Flare Network dropped this confident statement yesterday:

Flare DeFi just hit $236M TVL

Before you ask, it includes borrowing and liquid staking.

That’s not just capital. That’s conviction.

Builders are building. Users are sticking.And rewards? Still rewarding DeFi users that got us here. pic.twitter.com/e20rxIj33u

— Flare ☀️ (@FlareNetworks) August 7, 2025

Behind this bold claim lies one of 2025’s most compelling DeFi success stories. A network that has quietly transformed from an ambitious interoperability experiment into a thriving ecosystem where conviction meets capital, and where XRP finally gets the DeFi treatment it deserves.

What Is Flare Network? The Foundation Behind the Growth

Flare Network launched as a Layer-1 blockchain designed to solve a critical problem of bringing smart contract functionality to assets like XRP, Bitcoin, and Dogecoin that lack native programmability.

Key Innovations:

-

State Connector: Gathers and validates data from external blockchains and the internet, feeding it into smart contracts

-

Flare Time Series Oracle (FTSO): Provides decentralized, high-frequency price data directly on-chain

-

FAssets Protocol: Allows non-smart contract tokens (like XRP) to be wrapped and used across DeFi applications

Since its mainnet launch on July 14, 2022, Flare has processed over 240 million transactions across 40+ million blocks, with nearly 4 million unique wallets calling the network home.

The Numbers Behind the $236M TVL Surge

Current Ecosystem Metrics:

-

Total Value Locked (TVL): $236M (including borrowing and liquid staking)

-

Stablecoins: $129M+ (primary driver of liquidity)

-

Active Users: Nearly 4 million unique wallets

-

Daily Transactions: ~445,000 at 1.8-second block time

-

Staking Participation: Nearly 75% of all FLR tokens are staked or delegated

The TVL journey has been remarkable:

-

July 2024: DeFi debuts with SparkDEX at modest levels

-

April 2025: USD₮0 integration triggers surge from ~$76M to $170M+

-

August 2025: Breaks through $236M milestone

Recent Developments Fueling the Conviction Narrative

1. Institutional Partnerships Drive Real Capital

- VivoPower Partnership: NASDAQ-listed VivoPower committed to deploying $100 million in XRP for institutional yield strategies through Flare’s infrastructure. It is a clear signal of institutional confidence.

- BitGo Custody Integration: U.S. and European institutional investors can now securely access FLR and SGB tokens through BitGo’s trusted custody solutions, removing a major barrier to institutional participation.

2. XRPFi: The Game-Changer for XRP Holders

- Uphold Partnership: Launched XRPFi, a comprehensive DeFi suite allowing XRP holders to stake, lend, and earn yields directly on Flare. This will unlock utility for over $116 billion worth of XRP.

- Luminite Wallet: Just launched this week, this seedless wallet eliminates complex barriers like seed phrases, using passkeys, biometrics, or email sign-ins to make DeFi accessible to mainstream users.

- FXRP Integration: XRP holders can now wrap their tokens into FXRP via Flare’s FAssets protocol, deploying them across staking and liquidity products without leaving the ecosystem.

3. Technical Infrastructure Upgrades

- FTSOv2 Launch: Upgraded oracle system provides truly decentralized price feeds directly on-chain, enhancing reliability and reducing external dependencies.

- Network Upgrade (August 5): Recent technical improvements have enhanced performance and scalability.

- USDT0 Integration: Tether’s omnichannel stablecoin integration saw over $60 million minted in early deployment, dramatically boosting DeFi adoption and platform liquidity.

