Dogecoin, the cryptocurrency that began as a joke, has now reached a new milestone. The Rex-Osprey Dogecoin ETF (ticker: DOJE) has been approved under the U.S. Investment Company Act of 1940, making it the first fund of its kind to focus on a memecoin. This means investors will soon be able to buy shares of Dogecoin exposure through a regulated exchange-traded fund, without needing to hold the cryptocurrency directly. The launch is scheduled for September 18, 2025, on a major U.S. exchange.

This is significant because most crypto ETFs must go through a tougher approval process under different laws. By using the 1940 Act, DOJE avoids that route and instead operates under rules designed for mutual funds. To comply, it will hold at least 80% in Dogecoin or related investments, while spreading the rest into other assets to reduce risk. These rules require safeguards like audited custody and transparency about conflicts of interest, which helped address regulators’ concerns about volatility and speculation.

The ETF is structured with the help of a Cayman Islands subsidiary, a setup used before by other crypto funds. This design makes it possible to track Dogecoin while following U.S. governance standards. Investors will pay a 1.5% annual fee, which compares favorably with the costs of trading Dogecoin directly, where exchange fees and market swings can be high. The goal is to make Dogecoin more accessible for traditional investors. Retirement accounts, brokerage platforms, and large institutions can now include it in portfolios, which could bring in billions of dollars that were previously on the sidelines. Already, the news of the approval has pushed Dogecoin’s price up by 13% in a week, reaching about $0.26, with trading volumes jumping 12%.

This approval also reflects a broader shift in how U.S. regulators view crypto. Under the leadership of SEC Chairman Paul Atkins, the agency has shown more willingness to support innovation. While almost 100 other ETF filings for tokens like Solana and XRP remain stuck in review, DOJE managed to move forward because of its use of the 1940 Act. This approach allows certain funds to launch within 75 days of filing, without needing the same direct approvals required for spot crypto ETFs.

While Dogecoin is often thought of as a meme, the network shows signs of real activity. Data reports that active addresses are up 15% year-over-year, now at 4.2 million. Transaction fees paid in DOGE reached $1.2 million last month, which shows growing use in payments and transfers. The Dogecoin Foundation described the ETF as a “bridge to legitimacy,” noting that it embeds Dogecoin into long-term investment strategies.

Still, not everyone is convinced. Bloomberg analyst Eric Balchunas joked that this may be the first U.S. ETF built around something that “has no utility on purpose.” Critics point out that the fund’s reliance on futures and indirect holdings may create tracking errors, especially during Dogecoin’s wild price surges. High fees and the requirement to diversify into other assets could also reduce pure Dogecoin exposure.

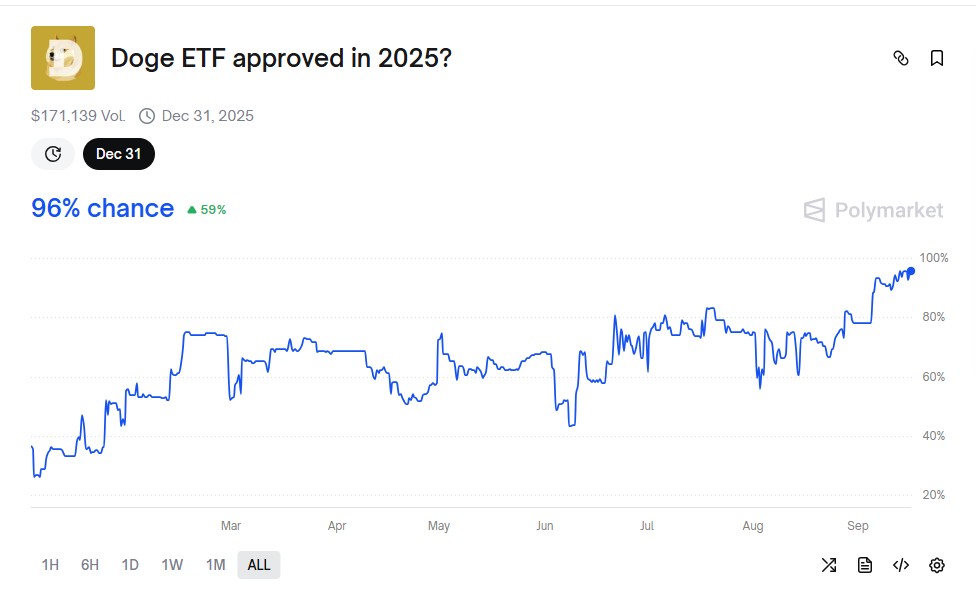

The Dogecoin ETF fits into a larger wave of memecoin-related products. Bitwise has a delayed spot Dogecoin ETF filing under review, while Grayscale is pursuing a conversion of its Dogecoin trust later this year. Prediction markets give a 96% chance of a full spot ETF approval by the end of 2025, up sharply from earlier in the year.

Dogecoin’s path from a playful fork of Litecoin in 2013 to a cryptocurrency with a market cap of over $40 billion shows how far it has come. It outpaced rivals like Shiba Inu by being more efficient in proof-of-work mining and has long been used for small online payments and tipping. Now, with the ETF, it is entering mainstream finance in a way few would have imagined during its early meme days.

What Lies Ahead for Dogecoin

The ETF will start trading on September 18 with a goal of reaching $100 million in assets under management. Analysts say its success will depend on how well it balances accessibility with performance. If it attracts enough institutional interest, Dogecoin could see more stable growth. If not, it may struggle against concerns about its volatility and lack of capped supply. For both institutions and retail investors, the ETF provides a way to hold Dogecoin without wallets or private keys. Shares can be bought through platforms like Vanguard or Fidelity, and investors can even place them into retirement accounts, avoiding some tax complications.

The launch of the Rex-Osprey Dogecoin ETF marks a turning point. It tests whether a cryptocurrency born as a joke can survive in the world of regulated finance. It also highlights a bigger truth in crypto, legitimacy often comes when money starts flowing in, but long-term survival depends on culture, community, and real-world use.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.