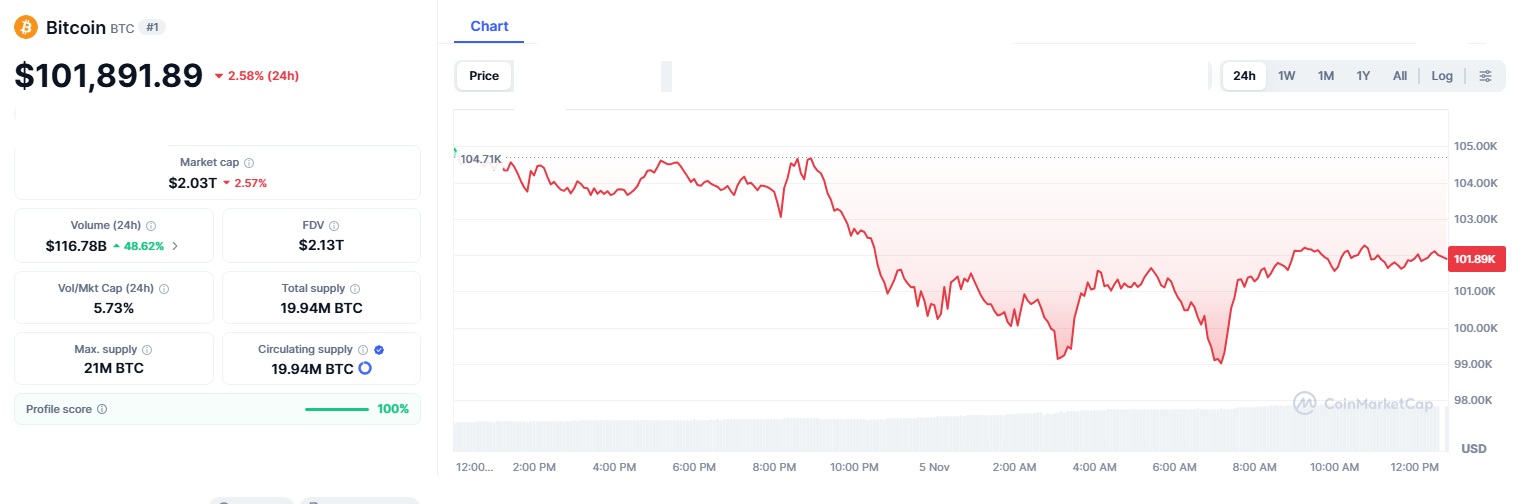

The crypto market faced a sharp shock on November 3, 2025, when more than $2 billion worth of positions were liquidated within a single day. This happened as Bitcoin slipped below $100,000 for the first time in half a year and Ethereum reached its lowest point since July. Events like this can feel overwhelming, but they are often tied to one major factor: too many traders using high leverage at the same time.

Leverage allows people to trade with borrowed money, which can increase profits but also magnify losses. When prices drop quickly, leveraged positions get force-closed, creating a chain reaction. At our crypto and blockchain publication, we compared real-time reports with on-chain data, market sentiment, and past events to help readers understand what really caused this downturn and whether it signals a deeper problem or just a temporary shakeout.

In just 24 hours, the crypto market saw more than $2 billion worth of trades forcibly closed. Most of these were long positions, meaning many traders had bet on prices going up. Bitcoin alone accounted for over $600 million in liquidations, and Ethereum with roughly $655 million. While these numbers seem huge, they are relatively small compared to the size of the entire market, which is worth trillions of dollars.

“Too many traders were using borrowed money to bet on prices going up,” Maja Vujinovic, co-founder and CEO of digital assets at Ethereum treasury firm FG Nexus.

The rapid drop happened because a large number of automated stop-losses and liquidation levels were clustered around similar price ranges. Once Bitcoin fell from around $101,000 to below $100,000, trading bots on major exchanges reacted instantly, pushing prices even lower. Ethereum followed the same pattern, dropping nearly 9 percent as traders rushed to reduce risk.

Despite the dramatic moves, the broader market did not show signs of long-term damage. Spot traders those who hold assets without leverage experienced far smaller losses. This shows that the biggest pressure came from leveraged bets rather than fundamental weakness in Bitcoin or Ethereum.

Many industry experts described this event as a necessary “clean-up” rather than a sign of deeper trouble. They explained that markets often become overheated when large amounts of leverage build up. A sudden correction forces out weak positions and resets prices at healthier levels.

For traders, moments like this are reminders of how quickly leverage can turn against the market. Many experienced investors use these periods to reassess their strategies, reduce unnecessary risk, or wait for more stable conditions before entering new positions. Some look at major support levels, such as Bitcoin near $100,000 or Ethereum around $3,200, for early signs of recovery.

For long-term holders, events like this show the importance of patience. Large drawdowns have happened many times in the history of crypto, and the market has repeatedly recovered and moved higher after the excess leverage clears out.

A Tough Day, but Not the End of the Story

The sudden liquidation wave shows how quickly the crypto market can shift when too much leverage builds up. Bitcoin’s fall below $100,000 and Ethereum’s sharp decline were alarming, but the broader picture suggests the market is adjusting rather than collapsing. With strong demand still entering from institutional players and ongoing development across blockchain networks, this downturn is likely a temporary setback. As conditions settle, opportunities may appear again but with a clearer understanding of the risks that heavy leverage brings.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.