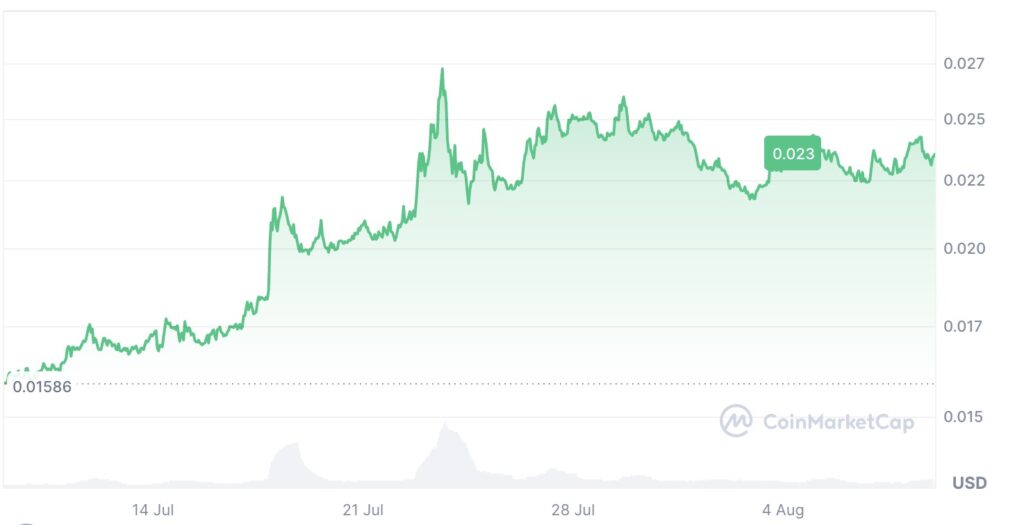

How This Ecosystem Growth Impacted FLR Price?

Looking at the current FLR token performance through the lens of this ecosystem expansion:

Current Price Data (August 9, 2025):

-

Price: $0.02351 (+45.29% in 1 month)

-

Market Cap: $1.68B

-

24h Volume: $16.53M (+63.66%)

-

Circulating Supply: 71.56B FLR

-

Volume/Market Cap (24h): 0.986%

Price Momentum Drivers:

-

TVL Growth: The surge from $170M to $236M TVL represents over 38% growth, directly correlating with increased FLR utility and demand

-

Institutional Validation: VivoPower’s $100M commitment and BitGo integration legitimize Flare for professional investors

-

XRP Integration Success: With XRPFi enabling DeFi for the world’s 7th largest cryptocurrency, network effects are accelerating

-

Supply Dynamics: With 75% of tokens staked/delegated, circulating supply remains constrained while demand grows

The price chart shows a classic accumulation pattern with a sharp breakout in late July/early August, coinciding perfectly with the TVL surge and institutional announcements. The 45% monthly gain reflects genuine fundamental growth rather than speculative pumping.

The “Conviction vs Capital” Narrative

Flare’s tweet emphasizes that their $236M TVL represents “conviction” rather than just capital and the data supports this claim:

- Builder Activity: Integrations with SparkDEX, TrustSwap, and Team Finance provide comprehensive token launch and management infrastructure.

- User Retention: Nearly 4 million wallets with sustained daily transaction volumes around 445,000 indicate sticky, active usage rather than one-time speculation.

- Reward Sustainability: The FTSO system distributes FLR tokens through accurate price data provision, creating genuine utility-based earning opportunities.

- Ecosystem Maturity: From oracle services to institutional custody to user-friendly wallets, Flare has built comprehensive infrastructure that attracts long-term builders and users.

Can This Momentum Sustain?

Bullish Factors:

-

Upcoming ETHGlobal NYC participation (August 15-17) could attract new developers

-

XRP integration still in early stages with massive addressable market

-

Institutional adoption pipeline appears strong with recent partnerships

-

TVL growth trajectory suggests ecosystem Product-Market Fit

Risks to Monitor:

-

Competition from other interoperability solutions

-

Regulatory uncertainty around wrapped assets

-

Dependency on XRP market sentiment

-

General crypto market volatility

Analysts project FLR could reach $0.027-$0.041 by year-end if current growth trends continue, though the usual crypto volatility warnings apply.

More Than Hype, Building Real Infrastructure

Flare’s $236M TVL milestone isn’t just another DeFi number—it represents successful execution of a multi-year vision to bring programmability to non-smart contract assets. With institutional backing, user-friendly innovations like Luminite wallet, and genuine utility for the massive XRP holder base, Flare has moved beyond experimental territory into legitimate infrastructure.

The 45% monthly price gain for FLR reflects this fundamental shift: from speculative positioning to actual utility demand. Whether this translates into sustained growth depends on continued execution, but the foundation—true conviction from builders, institutions, and users—appears solid.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.