- Bitcoin and Ethereum maintained dominance as market sentiment stayed neutral at 53.

- Altcoins showed sharp volatility with quick rebounds, led by OKB, Mantle, and PENGU.

- Liquidations topped $388M, with Ethereum and Bitcoin accounting for the largest share.

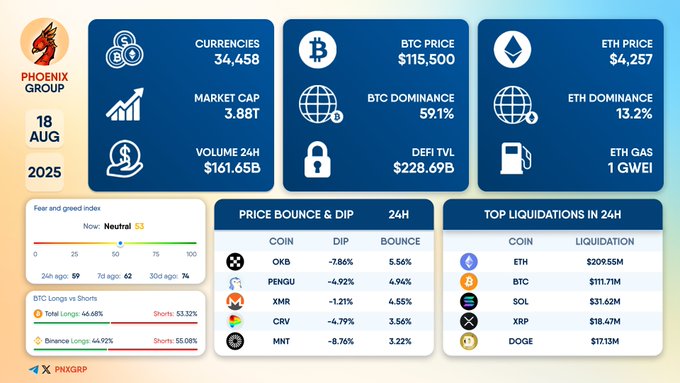

The crypto market displayed a mixed performance on August 18, 2025, with total capitalization standing at $3.88 trillion and trading activity reaching $161.65 billion in 24 hours. Data from Phoenix Group showed that 34,458 currencies are actively tracked, with Bitcoin and Ethereum continuing to command the largest share of the market. Despite fluctuations across major tokens, sentiment indicators displayed a period of relative balance between bullish and bearish positions.

Bitcoin traded at $115,500, securing 59.1% dominance of the global market. Ethereum followed at $4,257, maintaining a 13.2% share. Gas fees on the Ethereum network remained low at 1 gwei, supporting broader participation in decentralized applications.

Daily Summary on August 18, 2025$OKB $PENGU $XMR $CRV $MNT $ETH $BTC $SOL $XRP $DOGE#dailysummary #DeFi #Crypto pic.twitter.com/6I5YYoP87T

— PHOENIX – Crypto News & Analytics (@pnxgrp) August 18, 2025

The decentralized finance (DeFi) network also recorded continuous engagement. Total value locked (TVL) reached $228.69 billion, reflecting continued involvement from both institutional investors and retail participants. This stability confirmed the ongoing role of blockchain-based services in financial markets.

Neutral Sentiment Impacts the Crypto Market

The Fear and Greed Index recorded a reading of 53, placing market sentiment in the neutral zone. This reflected balanced expectations for price direction among participants. Trading activity across major exchanges further confirmed this cautious approach. On Binance, data showed 44.92% long positions compared with 55.08% short positions, signaling slightly higher bearish pressure as traders navigated intraday swings.

The crypto market also showed that traders were more inclined toward short-term positioning, with measured optimism giving way to a cautious strategy. Market participants closely monitored both liquidity flows and price volatility across major tokens.

Altcoins Face Volatility with Quick Rebounds

Several altcoins, as reported by Blockchain Magazine, recorded changes before stabilizing. OKB declined 7.86% before recovering 5.56%, while Mantle (MNT) mirrored this pattern with a 7.86% dip followed by a 3.22% rebound. PENGU posted a 4.92% loss before bouncing 4.25%, while Curve (CRV) fell 4.79% and later regained 3.56%.

Source: Phoenix Group

Privacy-focused token Monero (XMR) showed smaller price movement, with a 1.21% decline followed by a 4.55% recovery. The rapid corrections highlighted ongoing volatility, particularly in mid-cap assets facing increased trading pressure.

Liquidations Concentrated in Leading Assets

Leveraged traders faced big challenges as liquidations mounted across major cryptocurrencies. Ethereum led with $209.55 million in forced positions, followed by Bitcoin at $111.71 million. Solana (SOL) accounted for $31.62 million, while XRP and Dogecoin (DOGE) recorded $18.47 million and $17.13 million, respectively.

The concentration of liquidations in top assets showed the risks associated with derivatives trading amid rapid price swings. With both long and short positions liquidated across multiple exchanges, volatility remained a defining feature of the trading environment.

The crypto market on August 18 reflected a state of balance. Bitcoin and Ethereum maintained strong dominance, DeFi activity continued steadily, and altcoins experienced notable intraday reversals. While overall sentiment was neutral, the scale of liquidations revealed the challenges leveraged traders continue to face in navigating sharp market adjustments.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.