- ARB leads crypto declines with 5.85% drop, $756.72M volume signals heavy market activity.

- SOL posts $7.57B trading volume despite 2.58% price dip, showing strong liquidity.

- Broad losses hit DeFi and Layer 2 tokens, with high turnover indicating active repositioning.

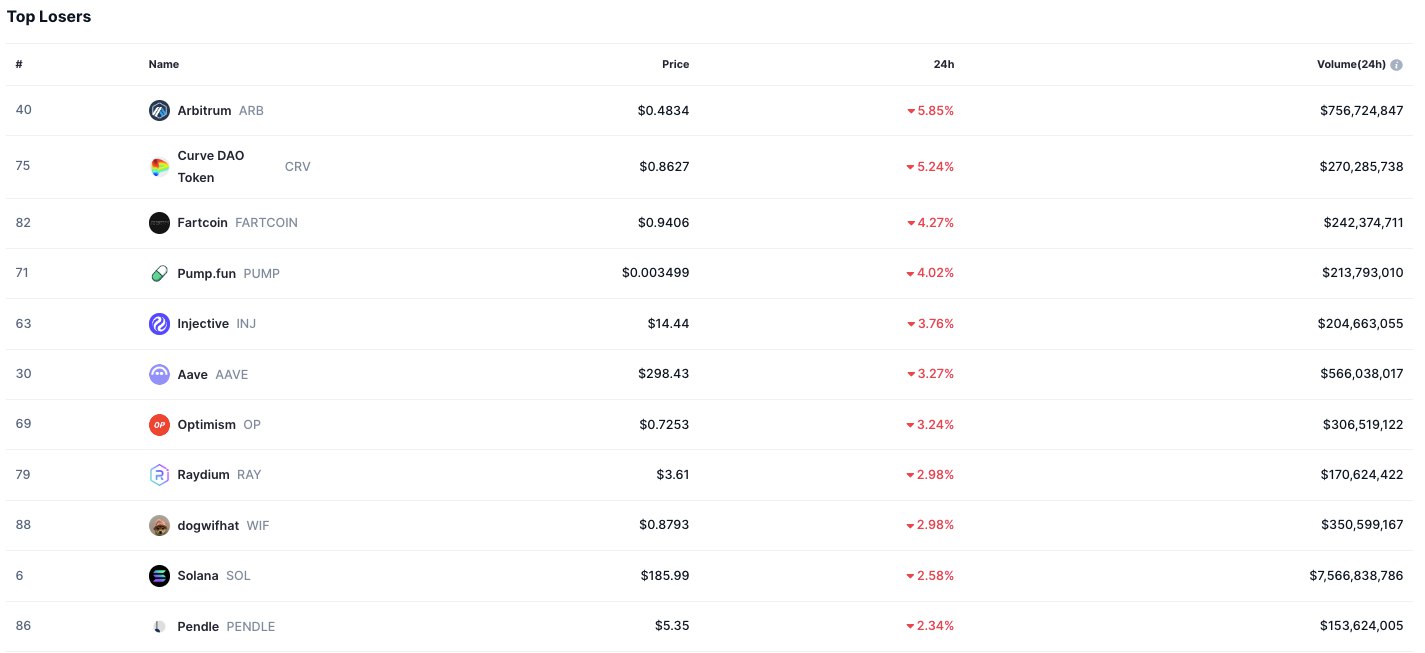

The crypto market recorded declines across multiple large- and mid-cap assets over the past 24 hours, with both decentralized finance protocols and high-capitalization blockchain networks facing downward price movement.

Data from CoinMarketCap shows that Arbitrum (ARB) led the list of top percentage losers, with other notable assets including Solana (SOL), Curve DAO Token (CRV), and Aave (AAVE) also posting drops. Trading volumes remained high across several tokens, signaling sustained market participation despite the overall negative trend.

Arbitrum (ARB) recorded the largest percentage loss among tracked assets, falling 5.85% to $0.4834. The Layer 2 scaling solution registered $756.72 million in trading volume during the period, reflecting large sales amid the price drop. Curve DAO Token (CRV) followed, declining by 5.24% to $0.8627 with a daily volume of $270.29 million.

Source: CoinMarketCap

Other losses were observed in smaller-cap tokens with active markets. Fartcoin (FARTCOIN) dropped 4.27% to $0.9406, with trades totaling $242.37 million. Pump.fun (PUMP) saw a 4.02% decrease, closing at $0.003499 on $213.79 million in transactions.

DeFi and Layer 2 Projects Experience Pressure

In the decentralized finance and Layer 2 sectors, Injective (INJ) declined by 3.76% to $14.44 on $204.66 million in trading activity. Aave (AAVE), another major DeFi protocol, fell 3.27% to $298.43, supported by $566.04 million in turnover. Optimism (OP) registered a 3.24% loss, trading at $0.7253 on $306.52 million in volume.

Raydium (RAY) and Dogwifhat (WIF) recorded similar percentage declines of 2.98%. RAY ended the session at $3.61 with $170.62 million in trades, while WIF closed at $0.8793 with $350.60 million exchanged.

Solana Maintains Largest Trading Volume in Crypto Market

Among higher market capitalization assets, Solana (SOL) posted a 2.58% decline to $185.99. Despite the price drop, SOL maintained the highest trading volume of all tokens in the session at $7.57 billion. This figure exceeded the trading volume of every other asset in the group, reflecting deep liquidity and sustained market engagement. Pendle (PENDLE) completed the list of notable declines, dropping 2.34% to $5.35 after recording $153.62 million in daily transactions.

High trading volumes accompanied the across-the-board losses in several tokens, including ARB, AAVE, and SOL, where activity exceeded half a billion dollars or more. The alignment of price decreases across diverse market areas shows that traders adjusted positions in response to prevailing market forces.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.