This survey note takes a close look at Tezos Crypto XTZ, where it stands in the market right now, what’s been happening recently, and whether it’s more likely to crash or climb above the $1 mark. The analysis is based on the most recent data and brings together insights from market trends, the latest news, and what crypto influencers are saying. Whether you’re watching Tezos as an investor or just curious about its future, this breakdown covers all the key points.

Introduction to Tezos Crypto

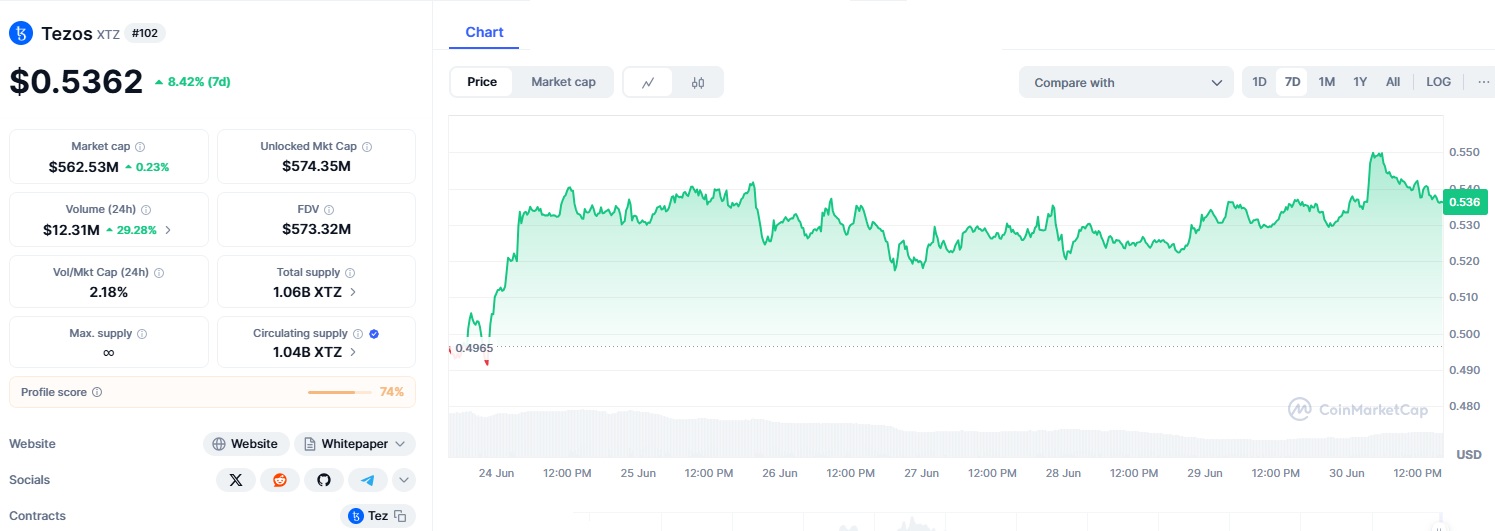

Tezos crypto is an open-source blockchain platform built for digital assets and decentralised applications, with a strong focus on self-upgrading technology, on-chain governance, and decentralisation. It was launched back in 2014 by Arthur and Kathleen Breitman and has since aimed to compete with major platforms like Ethereum and Solana, especially when it comes to scalability and security. As of June 30, 2025, Tezos is trading at around $0.53, with a market cap of $562 million and a 24-hour trading volume of $12 million.

The following table summarizes key metrics for Tezos as of June 30, 2025, based on reliable sources:

| Metric | Value |

|---|---|

| Current Price (USD) | $0.53 |

| Market Cap (USD) | $562 million |

| 24-Hour Trading Volume | $12.31 million |

| Rank (CoinMarketCap) | #102 |

| 7-Day Price Change | +8.42% |

Tezos has shown signs of volatility, with a 9.38% price decrease over the last month, suggesting a dip that some investors view as a buying opportunity. The 24-hour trading volume indicates moderate activity, which could be influenced by recent developments and market sentiment.

Fear and Greed Dynamics

In the world of crypto, fear and greed are two powerful emotions that often drive price swings. When fear takes over especially when prices are far below past highs investors tend to panic and sell. On the flip side, greed kicks in when people think a coin is undervalued and jump in hoping for big gains.

That’s exactly what’s happening with Tezos right now. At $0.53, well below its all-time high, some investors are worried it could fall even further, while others see this as a chance to buy low. This split in sentiment is clear in current predictions some analysts are even warning that XTZ could drop to $0.22 by the end of 2025.

Recent Developments and Positive Catalysts

In 2025, Tezos has made some major changes that could ease investors’ worries and attract new interest. One big update is the launch of Fast Withdrawals, which now allows users to withdraw funds in just one minute, compared to the old 15-day wait. This improvement, enabled by Etherlink, was officially announced on June 27, 2025. It significantly enhances the user experience and could bring more people into the Tezos ecosystem.

Another key update is the activation of the Quebec protocol in early 2025. This update brought faster block times and better staking rewards with Adaptive Issuance, making staking more appealing. These changes aim to make Tezos more scalable and efficient, helping it compete with other platforms like Ethereum and Solana. Additionally, the Tezos community remains active and engaged. Events like the Digital Art Mile in Basel (June 16-22, 2025) and new announcements from TZ APAC show that the community is still vibrant and growing.

Roadmap and Future Prospects

Tezos’ roadmap for 2025 and beyond plays a big role in shaping its future. With the Quebec protocol already improving block times and staking incentives, the next big move is splitting transaction execution into a separate layer a change designed to improve scalability and make the network more flexible for developers. Tezos has room to grow thanks to its tech upgrades, new partnerships, and an expanding ecosystem. They’ve projected its price could reach $1.17 to $1.45 in 2026.

Recent updates like Fast Withdrawals and new plans for the future show that Tezos has potential for growth. People are optimistic about these changes, but there are also risks due to the unpredictable nature of the crypto market. Investors should always do their own research, consider different opinions, and understand their own risk tolerance. Whether Tezos goes above $1 or drops further will depend on factors like how many people use it, community support, and how successful upcoming updates are. In the end, navigating the crypto market means staying informed and ready for anything.

FAQs

- What is Tezos Crypto?

Tezos (XTZ) is an open-source blockchain platform focused on self-amendment, on-chain governance, and decentralization, competing with platforms like Ethereum. - What is the current price of Tezos Crypto?

As of June 30, 2025, Tezos (XTZ) is trading at approximately $0.53, with a market cap of $558 million. - Why is there fear and greed in Tezos Crypto?

Fear stems from recent price volatility and predictions of a potential drop to $0.22, while greed is driven by its low price and recent upgrades, seen as a buying opportunity. - Will Tezos Crypto skyrocket over $1?

Some analysts predict a rise to $1.25 by 2026 due to scalability improvements, but others warn of short-term declines, making the outcome uncertain. - What recent developments support Tezos Crypto’s growth?

Fast Withdrawals (reducing times to one minute) and the Quebec protocol (faster block times) enhance user experience and network efficiency.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.