Bitcoin SV, or “Bitcoin Satoshi Vision,” sits quietly on the cryptocurrency map, seldom the subject of hype but always part of big conversations about Bitcoin’s direction and the intended promise of blockchain technology. As of today, BSV trades just above $29 per coin, far from its all-time high, but holding a steadily active role among digital assets. To understand where BSV stands now, and where it could go, it’s key to look at what sets it apart, the realities of its market, and what’s actually happening behind the scenes.

A Blockchain Built on “Vision”

Launched in late 2018 via a split from Bitcoin Cash (which itself forked from the original Bitcoin), BSV is nothing if not ambitious. Its creators, most prominently Craig Wright and Calvin Ayre, claim that BSV enshrines the closest thing to Satoshi Nakamoto’s original blueprint: a protocol emphasizing massive scaling, rock-bottom transaction fees, and a “set-in-stone” rule set designed for both money and enterprise data on the blockchain.

Unlike Bitcoin (BTC), whose development path has been cautious and conservative, BSV took a radical stance remove block size limits and encourage on-chain scalability that, in theory, could serve everything from microtransactions to supply chain management, NFTs, and digital identity.

Where’s BSV Now?

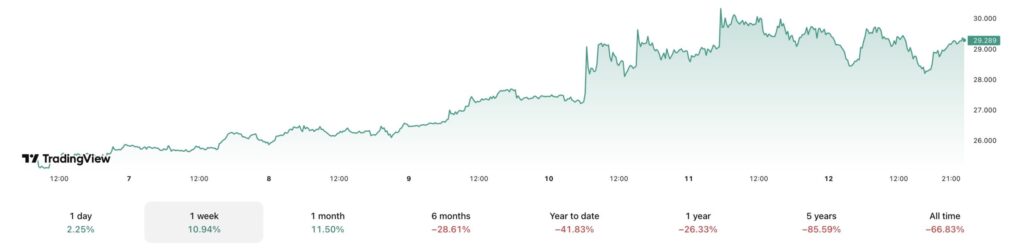

The latest market stats paint a telling picture. BSV’s price holds at $29.29, showing a modest daily gain of 2.25% but when zoomed out, the five-year chart is stark. BSV is down about 86% from its peak, and the all-time high remains a distant $480.

Source: TradingView

The market cap hovers around $583 million, and all of BSV’s 19.91 million coins are in circulation and there’s no further dilution risk. Its trading volumes, at just over $84 million in the past 24 hours, show that BSV still draws speculative attention, but not the sort of flows that marked its early days after the hard fork drama.

The performance over different windows tells the story of a coin with short-term buyer flurries—up nearly 11% over the past month, but still trailing sharply against its 2021 highs or against the gains seen in a Bitcoin or Ethereum bull cycle.

Beyond Price – What Does BSV Actually Do?

For all its price charts and history, Bitcoin SV’s technical vision is notable:

-

Unbounded block sizes (up to 2GB today and aiming much higher), intended to let the network process hundreds of thousands (or even millions) of transactions per second.

-

Low transaction fees, with the goal of enabling micropayments, enterprise data, and on-chain applications that would be impossible or too expensive on BTC or Ethereum.

-

Native support for enterprise utilities: NFT minting, on-chain data storage, tokenization, gaming, and more, all without needing side chains or “Layer 2” solutions.

-

Proof-of-work consensus and a familiar 21 million supply cap, mirroring Bitcoin’s monetary inflation schedule.

And while BSV has never achieved the retail or institutional network effect of its “parent” chains, it’s quietly powering industry pilots in supply chain, content monetization, and even national digital currencies, albeit with more adoption on the enterprise and government side in Asia and the Middle East than in Western DeFi circles.

The Market’s Take (Technically)

- Oscillators and momentum indicators: Relative Strength Index at 58, MACD neutral, momentum and awesome oscillator flashing “buy” signals—suggest that BSV is neither overbought nor oversold, with cautious optimism returning after months of decline.

- Moving averages confirm the challenge: Short-term and medium-term averages cluster just under $29, providing support, but every major technical level—simple/exp moving averages up through 200 days—shows clear resistance stepping up in the mid-$30s.

- Select oscillators: Stochastic RSI fast at 96, CCI (20) at 82 suggest bouts of volatility, and, as the chart in your second screenshot reveals, the last month’s bounce has not reversed the general long-term trend downward. BSV’s volatility has often made it appealing for swing traders rather than long-term “holders.”

The network pays miners with a block subsidy that, like Bitcoin, halves on schedule and further focusing miners’ incentives toward transaction fees in the long run.

Notably, BSV’s supply cap, protocol rules, and emission rates are all fixed so price action will be driven almost entirely by demand, adoption, and broader speculative cycles.

A Coin at the Crossroads

BSV today is a working blockchain boasting real technical scaling but facing sharp skepticism in mainstream crypto. Its community touts real-world business solutions; its critics argue over decentralization and original intent. As the screenshots make clear, most market signals suggest BSV is in a holding pattern – stabilized – but with a long road ahead to regain mainstream relevance.

In a market filled with narratives, BSV’s is starkly about scale, stability, and, perhaps most controversially, the meaning of “Satoshi’s Vision.” Whether those principles will spark a new wave of enterprise or just keep BSV as a specialist niche remains to be seen.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.