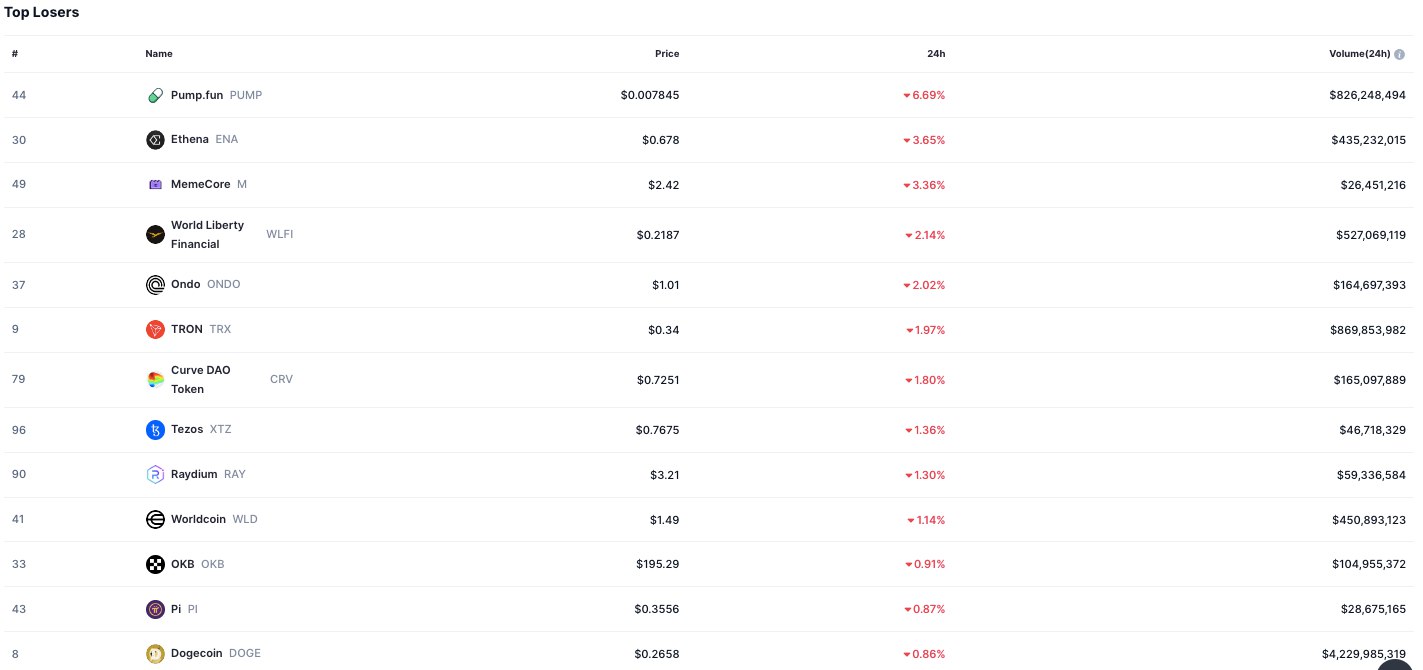

- Pump.fun led daily losses with a 6.69% drop despite $826M in trading volume.

- Mid-cap tokens Ethena, MemeCore, WLFI, Ondo, and Tron posted sharp declines.

- Dogecoin held steady, trading $4.22B, showing resilience in the crypto market.

The crypto market recorded large declines over the past 24 hours, with both meme tokens and larger blockchain projects facing downward pressure. Trading activity across the board remained strong, confirming that investor engagement continues despite the pullback in asset prices.

Pump.fun (PUMP) stood out as the biggest loser of the session. The token fell 6.69% to $0.007845, placing it at the top of the list of daily losers. Market data showed volumes of more than $826 million during the period, displaying active trading even as prices slipped. The decline marked the largest move in the crypto market during the day’s trading.

Mid-Cap Tokens Register Losses

According to a Blockchain Magazine report, a series of mid-cap tokens also came under pressure. Ethena (ENA) moved 3.65% to $0.678, backed by $435 million in trading volume. MemeCore (M) lost 3.36% to close at $2.42, while World Liberty Financial (WLFI) dropped 2.14% to $0.2187 on more than $527 million in activity.

Source: CoinMarketCap

Ondo (ONDO) eased 2.02% to $1.01, while Tron (TRX), one of the most traded networks in the crypto market, moved 1.97% lower to $0.34. Despite the decline, Tron posted a volume of $869 million, reflecting strong liquidity.

DeFi and Large-Cap Tokens Weaken

Losses extended to blue-chip and DeFi-focused assets. Curve DAO Token (CRV) shed 1.80% to $0.7251, while Tezos (XTZ) fell 1.36% to $0.7675. Raydium (RAY), a Solana ecosystem project, ended 1.30% lower at $3.21.

Worldcoin (WLD) decreased by 1.14% to $1.49, paired with more than $450 million in volume. OKB, the exchange-linked token, slipped 0.91% to $195.29, and Pi Network (PI) edged 0.87% lower to $0.3556.

Dogecoin Shows Resilience in the Crypto Market

Among larger-cap tokens, Dogecoin (DOGE) posted the smallest decline. The meme coin dropped by 0.86% to $0.2658 but maintained a commanding position in trading activity. Volumes surpassed $4.22 billion, making Dogecoin one of the most heavily traded assets in the crypto market during the session.

Volumes Stay Strong Despite Pullback

Although prices fell across different sectors, including meme assets, mid-tier projects, and major blockchain platforms, trading volumes signaled a different dynamic. High turnover in tokens such as Pump.fun, Tron, and Dogecoin indicated that the declines were accompanied by steady liquidity.

The session closed with slight but broad-based losses across the crypto market, confirming a phase of active repositioning rather than inactivity. Heavy volumes across multiple projects showed that market participants remained engaged despite the declines.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.