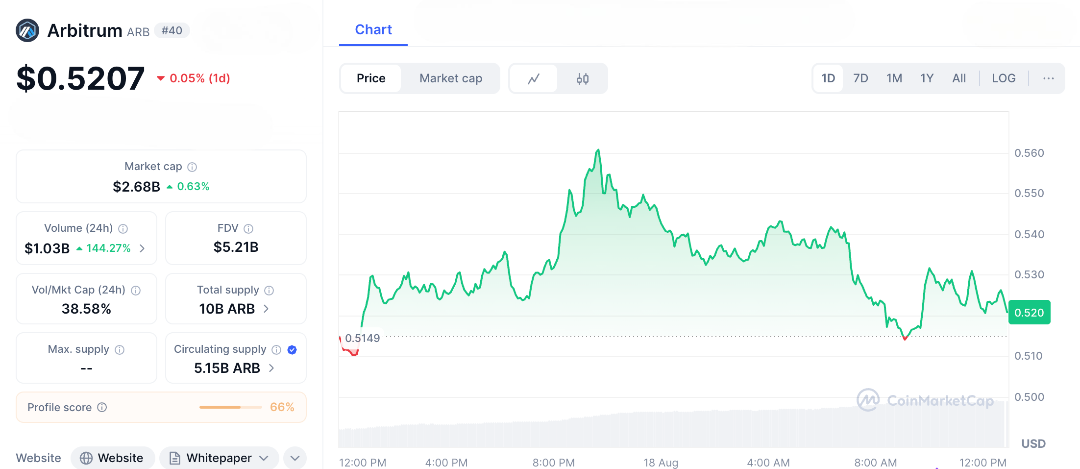

ARB crypto, the governance token for Arbitrum, is currently priced at $0.52. This might seem low, especially considering its past highs. ARB crypto originated to address the high gas fees and slow transactions on Ethereum, offering a faster and cheaper solution for dApps and users. Arbitrum’s technology works by handling transactions off-chain while still maintaining Ethereum’s strong security. Offchain Labs, the creators of Arbitrum, designed it so that disputes are rare and resolved quickly, making transactions more efficient.

The ARB crypto airdrop was a big event, rewarding early users and causing the token’s price to skyrocket. However, like many cryptocurrencies, ARB experienced significant drops during bear markets and has not yet returned to its peak value. Despite this, there is potential for ARB to make a strong comeback. Some believe that by 2030, ARB could reach $5, positioning Arbitrum as a leading Layer 2 solution. This optimism is based on the platform’s technology and its potential for wider adoption.

Arbitrum was created during a time when Ethereum was overwhelmed by the surge in DeFi and NFTs, making transactions costly and slow. Arbitrum came to the rescue with smart fraud proofs and compatibility that allowed dApps to move over easily without needing to rewrite code.

The Nitro upgrade significantly increased transaction speed, handling thousands of transactions per second at a very low cost. ARB crypto is more than just a token; it gives holders the power to vote on protocol upgrades and how to use the treasury. This democratic feature has attracted a diverse community, from yield farmers to big institutions looking for scalable solutions.

Partnerships flourished, with integrations across major wallets and exchanges, propelling ARB to an all-time high over $2. But crypto’s rollercoaster struck, volatility, broader market chills, and competition from Optimism and Polygon caused prices to dip. Yet the ecosystem stayed alive, with total value locked stabilising as developers doubled down on Arbitrum’s reliability and speed.

Quiet Resurgence and Layer 2 Leadership

Zooming to the present, Arbitrum’s story shifts toward resurgence. The network has been quietly stacking wins, strengthening its position as a Layer 2 frontrunner.

Recent moves highlight its strategic growth, millions in ARB crypto have been allocated to subsidise security audits for projects building on the network, ensuring robustness in an era where hacks make headlines. Speculation around PayPal’s stablecoin PYUSD potentially launching on Arbitrum sent ripples through the market, hinting at mainstream bridges that could funnel billions in liquidity. Other innovations include the tokenized stock launch with Robinhood, allowing European users to trade U.S. equities on-chain, blending traditional finance with crypto’s agility. These aren’t isolated sparks they form part of a broader push, including a hefty ecosystem fund for gaming dApps, where Arbitrum’s low latency enhances immersive experiences.

Offchain Labs has even announced plans to acquire ARB for its treasury, signalling long-term confidence from the core team. Add in the DAO’s approval for tokenized U.S. Treasurys, attracting real-world assets and yield-seeking investors, and it’s clear that Arbitrum is evolving from a scaling solution into a full-fledged financial hub.

Could $5 Be Within Reach by 2030?

Many believe ARB could reach $5 by 2030. Predictive models based on past trends and growth data suggest it’s possible if things go well. Arbitrum’s Orbit chains allow anyone to create custom Layer 3 chains, which greatly expands its ecosystem. The Ethereum Dencun upgrade improves data availability, lowers costs, and attracts more transactions. Daily active users are increasing, DeFi protocols like GMX are thriving, and new sectors, like AI-driven applications, are finding success in Arbitrum’s efficient and low-latency environment.

Tokenomics also play a role, ARB’s supply is capped, and governance burns could tighten circulation as adoption grows. If regulatory clarity paves the way for institutional inflows, or Ethereum’s role as a settlement layer strengthens, Arbitrum stands to capture a significant market share. Analysts highlight its user experience edge: sub-cent fees, instant confirmations, and EVM equivalence make Arbitrum a developer favorite, adding another layer of potential for long-term growth.

ARB crypto faces several hurdles. The competition among Layer 2 solutions could spread focus thin, global economic issues might slow its progress, and rivals are continuously innovating. Plus, the inherent risks of the crypto world—hacks, sudden market drops, and high volatility add to the uncertainty. However, Arbitrum isn’t just surviving; it’s building a foundation for future dominance. Picture a future where everyday financial transactions, from small payments to large business deals, run smoothly on Arbitrum’s technology. For ARB holders, this isn’t just a hope, it’s a bet on a system that could transform Ethereum’s ecosystem.

The potential for ARB to rise from $0.52 to $5 is supported by some models, but the true strength lies in the community’s passion and the technology’s resilience. This story of ambition could lead to a significant breakthrough. Share this with others; the next wave of believers might be about to join the journey.

FAQs

- What is ARB crypto?

ARB crypto is the governance token for Arbitrum, an Ethereum Layer 2 scaling solution using optimistic rollups for faster, cheaper transactions. - Why is ARB crypto at $0.52 today?

ARB crypto’s current price stems from market volatility, but recent ecosystem growth and partnerships are fueling optimism for recovery. - Can ARB crypto hit $5 by 2030?

Predictive models suggest ARB crypto could reach $5 by 2030 if adoption in DeFi, gaming, and real-world assets accelerates, though risks persist. - What makes Arbitrum stand out?

Arbitrum excels with low fees, high throughput via Nitro upgrades, and custom Layer 3 chains, making it a top Ethereum scaler. - Is ARB crypto a good investment?

ARB crypto offers strong governance and utility potential, but crypto’s volatility means thorough research and risk assessment are essential.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.