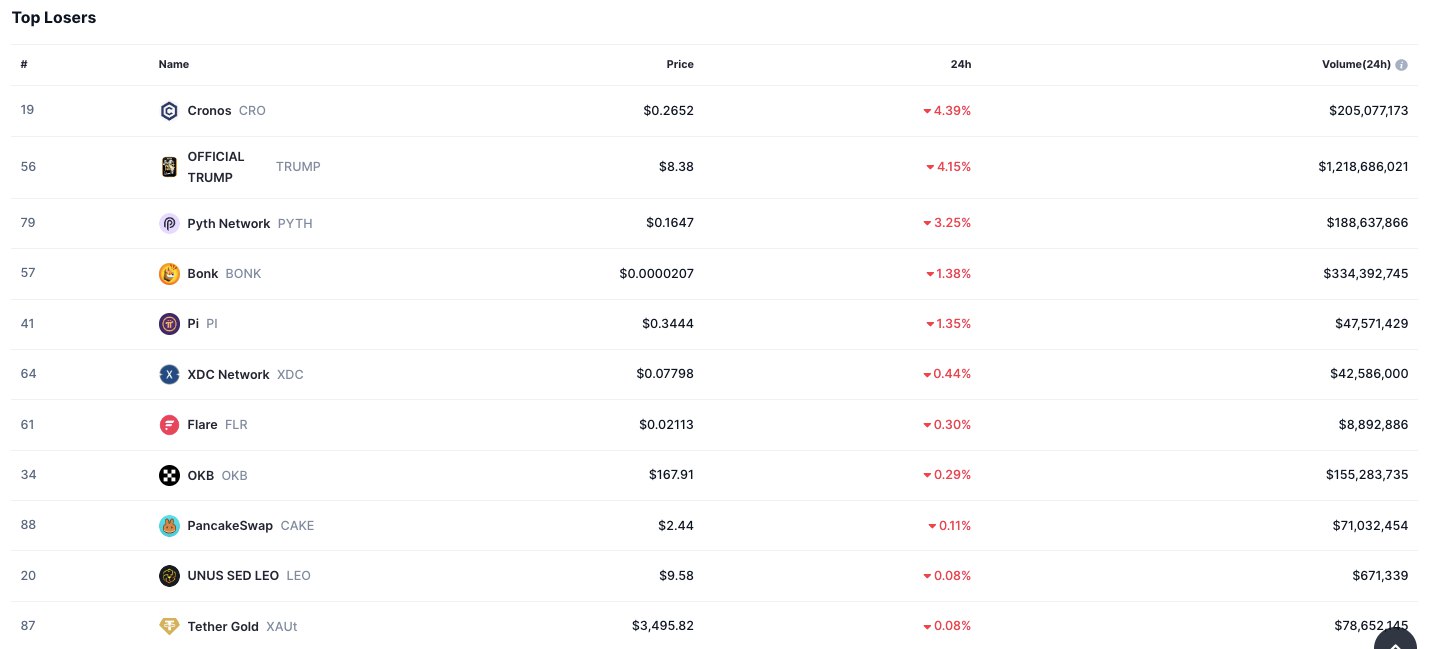

- Crypto losers led by CRO, TRUMP, and PYTH posted declines under 5% with strong liquidity.

- Meme coins BONK and PI saw modest pullbacks but maintained high trading activity.

- Stable tokens LEO and XAUt recorded minor dips, signaling broad but measured market retracement.

Crypto losers dominated the market session as several tokens recorded daily declines, with activity pointing to mild corrections rather than steep sell-offs. Losses stayed under 5% across most assets, but liquidity levels remained robust, particularly for TRUMP and BONK.

Cronos (CRO) stood out among the top crypto losers, falling 4.39% to $0.2652 on trading volume of $205 million. OFFICIAL TRUMP (TRUMP) followed with a 4.15% decline to $8.38, though it maintained the highest liquidity of the day, with volumes exceeding $1.2 billion.

Pyth Network (PYTH) registered a 3.25% dip, trading at $0.1647 with $188.6 million in activity. These declines displayed the weight of the day’s crypto losers in driving broader market sentiment.

Meme Coins and Mid-Tier Pullbacks

Bonk (BONK) slipped 1.38% to $0.0000207, supported by $334.3 million in transactions, marking one of the strongest liquidity profiles among declining assets. Pi Network (PI) also weakened, dropping 1.35% to $0.3444, generating $47.6 million in daily volume.

Source: CoinMarketCap

Additional pullbacks were noted in mid-tier projects. XDC Network (XDC) edged down 0.44% to $0.07798, Flare (FLR) declined 0.30% to $0.02113, and OKB (OKB) dropped 0.29% to $167.91 on $155.3 million in trading. PancakeSwap (CAKE) recorded a small 0.11% dip to $2.44, backed by $71 million in transactions.

Stable Ecosystem Tokens Record Minor Losses

Even tokens generally viewed as less volatile experienced slight declines. UNUS SED LEO (LEO) slipped 0.08% to $9.58 on low activity of $671,339. Tether Gold (XAUt), which shows physical gold prices, decreased 0.08% to $3,495.82 with $78.6 million in daily trading volume.

While crypto losers shaped the session, market activity remained steady. TRUMP and BONK showed the strongest liquidity among the declining assets, reflecting continued engagement from traders. Overall, the declines indicated moderate retracement rather than heavy selling, keeping market conditions active.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.