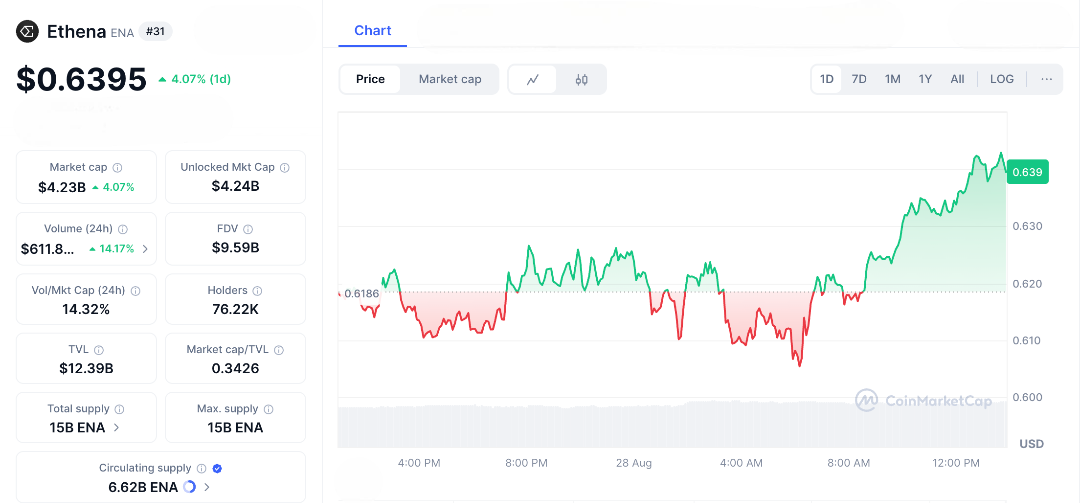

In a major power-up for its stablecoin game, Ethena Labs has added some big name cryptocurrencies BNB, XRP, and Hyperliquid’s HYPE as backing for its synthetic dollar, USDe. This move helped push the protocol’s total value locked (TVL) to a record $12 billion and gave its governance token, ENA Crypto, a nice 15% boost to around $0.63.

By allowing more types of collateral, Ethena aims to make USDe more stable and competitive against giants like Tether and Circle. The expansion is part of their new Eligible Asset Framework, rolled out on August 22, 2025, designed to strengthen trust and usability. Now everyone’s wondering.

Will this diversified approach keep USDe growing so fast? Or could future regulations slow it down?

How ENA Crypto USDe Stablecoin Actually Works

You might be wondering how USDe is different from stablecoins like USDT or USDC. It all comes down to a smart strategy Instead of being backed by dollars in a bank, USDe is backed by crypto assets like Bitcoin, Ether, and now BNB, XRP, and HYPE. Ethena uses a financial strategy called “delta-hedging” with perpetual futures contracts to keep its value pegged at $1.

The Strict Rules for New Collateral

Ethena doesn’t just add any coin. Their Risk Committee has super strict rules to make sure everything is safe and liquid. To be considered, an asset must have:

-

A huge amount of trading activity.

-

High daily trading volume .

-

Deep, liquid markets to prevent big price slips.

BNB was the first to meet all these tough conditions, with XRP and HYPE following right after. By adding more types of collateral, Ethena aims to make USDe more robust against market swings. Founder Guy Young is super optimistic, saying USDe’s supply could hit $20 billion in just a few months if the market plays along!

The Market Went Wild!

The response to Ethena’s news was huge and immediate. The price of its ENA Crypto token shot up from $0.63 to $0.73, and trading volume exploded to over $611 million as everyone jumped into action.

USDe itself smashed through a major milestone, pushing its Total Value Locked past $12 billion. This solidifies its position as the third-largest stablecoin, right behind the giants Tether (USDT) and Circle (USDC). On-chain data shows that institutional investors moved over $40 million worth of ENA Crypto to exchanges. This usually means one of two things: some were cashing out profits, while others were likely moving their tokens to stake them and earn rewards.

A key part of Ethena’s success is its more traditional stablecoin, USDtb. Launched in late 2024, it’s backed mostly by BlackRock‘s tokenised money market fund (BUIDL). This provides a safer, regulated anchor for the system, especially during rocky market periods, and helps give users and big investors more confidence.

Why Adding XRP & BNB is a Big Move

Ethena’s decision to use XRP and BNB as collateral is strategic, but not without its risks. Both assets are under regulatory scrutiny, which could pose challenges. So why include them? Liquidity. XRP, for example, has massive trading activity with over $300 million in average open interest. This deep liquidity is crucial for Ethena’s hedging strategy to work smoothly. Meanwhile, adding HYPE brings a more speculative, high-growth element into the mix, concentrated heavily on its own decentralised exchange.

Ethena didn’t just pick these coins at random. They used a strict, data-driven process powered by CoinGlass’s Open API to evaluate potential collateral. Tokens like SUI and ADA didn’t make the cut because they didn’t meet the tough liquidity requirements. This selective approach helps ensure that only the strongest, most liquid assets back USDe, making the stablecoin more secure and reliable.

This move is part of a larger shift in the stablecoin world toward diversified collateral. As global regulators increase oversight especially after the crypto crackdowns of 2024 projects like Ethena are adapting by choosing transparent, data-backed methods to build trust and ensure stability. By blending established tokens with newer, high-performance assets, Ethena isn’t just growing it’s evolving how stablecoins can stay both innovative and secure.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.