- Senate progress on ending shutdown sparks broad crypto market rebound.

- WLFI, STRK, and XRP lead gains amid renewed institutional and retail activity.

- AI, DeFi, and payment-focused tokens drive strong sector-wide performance.

The crypto market staged a strong rebound on Monday after the U.S. Senate advanced a bipartisan bill to end the 40-day government shutdown. Lawmakers voted 60–40 to move forward with a funding package that would restart key federal agencies and secure operations through January 30, 2026. The development, as highlighted in our previous post, alleviated investor uncertainty and boosted sentiment across risk assets, resulting in gains among digital tokens.

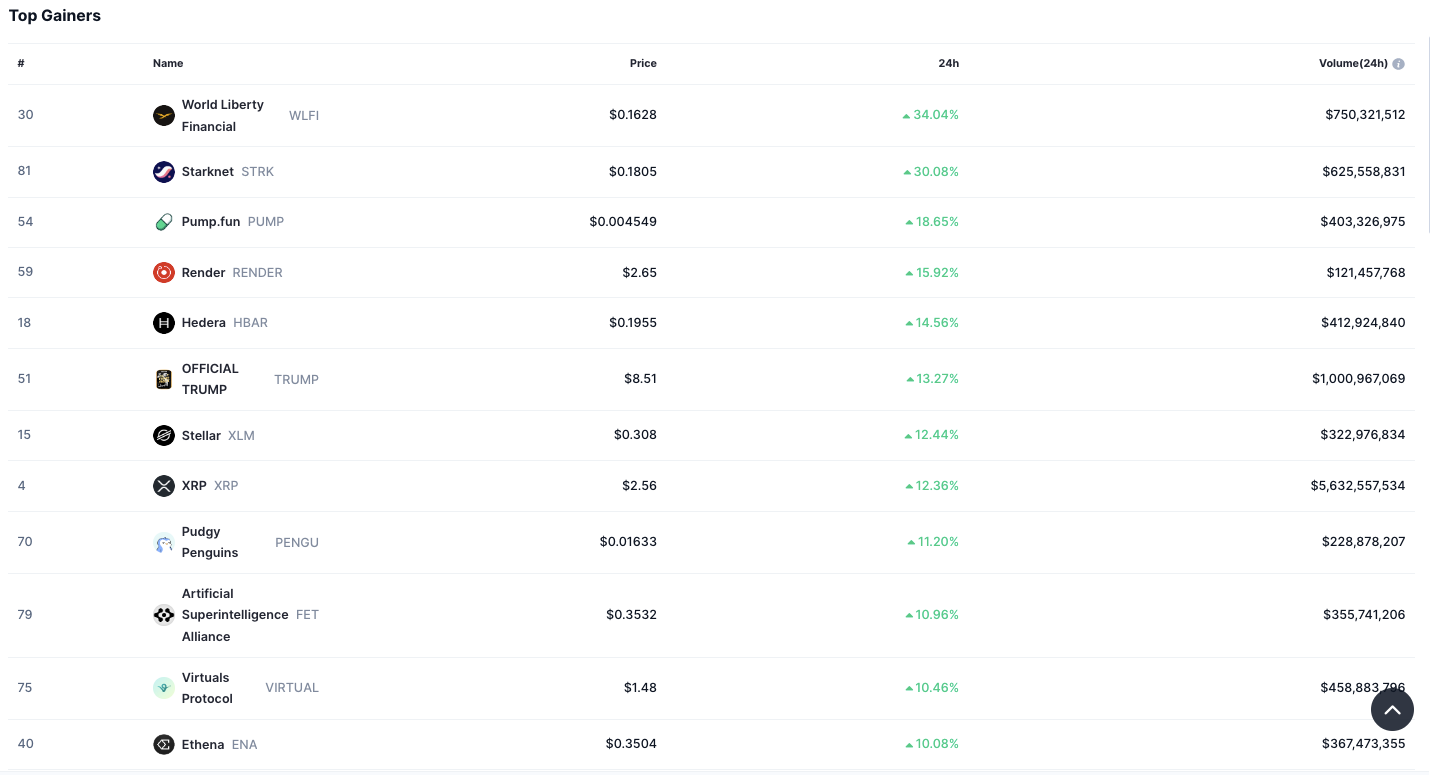

World Liberty Financial (WLFI) emerged as the session’s top performer, jumping 34.04% to $0.1628 with trading volume exceeding $750 million. The surge reflected renewed demand for smaller-cap assets as macroeconomic conditions stabilized. Starknet (STRK) followed with a 30.08% rise to $0.1805, benefiting from a resurgence of activity in Ethereum Layer 2 ecosystems, where traders sought efficiency from lower gas fees and scaling updates.

Pump.fun (PUMP), a meme-driven community token, added 18.65%, while Render (RNDR), tied to decentralized GPU and AI rendering, climbed 15.92% to $2.65, supported by persistent interest in AI-related blockchain projects.

Institutional Flows and Cross-Border Payment Gains

Among higher-capitalization assets, Hedera (HBAR) gained 14.56% and Stellar (XLM) rose 12.44%, both extending prior advances linked to progress in cross-border payment technology. XRP also maintained strong momentum, trading at $2.56 after a 12.36% increase.

Source: CoinMarketCap

Analysts attributed part of its performance to investor anticipation surrounding the forthcoming spot XRP ETFs, which are listed on the Depository Trust and Clearing Corporation (DTCC). XRP’s $5.63 billion in daily volume surpassed other leading assets, indicating robust institutional participation.

Political and AI Tokens Join the Advance

Political-themed token Official Trump (TRUMP) climbed 13.27% to $8.51, recording more than $1 billion in turnover amid renewed online attention. AI-linked assets also strengthened, with Fetch.ai (FET) advancing 10.96% and Virtuals Protocol (VIRTUAL) gaining 10.46%, thereby increasing demand for projects that integrate artificial intelligence and blockchain frameworks.

NFT-related Pudgy Penguins (PENGU) and DeFi platform Ethena (ENA) each rose over 10%, closing out a day characterized by broad-based strength across multiple crypto sectors.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.