Ethereum is going through one of its toughest periods in recent months. Spot Ethereum ETFs have now seen $1.42 billion leave the market, a clear sign that big institutional investors are pulling back. While this doesn’t change Ethereum’s long-term potential, it does have a real impact on short-term liquidity, investor confidence, and daily price movement.

These outflows have pushed ETH closer to the important $3,000 level. Traders consider this price zone meaningful not just for technical reasons, but also because it affects overall market sentiment. The big question now is whether this is just temporary profit-taking and capital rotation, or if it signals deeper uncertainty about Ethereum’s position in the crypto ecosystem.

Many professional investors currently see Bitcoin as the safer and more predictable option, especially when global markets look shaky. As a result, some of the money leaving Ethereum ETFs is likely being moved into Bitcoin ETFs instead. This shift isn’t necessarily a negative judgment on Ethereum. It simply reflects how institutional investors behave in uncertain economic environments, they tend to reduce exposure to assets they consider more volatile and move into those they view as more stable.

Ethereum ETFs saw strong inflows when they first launched, mainly because many traders expected big gains. Now, some of that money is being pulled out as investors take profits or adjust their portfolios. This kind of movement is normal, especially when the price becomes uncertain or when the earlier inflows were based on short-term excitement rather than long-term confidence.

Another reason for the outflows is the cost of investing. Some of the older Ethereum products had higher fees. With newer, lower-fee ETFs now available, investors are moving their money into cheaper options. This creates the impression that interest in Ethereum is dropping, even though many investors are simply shifting their exposure from one product to another.

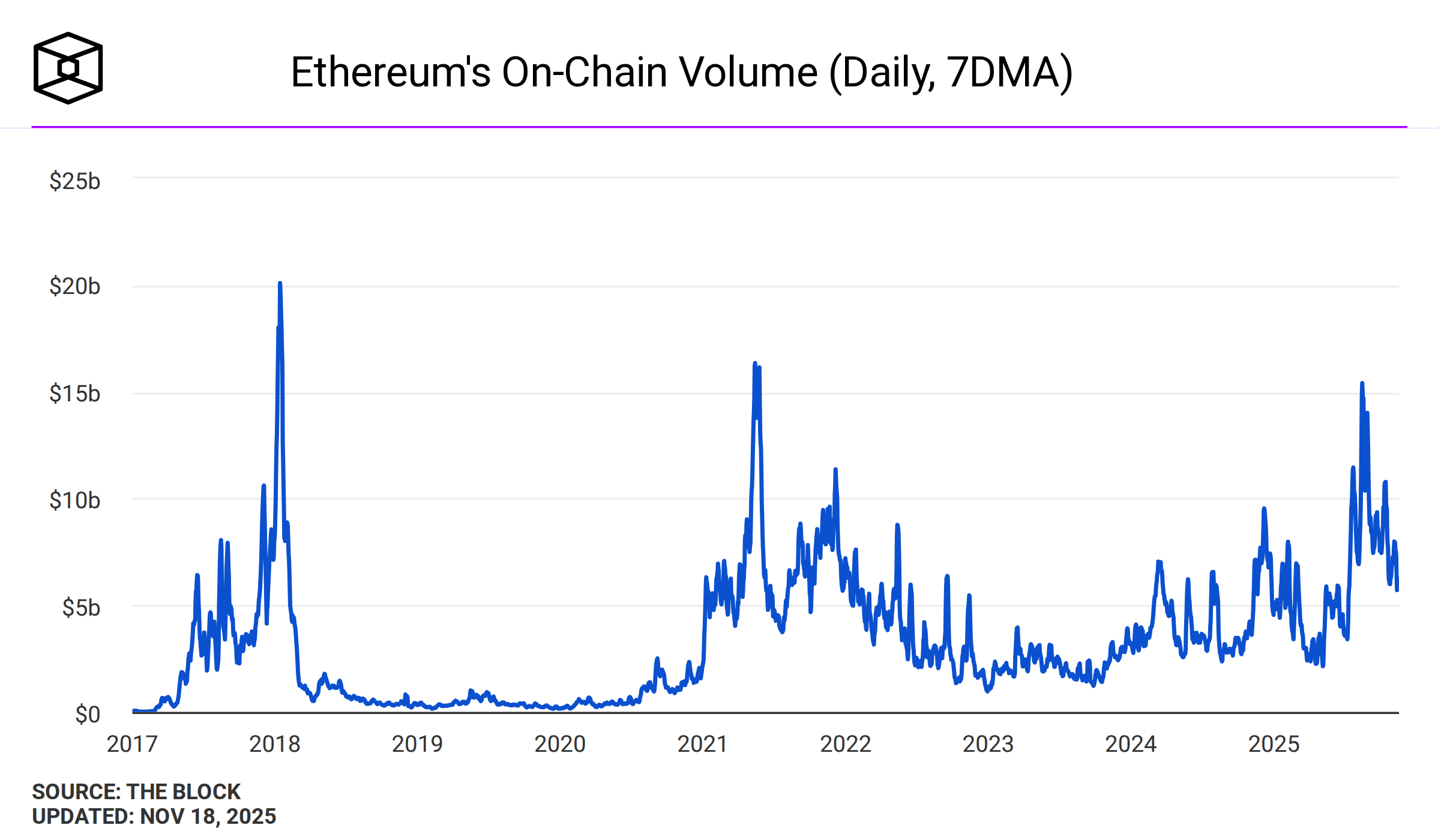

Despite the ETF outflows and price drops, Ethereum has seen strong underlying on-chain activity, including near-record daily transactions and an all-time high in the number of accumulation addresses (wallets with no history of selling). This contrast is important because staking represents a form of long-term commitment. Stakers are not speculating on short-term price movements. They are locking up ETH because they believe in the network’s growth, long-term security, and yield potential.

![]()

This situation has created two different viewpoints within the Ethereum community. Investors who buy and sell through ETFs usually react to market trends, news, and global economic signals. Meanwhile, people who stake ETH focus more on the long-term technology and Ethereum’s role as the base layer for decentralized apps and financial systems.

As ETH approaches the important $3,000 level, traders are watching closely. This price zone has become a key area where buyers and sellers push against each other. If the outflows continue, Ethereum may have a hard time staying above $3,000. But if buyers step in and defend this level, it could show strength and bring back investor confidence.

Where Ethereum goes next will depend on multiple factors: ETF flows, staking demand, and overall market conditions. If investors keep withdrawing from ETFs, ETH could remain under pressure. But if outflows slow down or if new institutional demand appears, the market could stabilize. Staking remains one of Ethereum’s strongest support pillars and may help the ecosystem recover once the larger economic environment becomes more supportive. shape the next phase of ETH’s market behavior.

Can Ethereum Hold the $3K Level?

Ethereum is facing real pressure in the short term, but the long-term foundation of the network remains strong. The sharp ETF outflows show how sensitive institutional money can be to market conditions, yet the rise in staking and on-chain activity suggests that long-term users still believe deeply in Ethereum’s future. Whether ETH falls below or holds above the $3,000 mark will depend on how these two sides short-term sentiment and long-term conviction balance out in the coming weeks.

Do you think Ethereum will defend the $3,000 level, or will institutional outflows push it lower before the next recovery phase begins?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.