- OP nears $0.90 resistance with 70% of Ethereum Layer 2 volume, signaling breakout potential.

- ETH rallies to $4,713 with strong RSI and MACD readings, approaching $4,800 all-time high.

- Sustained ETH exchange outflows since July align with price surge from $2,500 to over $4,700.

Market analyst Michaël van de Poppe, a crypto analyst, has taken on his X account to note that the Ethereum network may be on the edge of big gains once ETH stabilizes. In a recent update, he highlighted that the OP currently handles over 70% of Layer 2 transaction volume on Ethereum but has yet to record a large price move. According to van de Poppe, the token is now facing accumulation range resistance, and higher time frame bullish trends are appearing on the charts, which could signal a breakout if momentum continues.

The entire $ETH ecosystem is about to explode once #Ethereum stabilizes, as the money will flow into the entire ecosystem.

In this episode of @new_era_finance, we discuss the upside of $ETH and why $OP is doing 70%+ of Layer 2 volume on $ETH.

Watch here:https://t.co/00TWAxxyuD… pic.twitter.com/4Gg3kyrDX0

— Michaël van de Poppe (@CryptoMichNL) August 13, 2025

OP’s recent trading behavior supports this observation. After peaking in early 2023, the asset entered a prolonged downtrend marked by lower highs and lower lows. The decline slowed mid-year, giving way to a consolidation phase with multiple tests of horizontal support. Over the past several weeks, OP has moved toward a resistance zone between $0.88 and $0.90, an area that has repeatedly limited price gains.

According to our previous post, this upward move has been accompanied by regular surges in trading volume, which suggests higher market participation. Analysts note that a final break above this resistance could shift the market structure from consolidation to an uptrend. However, failure to clear the zone could keep OP confined within its recent range, delaying any sustained rally.

Ethereum Market Trends and Price History

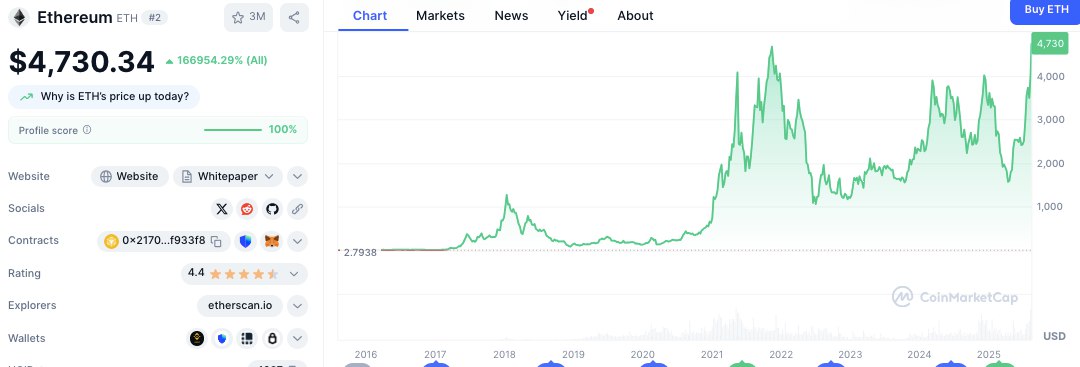

At the time of writing, Ethereum was trading at $4,713.8,9, recording an increase of 2.69% over the past 24 hours. Price history shows that ETH has risen from 166,954.29% since inception, with major growth cycles and corrections. Following its late 2017 surge and 2018 correction, ETH experienced a big rally in late 2020, fueled by decentralized finance (DeFi) and non-fungible token (NFT) adoption, reaching an all-time high above $4,800 in 2021.

Source: CoinMarketCap

Following market declines in 2022, the price of the token was pushed below $1,000 before a recovery began in 2023. By 2024 and into early 2025, Ethereum regained strong bullish momentum, supported by increased staking participation and network upgrades, bringing it close to its earlier record high.

Exchange Flows and Market Supply Impact

Exchange flow data from the past 10 months adds another layer to the market overview. Between late October 2024 and mid-February 2025, netflows were negative, with outflows exceeding $400 million on multiple days.

Source: Coinglass

This trend decreased between March and May before shifting back to sustained outflows from mid-July, coinciding with ETH’s rise from about $2,500 to over $4,700.

Moreover, adding to this sentiment, Ethereum technical indicators currently show strong momentum. The Relative Strength Index (RSI) stands at 79.44, pointing to heavy buying pressure but also indicating overbought conditions.

Source: TradingView

The Moving Average Convergence Divergence (MACD) positions the MACD line at 304.62, above the signal line at 233.67, with a positive histogram confirming bullish control. If ETH maintains this pattern and surpasses the $4,800 mark, analysts note that new all-time highs could be recorded.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.