Crypto price watchers are holding their breath as the total market cap stays close to the $4 trillion mark a key level that’s become a symbol of strength amid the recent ETF excitement and big institutions fearing they might miss out. Fresh investments could transform this digital landscape. Historically, major price movements often signal bigger changes. Right now, the market cap is holding steady at $4.06 trillion, up nearly 2% in the last day, suggesting a calm before potential major developments.

This stability isn’t random; it’s driven by the excitement around ETFs attracting billions from Wall Street and creating a fear of missing out among institutions. This stable base might be setting the stage for the next big phase in the crypto market. If you’re someone who watches crypto charts closely, take note 2025 might be the year where $4 trillion becomes the new normal, and discussions about crypto price become more prominent than ever.

Crypto Prices Steady Amid Big ETF Surge

At the moment, the crypto market is influenced by several major factors. Bitcoin, currently holding strong at around $120,000, acts as the market’s foundation. However, the big news is the surge in Bitcoin ETFs (Exchange-Traded Funds), which have accumulated over $60 billion in assets. These funds are attracting both everyday investors and institutions with their safe and regulated investment options, with daily inflows exceeding $1 billion.

Ethereum ETFs are also gaining traction, amassing around $4 billion, and this has helped push Ethereum’s price to approximately $4,200, supported by strong staking rewards and increased DeFi (Decentralized Finance) activity.

This interest in ETFs is not just a passing trend; it represents real money entering the crypto market, which helps maintain its overall stability. Even when prices dip now and then, the total market value remains. Institutions that once stayed away because of volatility are now jumping in, with giants like BlackRock and Fidelity expanding their crypto products they don’t want to miss out on what could be a $10 trillion market wave ahead. On-chain data backs this up, transaction volumes are up 150% year-over-year, and wallet numbers are growing by 2 million every month, showing real demand beyond just speculation.

The $4 Trillion Crypto Market

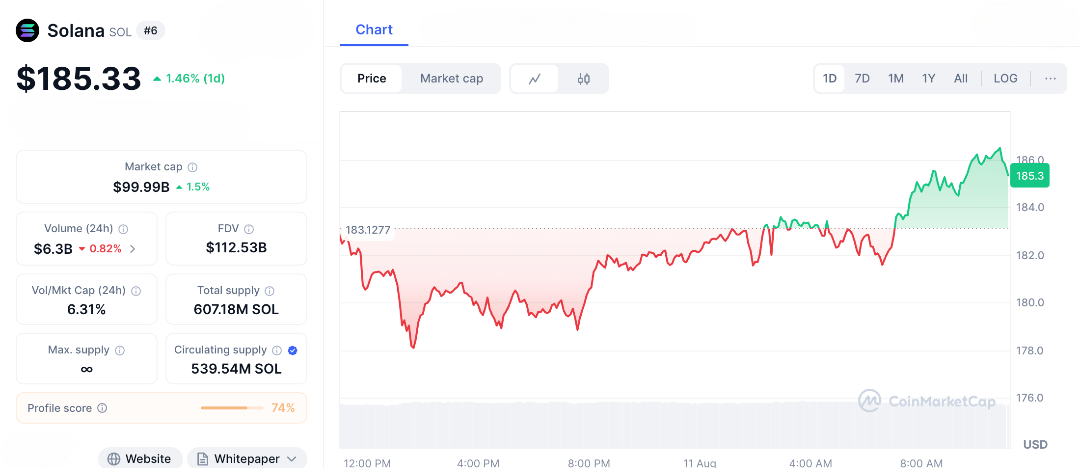

Holding steady at $4 trillion, the crypto market is showing signs of maturing. While popular altcoins like Solana at $185, it’s really the growing institutional trust that’s driving the momentum.

With ETF approvals for tokens like XRP expected soon, inflows could easily double, turning the fear of missing out (FOMO) into a powerful cycle that pushes prices even higher. Analysts are predicting the market could hit $5 trillion by mid-2025 if Bitcoin reaches $150,000 during its halving cycle. This kind of price stability might even attract big investors like pension funds and sovereign wealth funds. Of course, there are risks regulatory challenges and economic shocks like inflation could test that $4 trillion level. But the overall momentum feels strong, with DeFi’s total value locked (TVL) at $200 billion and NFT trading volumes bouncing back.

Why the $4 Trillion Crypto Market Has Everyone Talking

The story of cryptocurrency reaching $4 trillion is spreading quickly, moving from being overlooked as a passing trend to gaining significant attention. ETFs are making it easier for regular investors to get involved in crypto. For example, a trader in London might trade ETF shares to invest in cryptocurrency. As major financial institutions eagerly join in, the real question is whether this will lead to a strong increase in value or just create temporary bubbles. Historically, when these milestones are reached, it often signals the start of significant growth. Share this if you believe in the potential rise, because maintaining a $4 trillion value could be the starting point for cryptocurrency’s next big advancement.

FAQs

- What is the current crypto market cap?

As of August 11, 2025, the crypto market cap is $4.06 trillion, up 1.93% in a day, driven by ETF inflows. - How do ETFs boost the crypto price?

Bitcoin and Ethereum ETFs, with $60 billion and $4 billion in assets, stabilize the crypto price by attracting institutional and retail investments. - What is Bitcoin’s current crypto price?

Bitcoin trades at $115,000, anchoring the $4.06 trillion market cap and supporting broader bull momentum. - Could the crypto price hit $5 trillion in 2025?

Analysts forecast a $5 trillion cap if Bitcoin reaches $150,000 and ETF inflows double, fueled by institutional FOMO. - What risks could affect the crypto price?

Regulatory hurdles or macroeconomic issues like inflation might test the $4 trillion line, despite strong ETF-driven support.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.