- Crypto market hit $3.90T cap as volatility and sharp token swings dominated.

- Fear Index at 40 and near-even long-short ratio signaled cautious trader sentiment.

- $187M liquidations, led by ETH and BTC, exposed high risks from leveraged positions.

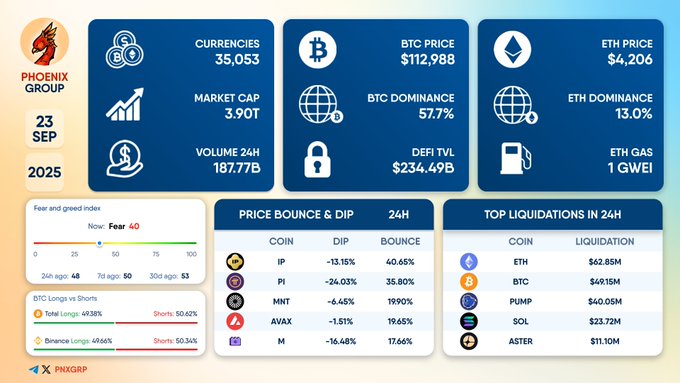

The crypto market faced heightened volatility on September 23, 2025, marked by liquidations and sharp price reversals across multiple tokens. Data placed the total market capitalization at $3.90 trillion, with 35,053 listed currencies and a 24-hour trading volume of $187.77 billion.

Bitcoin remained the anchor of the market, trading at $112,988 with a 57.7% dominance share, while Ethereum followed at $4,206 with 13% dominance. Meanwhile, the decentralized finance sector retained strong activity, recording a total value locked (TVL) of $234.49 billion.

Sentiment in the Crypto Market

Investor confidence remained fragile, as the Fear and Greed Index stood at 40, reflecting widespread fear. Exchange data showed traders nearly evenly split, with 49.32% long positions versus 50.68% short positions.

Daily Summary on September 23, 2025$IP $PI $MNT $AVAX $M $ETH $BTC $PUMP $SOL $ASTER#dailysummary #DeFi #Crypto pic.twitter.com/QaCiH45K3l

— PHOENIX – Crypto News & Analytics (@pnxgrp) September 23, 2025

On Binance, the ratio leaned bearish, with 46.66% longs and 53.34% shorts. These figures pointed to hesitation within the crypto market, with participants torn between hopes of recovery and concerns over further declines.

Mid-Cap Tokens Show Extreme Swings

The day’s trading highlighted major volatility in mid-cap tokens. IP dropped 13.15% before recovering with a 40.65% gain, while MNT recorded one of the sharpest moves, falling 6.45% and then surging 199%.

Other assets showed similar behavior. AVAX declined 6.37% before bouncing 15.90%, and M slid 16.48% before regaining 17.66%. Such abrupt reversals underscored speculative activity dominating sections of the crypto market, with traders targeting quick gains in a high-risk environment.

Liquidations Weigh on Traders

Leveraged positions added pressure across exchanges, as liquidations in the past 24 hours reached high levels. Ethereum led with $62.85 million liquidated, followed by Bitcoin at $49.51 million.

Source: Phoenix Group

Liquidations included $40.05 million in PUMP, $23.72 million in SOL, and $11.10 million in ASTER, among other tokens. These figures highlighted the vulnerability of leveraged accounts during rapid price shifts.

Outlook

The current context, as highlighted by Blockchain Magazine, shows a crypto market under stress, defined by divided sentiment, heavy leverage, and volatile trading patterns. While Bitcoin and Ethereum maintained dominance, mid-cap assets amplified instability through dramatic swings.

With long and short positions nearly balanced, traders remained uncertain on direction. The spike in liquidations led to heightened risks for overleveraged participants, leaving future moves hinged on liquidity flows and the ability of markets to absorb forced selling.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.