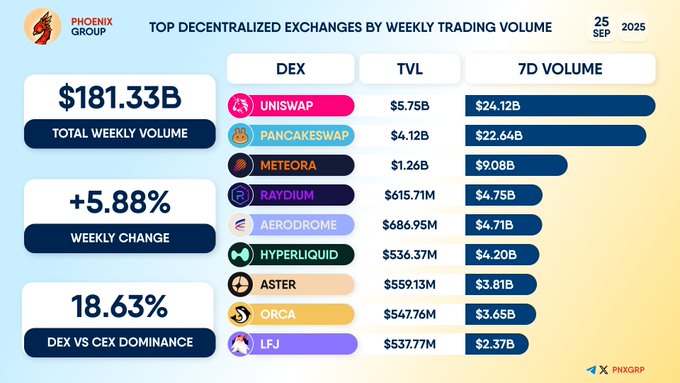

- Decentralized exchanges hit $181.33B weekly volume, rising 5.88% from the prior week.

- Uniswap and PancakeSwap drove nearly 25% of total DEX activity with $46.76B combined.

- Mid-tier DEXs like Meteora, Raydium, and Aster showed strong growth in trading volumes.

Decentralized exchanges reported a combined $181.33 billion in trading activity for the week ending September 25, 2025, according to Phoenix Group data. The figure marked a 5.88% increase compared to the previous week and accounted for 18.63% of overall cryptocurrency market transactions.

Uniswap and PancakeSwap continued to anchor the decentralized trading landscape.

Uniswap processed $24.12 billion in weekly trades, supported by a $5.75 billion total value locked (TVL). PancakeSwap followed with $22.64 billion in activity and a $4.12 billion TVL. Combined, the two exchanges contributed nearly one-quarter of the total weekly DEX volume. Their consistent output affirmed their leadership, keeping them ahead of competitors within the decentralized ecosystem.

TOP #DECENTRALIZED EXCHANGES BY WEEKLY TRADING VOLUME

#Uniswap #PancakeSwap #Meteora #Raydium #Aerodrome #Hyperliquid #Aster #Orca #LFJ pic.twitter.com/5g8s37wXk2— PHOENIX – Crypto News & Analytics (@pnxgrp) September 25, 2025

Mid-Tier Platforms Strengthen Their Share

Meteora generated $9.08 billion in volume, backed by a $1.26 billion TVL, securing its position as a rising mid-tier exchange. Raydium and Aerodrome both reported close to $5 billion in weekly transactions. Raydium’s TVL stood at $615.71 million while Aerodrome recorded $686.95 million, reflecting their active roles in Solana and Base networks.

Source: Phoenix Group

Hyperliquid processed $4.7 billion, supported by $536.37 million in TVL. Aster and Orca each surpassed $3.5 billion in trades, with locked values of $559.13 million and $547.76 million. LFJ closed the ranking with $2.37 billion in weekly activity.

Decentralized Exchanges Expand Market Share

The growth in volumes implies that decentralized exchanges are continuing to expand their market footprint. Uniswap and PancakeSwap remained at the forefront, while platforms such as Meteora and Aster showed measurable progress in building trading activity.

With decentralized exchanges now representing 18.63% of global crypto market trading, the weekly performance reflected a structural shift toward decentralized market infrastructure. The data pointed to rising liquidity across multiple blockchain ecosystems and consistent participation by traders seeking non-centralized alternatives.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.