- Zcash led market losses with a 16% drop as volatility surged across altcoins.

- Major Layer-1 tokens like NEAR and Litecoin saw over 7% declines amid profit-taking.

- DeFi and Layer-2 tokens fell as risk appetite weakened after Bitcoin and Ethereum swings.

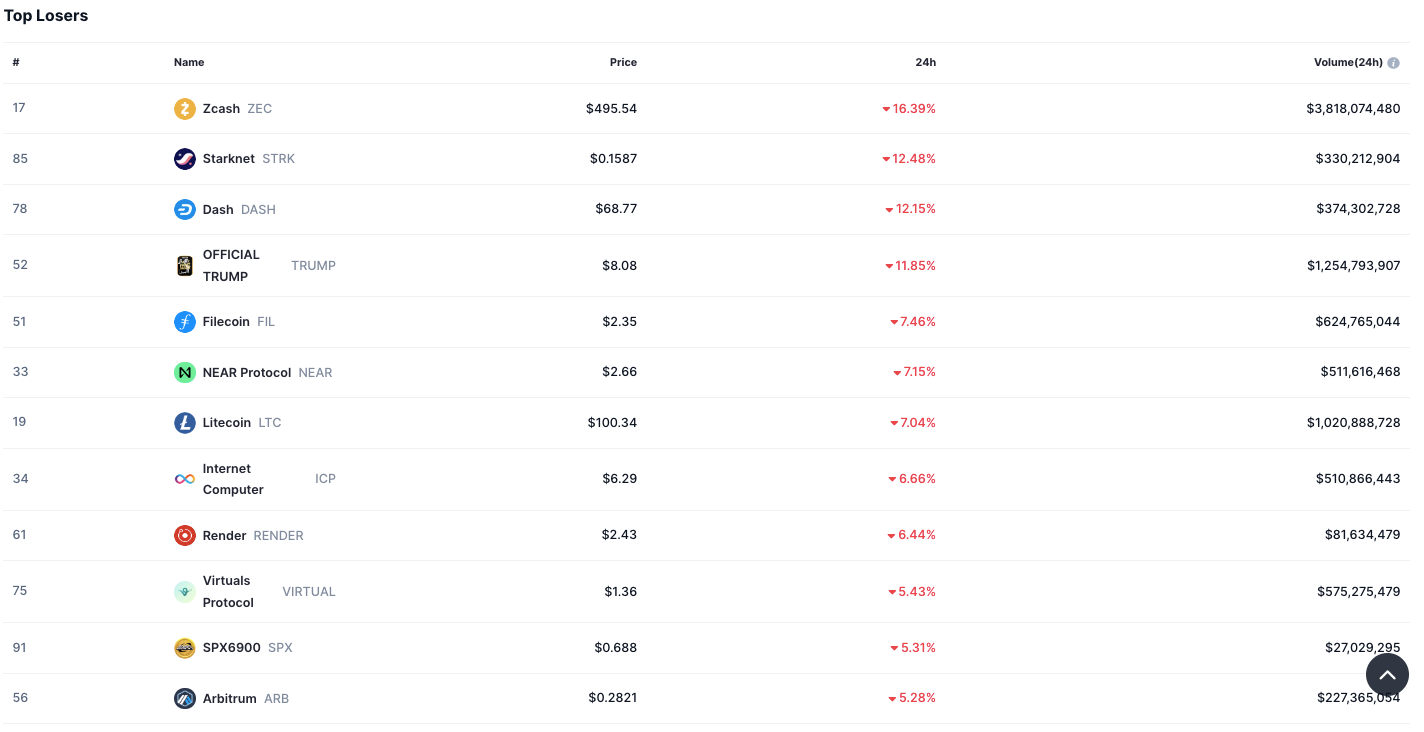

The crypto market recorded a large downturn over the past 24 hours, with widespread losses across major and mid-cap tokens signaling renewed volatility. Market data showed that Zcash (ZEC) faced the largest decline, tumbling 16.39% to $495.54, alongside a rise in trading activity that pushed its 24-hour volume to $3.82 billion.

Beyond Zcash, several altcoins saw double-digit losses. Starknet (STRK) dropped 12.48%, and Dash (DASH) followed closely with a 12.15% fall. Analysts linked the decline to a rotation of capital out of speculative assets after a period of elevated gains earlier this month. The Official Trump (TRUMP) token also declined 11.85% to $8.08, registering one of its largest single-day decreases in recent quarters as speculative demand eased.

Established Networks See Broad Pullback

Layer-1 blockchain tokens experienced notable corrections. Filecoin (FIL) declined 7.46%, while NEAR Protocol (NEAR) and Litecoin (LTC) each shed more than 7%, with both assets recording trading volumes above $500 million. Internet Computer (ICP) slipped 6.66%, and Render (RNDR) lost 6.44%, continuing the downward momentum observed in Web3 infrastructure assets.

Source: CoinMarketCap

DeFi and Layer-2 Tokens Decline

Losses also extended into the decentralized finance (DeFi) and layer-2 segments. Virtuals Protocol (VIRTUAL) dropped 5.43%, while Arbitrum (ARB) and SPX6900 (SPX) each fell around 5.3%, reflecting lighter trading activity in governance and scaling-focused tokens. The declines suggest a temporary reduction in risk appetite within decentralized ecosystems amid ongoing price adjustments.

Market Overview

Overall, the digital asset market reflected a broad corrective trend led by privacy and infrastructure-focused tokens.

Market participants attributed the decline to increased profit-taking and derivatives liquidations following sharp fluctuations in Bitcoin and Ethereum. Although trading volumes remained strong, the overall sentiment shifted toward caution, with investors closely monitoring support levels across major assets.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.