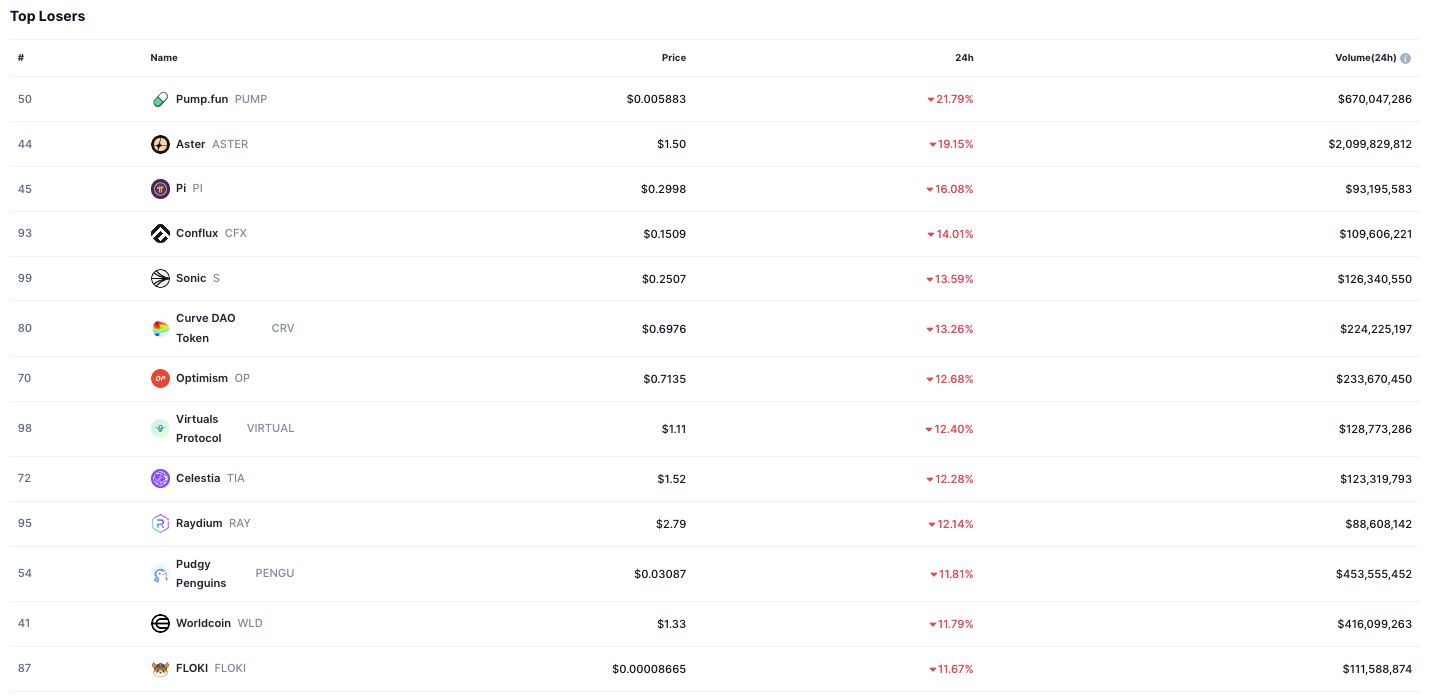

- Pump.fun leads losses with a 21.79% drop, as trading volumes stay unusually high.

- DeFi and Layer-2 tokens face heavy selling, with CRV and OP both sliding over 12%.

- Meme and identity tokens decline, with PENGU, WLD, and FLOKI all losing over 11%.

The crypto market recorded large losses over the past 24 hours, as leading tokens from different sectors faced double-digit declines. Trading activity remained strong, but the downturn displayed higher volatility across DeFi, Layer-2, and meme-linked assets.

Pump.fun (PUMP) registered the greatest decline in the crypto market, losing 21.79% to trade at $0.005883. Despite the fall, trading activity remained intense, with $670 million exchanged during the session.

Aster (ASTR) also posted a major correction, dropping 19.15% to $1.50. Its daily trading volume exceeded $2 billion, placing it among the most actively traded assets despite the downturn. Pi (PI) retreated 16.08% to $0.2998, supported by $93.1 million in daily turnover.

Altcoins and DeFi Tokens Under Pressure

Selling pressure extended to mid-cap assets. Conflux (CFX) dropped 14.01% to $0.1509, with reported trading volume at $109.6 million. Sonic (S) also faced double-digit declines, down 13.59% at $0.2507 on $126.3 million in transactions.

Curve DAO Token (CRV), one of the most traded DeFi assets, slid 13.26% to $0.6976 with $224.2 million exchanged. Layer-2 protocol Optimism (OP) recorded a 12.68% decline, closing the day at $0.7135 with $233.6 million in trades.

Source: CoinMarketCap

Virtuals Protocol (VIRTUAL) also experienced losses, falling 12.40% to $1.11. Celestia (TIA) dropped 12.28% to $1.52. Both tokens continued to register high volumes, reflecting ongoing activity in spite of falling valuations.

Established Projects and Meme Tokens Decline

Raydium (RAY), a Solana-based DeFi platform, fell 12.14% to $2.79. The decline showed that established projects were not immune to the broader market retreat. Pudgy Penguins (PENGU) also faced a major decline, dropping 11.81% to $0.03087. Trading remained active, with $453.5 million exchanged. Worldcoin (WLD), focused on identity-driven use cases, slipped 11.79% to $1.33.

Meme-inspired token FLOKI (FLOKI) closed the session with an 11.67% fall, settling at $0.00008665 on $111.5 million in trading. The drop reflected weakness across speculative assets that had previously drawn significant inflows.

The crypto market faced declines across nearly all categories, including DeFi tokens, Layer-2 platforms, and meme-based projects. While volumes stayed high, the losses marked one of the sharpest short-term adjustments for both mid-cap and established digital assets.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.