DMG Blockchain Solutions Inc. (TSXV: DMGI, OTCQB: DMGGF) is a Canadian company leading in blockchain and cryptocurrency, with a focus on Bitcoin mining, AI data centers, and blockchain software. As blockchain and AI technologies grow, DMG is diversifying to stay competitive.

Founded in 2011 in Delta, Canada, DMG operates two main segments:

-

Core (Infrastructure): Runs a Bitcoin mining and hosting data center in Christina Lake, British Columbia.

-

Core+ (Software): Develops blockchain tools like Terra Pool and Petra under the Blockseer brand, focusing on eco-friendly Bitcoin transactions and compliance.

DMG’s recent move into AI data centers taps into the rising demand for AI computing, reducing its reliance on volatile crypto markets.

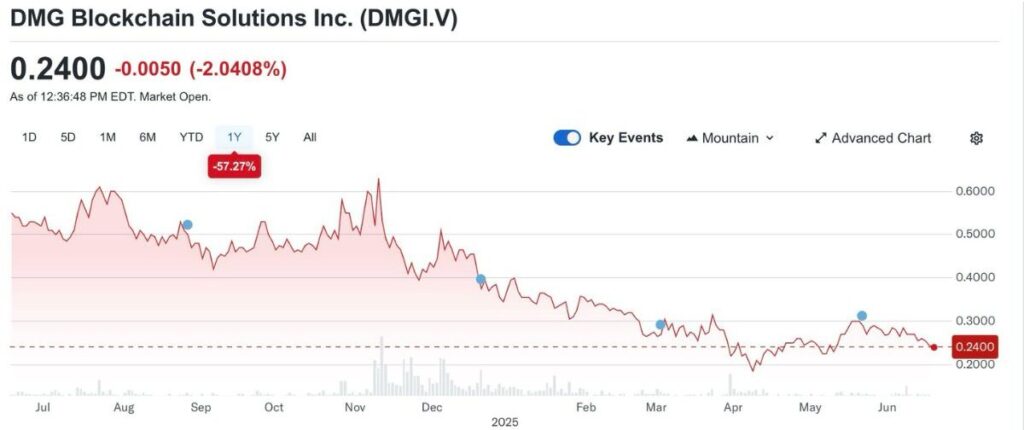

DMG Blockchain Stock Price and Performance

On June 18, 2025, DMG Blockchain stock (TSXV: DMGI) priced at ~CAD $0.24 (~USD $0.17, based on a ~1.38 CAD/USD exchange rate), with a market capitalization (total value of all shares) of CAD $48.78 million (~USD $35.35 million). On the U.S. OTCQB market (DMGGF), it trades at ~USD $0.17. The stock has been volatile, dropping ~56% from CAD $0.55 a year ago.

Key Stock Metrics

-

52-week range: CAD $0.185–$0.65 (~USD $0.13–$0.47), showing the stock’s lowest and highest prices in the past year.

-

Beta: 6.78, meaning the stock is much riskier than the average market (a beta above 1 indicates higher price swings).

-

Earnings per share (EPS): -CAD $0.10 (~USD -$0.072), showing the company is losing money per share, common for growth-focused firms.

-

Analyst target price: CAD $0.77 (~USD $0.56), suggesting a potential 220% rise from CAD $0.24.

-

Trading volume: ~241,649 shares daily on average, indicating moderate trading activity.

In Q4 2024, DMG’s revenue jumped 97% to CAD $11.6 million (~USD $8.41 million), beating expectations, but losses (negative EPS) continue due to high mining costs.

Recent Developments Impacting DMG Stock

DMG has taken steps to grow its business:

-

AI Expansion: Acquired two megawatts of AI data center infrastructure and signed an MOU for a 10-megawatt facility, diversifying into AI computing.

-

Bitcoin Mining: Mined 30 Bitcoin in April 2025 with a hashrate of 1.93 EH/s, aiming for 2.1 EH/s with new miners. Sold some Bitcoin (down to 351 BTC) to fund AI, impacting stock price.

-

Eco-Friendly Tools: Terra Pool and Petra promote carbon-neutral Bitcoin mining, attracting ESG investors.

-

New Patent: A December 2024 patent boosted its Blockseer software for compliance.

-

Financing: Raised CAD $17.25 million and proposed a CAD $15 million offering, with management buying shares, showing confidence.

Is DMG Blockchain Stock a Good Investment?

Why Consider DMGI Stock

-

Analyst Optimism: A CAD $0.77 target price suggests significant growth potential.

-

Revenue Growth: 97% revenue increase in Q4 2024 shows strong operations.

-

AI Pivot: AI data centers could reduce crypto volatility risks.

-

Sustainability: Carbon-neutral tools align with green investment trends.

-

Low Valuation: A CAD $48.78 million market cap may indicate undervaluation.

Risks to Understand

-

Losses: Negative EPS (-CAD $0.10) shows DMG isn’t profitable yet.

-

Volatility: High beta (6.78) means big price swings, risky for conservative investors.

-

Bitcoin Reliance: Revenue depends on Bitcoin’s unpredictable price.

-

Low Liquidity: Moderate trading volume (~241,649 shares) can lead to price instability.

-

Industry Risks: Crypto mining faces high energy costs and regulations.

DMG vs. Competitors

DMG competes with HIVE Digital Technologies (TSXV: HIVE), Bitfarms (TSX: BITF), and Hut 8 Corp (TSX: HUT). Its smaller market cap (CAD $48.78 million) contrasts with larger peers, but its AI and software focus sets it apart. For example, Hut 8 leans heavily into AI, while HIVE mines both Bitcoin and Ethereum.

Should You Invest in DMG Blockchain Stock?

Basis social media sentiment, investors are cautiously optimistic, citing DMG’s low market cap and past growth (from CAD $20 million to CAD $200 million). However, volatility and Bitcoin dependency raise concerns. DMG’s blockchain-AI strategy positions it for long-term growth, but profitability and market stability are key challenges.

DMG Blockchain Solutions (TSXV: DMGI) is a high-risk, high-reward stock. Its CAD $0.24 price, AI expansion, and revenue growth make it appealing for risk-tolerant investors, but losses and volatility require caution.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.