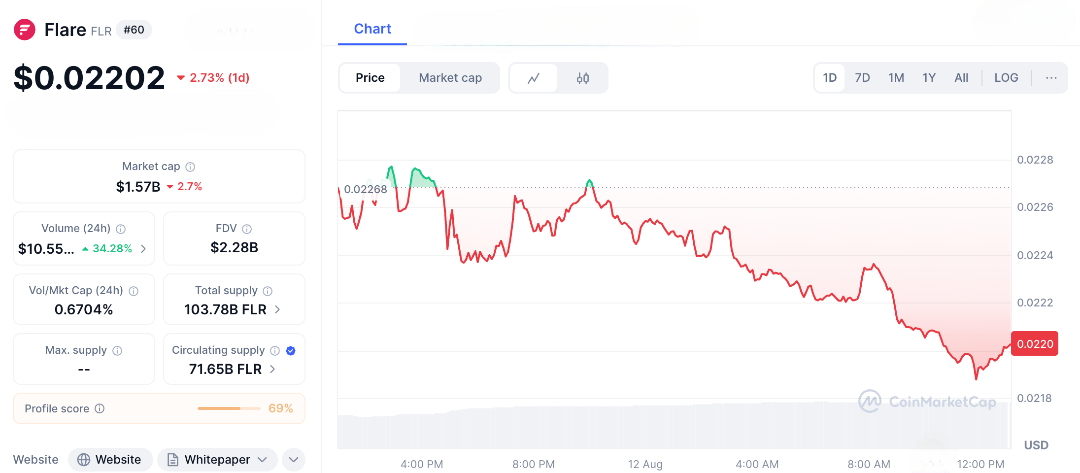

Flare crypto, an ambitious project aiming to connect smart contracts across different blockchains, has traders concerned as its price recently dipped close to $0.02. This has led to chatter that a much-anticipated price surge might be faltering before it truly begins. As of August 12, 2025, FLR is trading around $0.022 after a daily dip of 2-3% amid general volatility in the altcoin market. The recent sell-off has raised concerns, with data showing increased selling pressure. However, some recent updates suggest there might be underlying strength that could turn things around.

Flare crypto launched with a lot of excitement, aiming to provide decentralized data oracles for blockchains like XRP and Ethereum. These oracles supply secure, off-chain information that decentralized apps (dApps) depend on. The FLR token, used for staking, governance, and transaction fees, has seen highs above $0.05 but recently dipped near $0.02, down from summer peaks around $0.027. This decline matches a broader cooling off in the crypto market after Bitcoin’s record highs, where altcoins often feel the impact the most.

Whale wallets have been busy some taking profits by selling large amounts, while retail investors panic-sell, which makes the downward pressure worse. Looking at the charts, things aren’t great, the Relative Strength Index (RSI) is at 50, meaning the token is oversold, and the 50-day moving average has fallen below the 200-day average a bearish sign that signals caution. Is this the end of Flare’s bull run? Skeptics say yes, pointing to competition from big oracle players like Chainlink and Pyth, which have larger networks and more integrations.

Looking deeper into Flare crypto reveals some interesting aspects. FLR isn’t just any token; it’s built with a unique combination of Avalanche’s speed and Ethereum Virtual Machine (EVM) compatibility. This allows developers to access reliable data from both traditional Web2 sources and other blockchains without depending on centralized sources.

Recent upgrades, such as improvements to the Flare Time Series Oracle, have made it more appealing for decentralized finance (DeFi) and real-world assets (RWAs). Recently, Flare launched Luminite, a wallet without seed phrases that helps XRP holders access DeFi easily. With Luminite, XRP holders can wrap FXRP for staking and liquidity, potentially drawing millions from the Ripple community. These developments go beyond hype and offer real-world applications, supported by growing partnerships. Furthermore, FLR will be showcasing its technology at ETHGlobal’s New York event from August 15–17.

Analysts are optimistic, predicting that FLR could reach $0.034 by the end of the year if adoption increases. However, they also caution that the price could drop to $0.017 if market sentiment turns negative.

The recent dip to around $0.02 has raised some concerns. Flare crypto has a large circulating supply of over 71 billion FLR tokens, which can dilute value. Its market cap, about $1.5 billion, is relatively small compared to major players. While staking yields of 5-7% are attractive, they haven’t prevented some investors from pulling out, especially with worries about rising interest rates and the broader economy.

Think back to the 2022 crypto crashes, projects with strong technology survived by adapting. FLR could follow that path, especially now that TrustSwap’s launchpad is live on Flare’s network, letting new tokens launch via SparkDEX. Bulls are excited about the XRP-DeFi bridge, calling it a potential game-changer, while bears see the recent 7% weekly drop as a sign that hype might be fading.

Flare Crypto’s Comeback Story

Reflecting on Flare crypto’s path from the excitement of the Spark airdrop to becoming a promising oracle project, this recent price dip feels like a typical part of an underdog story. Major price increases often start during challenging times, driven by innovation and determination. If Luminite gains traction and institutions continue to invest in crypto, Flare could rally to $0.05 or even higher, turning today’s worries into celebrations. However, if adoption slows and the market remains bearish, the rise might stall, making FLR a niche player.

For traders, the key takeaway is clear, be prepared for volatility, diversify your investments, stake cautiously, and keep an eye on major investors. This journey is far from over. Share if you’re optimistic about Flare’s potential or if you’re being cautious.

FAQs

1. Why has Flare crypto’s price dropped to $0.02?

Flare crypto dipped near $0.02 due to profit-taking, whale sell-offs, and broader altcoin market corrections amid Bitcoin’s dominance.

2. Is the Flare crypto bull run over?

Not necessarily. The dip may be a correction, with potential for recovery if Flare’s DeFi and oracle upgrades gain traction.

3. What is Flare crypto’s role in the market?

Flare crypto provides decentralized data oracles for blockchains like XRP and Ethereum, enabling secure smart contracts and DeFi applications.

4. What caused the recent Flare crypto sell-off?

Increased whale activity, a bearish technical setup (e.g., 50-day SMA below 200-day), and market-wide volatility contributed to the drop.

5. Could Flare crypto rebound soon?

Analysts predict a potential rise to $0.034 by year-end if support at $0.017 holds and adoption grows, though risks remain.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.