Ethereum price has always been the heartbeat of the blockchain world, a sign of where innovation is headed. Now, it’s crossed the $4,000 mark, sparking whispers about whether it could double again to $8,000 or even higher. Remember back in 2017, when Ethereum was under $300. During the ICO boom, it shot up to $1,400 in just a few months and today’s rally feels like history repeating itself. Having followed crypto’s wildest moments, from Bitcoin’s halving cycles to DeFi’s rollercoaster crashes, I’ve seen Ethereum’s price swings turn small investors into big winners, and test the patience of even the most loyal holders.

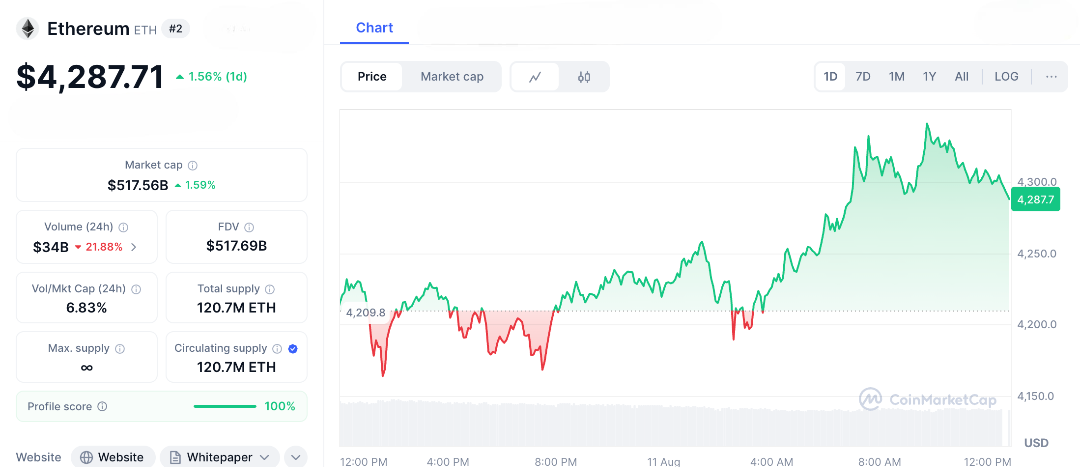

Right now, Ethereum’s price stands at about $4,287 after a strong 6% daily jump, powered by ETF inflows topping $4 billion. The big question isn’t just whether it’ll stay above $4,000, but whether it can reach $8,000 as institutions rush in and tech upgrades roll out. This kind of positive momentum and potential growth is quickly spreading among traders, with many excitedly asking, “Is ETH going to hit $8K? Should we invest more now?”

Ethereum’s price crossing $4,000 marks its highest point in four years, driven by spot ETFs that have attracted $4 billion in assets. This demand is supported by attractive staking yields around 5%. On-chain data tells a strong story: transaction volumes are up 120% quarter-over-quarter, and DeFi’s total value locked (TVL) has hit $120 billion, helped by lower fees following the recent Dencun upgrade. At $4,287, Ethereum shows solid strength. The Relative Strength Index (RSI) sits at 58, signaling bullish momentum without being overheated, while support levels around $3,800 remain firm.

If Ethereum firmly breaks past $4,300 as new support, analysts predict it could reach $7,330 by year-end. Some even whisper about $8,000, especially if Bitcoin climbs back above $125,000 and altcoins rally. Institutional buying is playing a big role firms like BlackRock are investing heavily, viewing Ethereum as the foundation for the future of tokenized assets, a market expected to hit $10 trillion by 2030.

Ethereum’s recent price increase is part of a larger trend. Upgrades such as danksharding aim to greatly enhance Ethereum’s scalability, making it crucial for the future of decentralized applications (Web3). Ethereum’s journey has seen it rise from lows near $2,000 to current highs, proving valuable for those who held onto it. Previous ETF launches have shown the potential for Ethereum’s value to double.

The main question is whether Ethereum could reach $8,000 if solutions like Optimism, which can make transactions much faster, attract more activity in decentralized finance (DeFi) and non-fungible tokens (NFTs). However, there are risks, such as potential regulatory delays or economic factors like inflation, which could bring Ethereum’s value down to around $3,500.

As of now, Ethereum is priced at $4,287, reflecting the balance between new innovations and market speculation. If Ethereum can consistently stay above $4,000, it might set off a significant rally similar to the one in 2021, where it surged by 400% to nearly $4,900. Ethereum has a market cap of about $517 billion, second only to Bitcoin’s $1.1 trillion, but it leads in usefulness, supporting 80% of DeFi projects. If it maintains the $4,000 level and investments continue to grow, reaching $8,000 is possible. This optimistic outlook is rapidly spreading within crypto communities, generating excitement and hope for the future.

Is Ethereum Price $8,000 Around the Corner?

Ethereum’s price reaching $4,000 brings up an important question:, will it go to $8,000 next, or will it take a break before moving higher? In the world of cryptocurrency, prices often signal what might happen next, and this rise could be the beginning of a major increase. If you’re investing in Ethereum, share this news because the price changes tomorrow could positively impact your investments.

FAQs

- What is the current Ethereum price?

As of August 11, 2025, the Ethereum price is $4,253, up 6% daily, crossing the $4,000 mark. - Why is the Ethereum price above $4,000?

Spot ETF inflows exceeding $4 billion and DeFi TVL reaching $120 billion are driving bullish momentum. - Could the Ethereum price hit $8,000?

If $4,000 becomes support and upgrades like danksharding boost adoption, analysts see potential for $8,000. - What risks threaten the Ethereum price?

Regulatory hurdles on staking ETFs or inflation could push prices back to $3,500 supports. - What supports Ethereum price growth?

Ethereum’s scalability via layer-2 rollups and 80% DeFi dominance fuel demand for its $510 billion market cap.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.