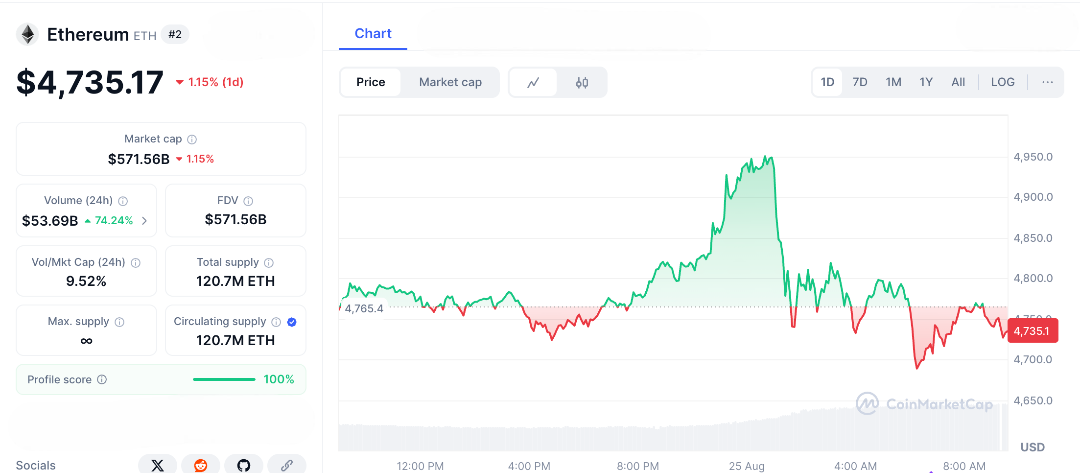

Ethereum smashed through its 2021 all-time high, surging past $4,900 on major exchanges. The crypto, which last peaked at $4,891 in November 2021, set a fresh record at $4,953 before cooling off and settling around $4,735 by August 25, 2025. The rally comes on the back of renewed institutional interest and dovish signals from the Federal Reserve, both of which have injected fresh optimism into the market. Now, with ETH trading in uncharted territory, the big question is on everyone’s mind, Will Ethereum finally break the $5,000 milestone or will volatility step in to spoil the party?

What Sparked Ethereum’s Breakout?

Ethereum’s run past $4,900 didn’t happen overnight it came after weeks of tight consolidation. For most of 2025, ETH bounced between $2,800 and $4,000, weighed down by regulatory uncertainty and shaky market sentiment.

The tide turned on August 23, when Federal Reserve Chair Jerome Powell dropped dovish hints about upcoming rate cuts during his Jackson Hole speech. That single spark ignited risk assets across the board. Almost immediately, Ether ETFs saw inflows pick back up after weeks of stagnation, and over $388 million in leveraged positions were liquidated as traders scrambled to adjust. On-chain data only adds fuel to the bullish case. Exchanges are reporting fewer ETH deposits and more withdrawals, a sign that investors are moving coins into self-custody rather than prepping to sell very different from the overheated setup seen during 2018’s peak.

“ETH hits new highs as Fed turns dovish, Ether ETF inflows resume.” With shrinking supply and rising institutional demand, the momentum behind Ethereum’s breakout looks anything but random.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.