seven days. GoPlus (GPS) also featured among the smaller-cap projects. These entries show that accumulation is not confined to established platforms but extends to newer and less capitalized tokens.

Significance of the Accumulation Phase

Phoenix Group noted that the accumulation phase is defined by trading volumes that exceed typical levels, suggesting increased involvement from trading bots or larger entities building positions. The duration of these phases varied across the highlighted assets. Trust Wallet, Zeta Markets, and peaq began their accumulation only a day prior, while Streamr and Nosana sustained the phase for a week. ImmutableX maintained its position for four days, while DeXe and Astar recorded mid-range durations.

Source: Phoenix Group

Crypto Assets displaying extended accumulation often draw attention from analysts, who monitor them as potential indicators of upcoming momentum. However, the report limited its findings to observed activity without offering forecasts.

Market Outlook

The range of projects, from billion-dollar networks such as ImmutableX to niche tokens under $20 million, demonstrates that Crypto Assets in accumulation span multiple tiers of the market. The report reflects current investor behavior, which is distributed across both high-cap and emerging projects.

For September 2025, the identified tokens underscore a shifting focus toward accumulation strategies. Phoenix Group’s data shows that interest remains spread across the sector, with assets at different stages of growth entering sustained activity.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.