- Bitcoin and Ethereum sustain dominance as market opens September with $3.75T capitalization.

- Traders remain split with long and short positions nearly balanced amid cautious sentiment.

- $123M liquidations highlight volatility as Mantle and TRUMP tokens lead token rebounds.

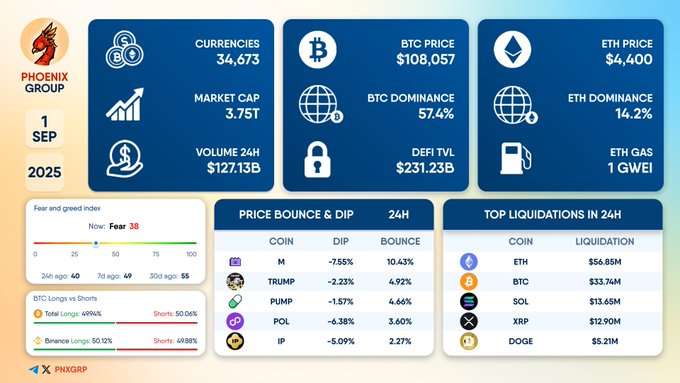

The global crypto market began September 2025 under cautious sentiment, according to data compiled on September 1. Market capitalization stood at $3.75 trillion, with trading volumes reaching $127.13 billion over 24 hours. More than 34,600 digital assets were listed across exchanges, but market participants faced an environment shaped by volatility and indecision.

Bitcoin continued to dominate overall capitalization with a 57.4% share, trading at $108,057. Its position strengthened the concentration of market value within the largest cryptocurrency.

Daily Summary on September 1, 2025$M $TRUMP $PUMP $POL $IP $ETH $BTC $SOL $XRP $DOGE#dailysummary #DeFi #Crypto pic.twitter.com/Zk0iJdL7gB

— PHOENIX – Crypto News & Analytics (@pnxgrp) September 1, 2025

Ethereum followed with a 14.2% share of market dominance and a price of $4,400. Network conditions remained efficient, as gas fees stayed at 1 Gwei, keeping transactions inexpensive. The broader DeFi sector, built heavily on Ethereum’s infrastructure, recorded $231.23 billion in total value locked (TVL), showing continued engagement with decentralized protocols despite investor caution.

Crypto Market Investor Sentiment and Trading Dynamics

The Fear and Greed Index registered 38, placing overall sentiment in the “fear” category. Trading activity reflected this uncertainty. Moreover, data from Binance showed that long and short positions were almost evenly balanced, with longs at 50.12%. Across the wider market, long positions made up 49.04%, while short positions stood at 50.96%. This narrow split highlighted indecision among traders at the start of the month.

Token Volatility and Price Movements

According to our previos report, several tokens in the crypto Market recorded major swings. Mantle (M) rebounded 10.43% after losing 7.55%, leading recoveries among major assets. TRUMP tokens, linked to former U.S. President Donald Trump, gained 4.36% following a 2.23% decline, showing short-term resilience. Pump (PUMP) and Polygon (POL) also registered moderate rebounds, though Internet Protocol (IP) saw weaker momentum, rising only 2.27% after a 5.09% decline.

Source: X

Derivatives markets experienced large liquidations. Ethereum accounted for the largest share, with $56.85 million liquidated within 24 hours. Bitcoin followed at $33.74 million, while Solana and XRP recorded $13.65 million and $12.90 million, respectively. Dogecoin also saw $5.21 million liquidated. The scale of losses pointed to aggressive leverage unwinding, contributing to heightened price swings across the sector.

The data showed a market marked by mixed performance. Bitcoin and Ethereum maintained their roles in the crypto market as the foundations of capitalization, while secondary tokens such as Mantle and TRUMP showed more volatility. The balance between long and short positions pointed to uncertainty, and the rise in liquidations underscored risk exposure within derivatives markets.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.