In the exciting world of crypto, where bold predictions spark discussions and dreams meet data, the idea of XRP reaching $1,000 has become more than just a fantasy. It’s a rallying cry for dedicated Ripple fans, challenging traditional limits of what’s possible. Watching XRP’s ups, downs, and legal battles, I’ve noticed that wild ideas often start in online forums and then go viral, influencing real markets.

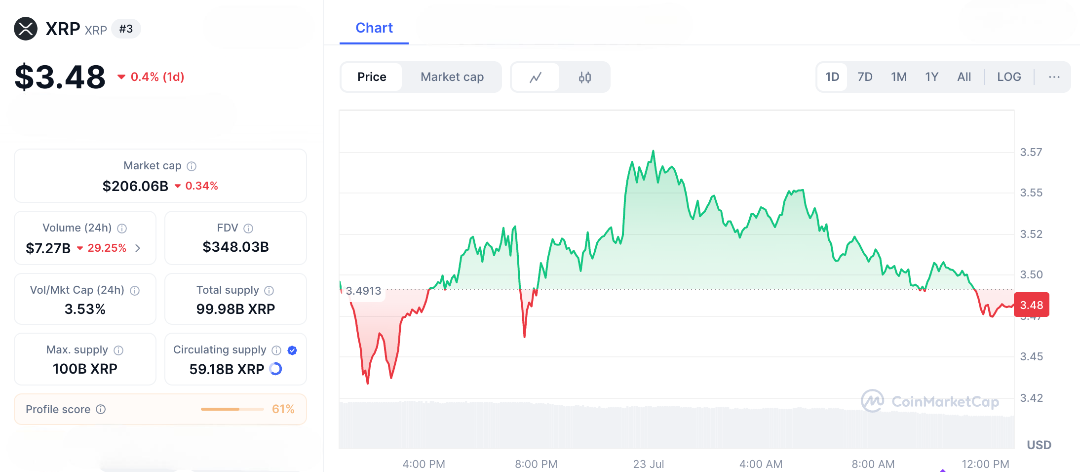

While the math around market cap makes $1,000 seem unlikely, supporters argue that XRP’s unmatched speed and liquidity for cross-border payments could push it to impressive heights, not just as a crypto token but as a global financial tool. With XRP currently at around $3.48, a $1,000 price seems far-fetched. But this isn’t just about hype; it’s based on XRP’s increasing real-world use, gradually revolutionizing how money moves around the globe.

XRP’s $1,000 Dream

This feels like the ultimate underdog story where XRP, long labeled a “banker’s coin,” is now being reimagined as a liquidity powerhouse in a crypto market known for volatility. At first glance, the $1,000 XRP price prediction seems impossible. After all, a $1,000 price tag would put its market cap above $50 trillion, more than the entire U.S. economy. But here’s where XRP supporters flip the narrative. Instead of fixating on market cap, they focus on liquidity the lifeblood of global finance. Ripple’s On-Demand Liquidity (ODL) system already uses XRP to settle international payments in seconds, replacing outdated banking rails that lock up trillions in idle capital.

Imagine unlocking $10 trillion worth of trapped global liquidity. That kind of real-world use case could massively boost demand for XRP, making old-school market cap calculations feel irrelevant in a high-velocity, real-time settlement world. This liquidity-first thinking isn’t brand new but it’s gaining serious steam. With Ripple expanding partnerships with payment giants across continents, the $1,000 XRP narrative is no longer just a moonboy meme it’s being framed as a potential outcome of massive adoption in a fast-evolving financial system.

Could XRP’s Speed and Scarcity Fuel a $1,000 Surge?

Crypto analysts, often called chart wizards, are exciting the XRP community with bold, data-based predictions. One analyst recently shared a technical analysis that’s catching everyone’s attention. He believes XRP could rise to $100 and eventually $1,000, not by defying logic but by following the principle of liquidity over supply. His charts suggest XRP is set for a multi-phase rally, driven by its increasing role in tokenized assets and real-time global payments.

The key factor is velocity, how quickly XRP is used and reused. As adoption increases, especially in cross-border transactions, this velocity could create a cycle that boosts XRP’s value beyond traditional expectations. He’s not alone; another analyst recently predicted that just 1,000 XRP could result in $50,000 in gains by the end of the year, suggesting a $50 base price. The long-term potential could be even higher if liquidity dynamics come into play.

This all depends on XRP’s fixed supply of 100 billion tokens, with over 50% locked in escrow. This scarcity, combined with rising demand, could really change the market. With global remittances expected to hit $800 billion annually, XRP could become the preferred bridge currency and possibly the backbone of a faster, leaner financial system.

XRP to $1,000? Skeptics Say “Not So Fast”

Of course, no epic is complete without a dose of doubt, and the XRP saga is no different. Skeptics are pushing back hard, arguing that no matter how fast XRP moves or how often it’s used, basic economics still apply. At $1,000 per token, XRP would need to capture a huge piece of the $120 trillion daily forex market a mountain-sized task, especially with competition from stablecoins and central bank digital currencies (CBDCs) heating up.

More cautious analysts peg XRP’s price potential closer to $15–$17 by the end of the cycle, pointing to regulatory uncertainty, market volatility, and overambitious forecasts as reasons to keep expectations grounded. But the XRP faithful aren’t backing down. They point to Ripple’s ongoing legal victories, clearer U.S. crypto regulations, and XRP’s recent 4% surge on a technical breakout as signs of momentum. The result? A full-blown crypto culture clash. On one side: liquidity maximalists posting rocket emojis and memes of XRP on the moon. On the other: number-crunching realists waving market cap charts like swords.

Disruption or Delusion? The $1,000 Debate Hits Home

Having interviewed Ripple executives and studied the XRP Ledger, the appeal of XRP is understandable. It’s not just another speculative token; it’s designed for speed and efficiency, with transactions completing in seconds for just pennies. Supporters believe that if liquidity truly unlocks trillions in idle capital, then $1,000 per XRP could become a reality, not just a fantasy. Picture a future where banks replace costly Nostro accounts with XRP liquidity pools, freeing up massive amounts of cash and creating real demand for the token. Crypto cycles have shown that real utility can overcome early doubts, turning early believers into very wealthy holders.

However, it’s important to stay realistic. The crypto world is full of overhyped promises that never come true. For XRP to reach $1,000, more than speculation is needed; a major increase in adoption is required, particularly through Ripple’s On-Demand Liquidity (ODL) system. Although ODL usage is growing, a significant leap is still needed. Even so, the dream is spreading quickly. Social media is buzzing, traders are buying in, and the $1,000 prediction is becoming a movement. So, whether you’re skeptical or hopeful, keep an eye on this. Share if you’re curious about the liquidity revolution because in crypto, sometimes the wildest ideas do come true.

FAQs

- What drives the xrp price prediction $1000 despite market cap concerns?

Proponents focus on XRP’s liquidity in payments, arguing it could unlock trillions in efficiency, boosting demand beyond cap limits. - Is the xrp price prediction $1000 realistic this cycle?

While some analysts like BarriC see a path via trends, most view it as long-term, dependent on global adoption. - How does liquidity factor into XRP’s value?

XRP’s role in instant settlements could increase its velocity, making it more valuable as a bridge asset in finance. - What are conservative XRP price forecasts?

Many predict $15-$17 by year’s end, citing volatility, but liquidity optimists aim higher. - Why is XRP’s supply important for predictions?

With 100 billion tokens and escrows, scarcity amid rising use could support gains if liquidity narratives hold.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.