- Strong capital inflows highlight rising institutional confidence in blockchain ventures.

- Funding spans gaming, payments, AI, and identity, showing broad blockchain sector growth.

- Venture and corporate backing signals expanding adoption of decentralized technologies.

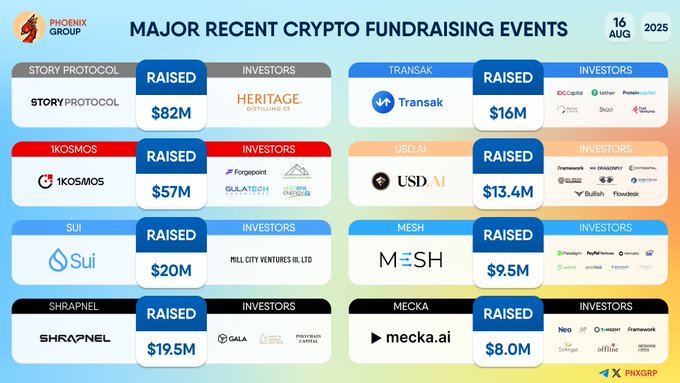

The crypto market recorded a series of major crypto fundraising rounds in mid-August 2025, with nine companies attracting big capital across different sectors. Phoenix data shows that hundreds of millions were raised in total, pointing to growing institutional and venture capital interest in blockchain-driven ventures.

MAJOR RECENT CRYPTO FUNDRAISING EVENTS#StoryProtocol $IP #1Kosmos #Sui $SUI #Shrapnel $SHARP #Transak #USDAI #Mesh #Mecka pic.twitter.com/ntT06cJ7hW

— PHOENIX – Crypto News & Analytics (@pnxgrp) August 16, 2025

Crypto Fundraising Highlights

Story Protocol completed the largest round in crypto fundraising, securing $82 million. Heritage Distilling Co. was among the investors, marking a mix of participation from traditional and digital-focused backers. This raise placed Story Protocol at the top of the week’s funding activity.

1Kosmos followed with $57 million, backed by Forepoint and Gulatchen. The funding solidified its position in blockchain-based digital identity solutions, a sector drawing attention as secure authentication gains priority.

Sui, a Layer 1 blockchain platform, closed a $20 million round with Mill City Ventures III Ltd. The raise pointed to continued confidence in scalable blockchain infrastructure. In the Web3 gaming space, Shrapnel secured $19.5 million, supported by Gala and Polychain Capital, highlighting sustained momentum in blockchain-integrated gaming projects.

Expanding Mid-Sized Rounds

Several companies also completed mid-range raises. Transak, a fiat-to-crypto payments gateway, raised $16 million from investors including BCG Capital and Animoca Brands. The deal showed demand for improved on- and off-ramp services in digital assets.

AI-focused USD.AI secured $13.4 million in crypto fundraising with backing from Framework Ventures and Bullish. The project’s focus on AI-integrated blockchain applications reflected rising interest in the overlap between artificial intelligence and decentralized networks.

Source: X

Meanwhile, Mesh, which targets connectivity and data use cases, raised $9.5 million with participation from Draper and PayPal Ventures. Mecka.ai concluded the list with an $8 million round, supported by NGC and Framework Ventures.

Market Implications of Fundraising Activity

The recent wave of crypto fundraising shows that investor participation is expanding across multiple blockchain segments, from payments and gaming to identity management and AI integration. The involvement of both venture capital firms and established corporations shows the breadth of support entering the sector.

The scale of capital inflows positions these projects to advance development efforts, scale adoption, and introduce new applications. With fresh funding secured, initiatives across gaming, payments, and infrastructure are set to progress in the coming months.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.